Question: Answer the questions below based on the following tax information: Orville and Rachel are married and lived together the entire tax year. Orville is 48

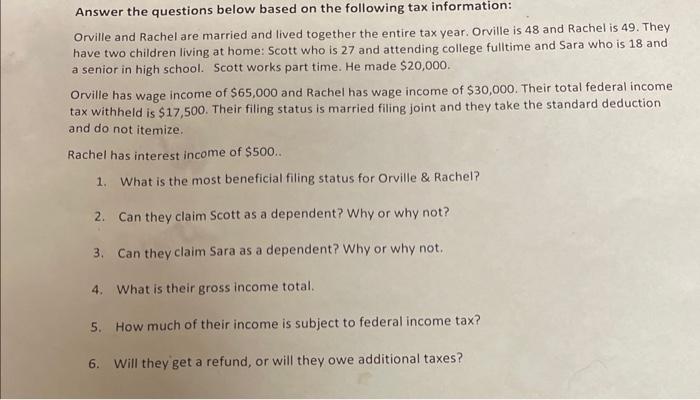

Answer the questions below based on the following tax information: Orville and Rachel are married and lived together the entire tax year. Orville is 48 and Rachel is 49. They have two children living at home: Scott who is 27 and attending college fulltime and Sara who is 18 and a senior in high school. Scott works part time. He made $20,000. Orville has wage income of $65,000 and Rachel has wage income of $30,000. Their total federal income tax withheld is $17,500. Their filing status is married filing joint and they take the standard deduction and do not itemize. Rachel has interest income of $500.. 1. What is the most beneficial filing status for Orville & Rachel? 2. Can they claim Scott as a dependent? Why or why not? 3. Can they claim Sara as a dependent? Why or why not. 4. What is their gross income total. 5. How much of their income is subject to federal income tax? 6. Will they get a refund, or will they owe additional taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts