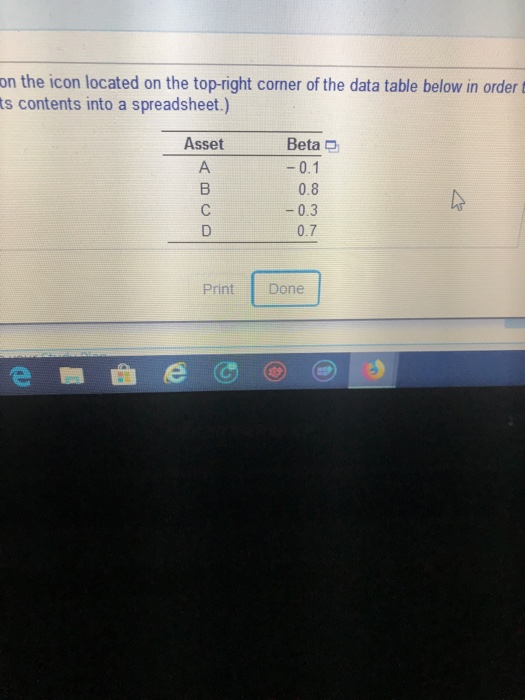

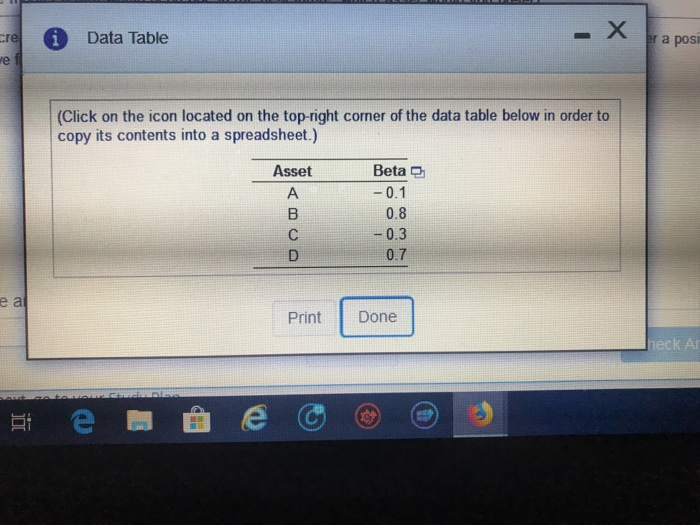

Question: Answer the questions below for assets A to D shown in above table. on the icon located on the top-right corner of the data table

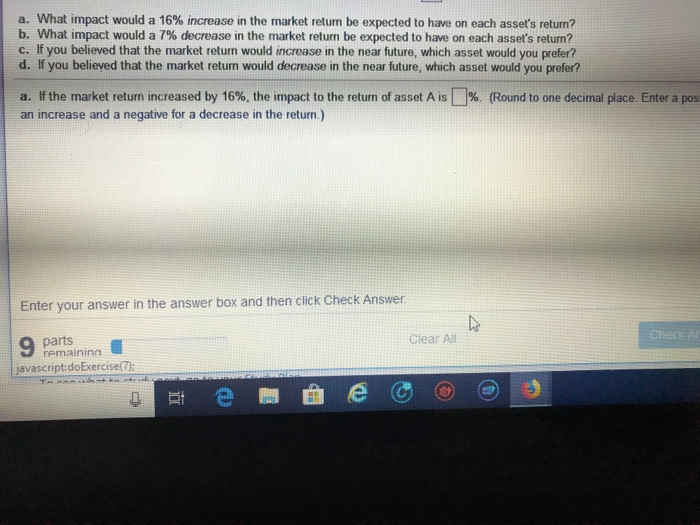

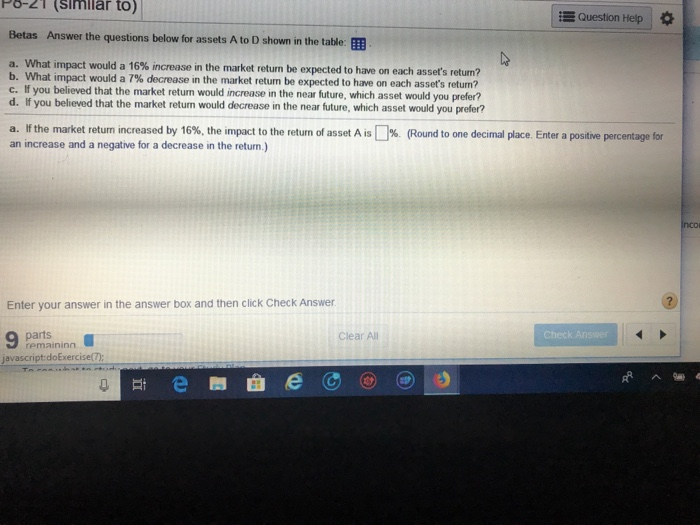

on the icon located on the top-right corner of the data table below in order t s contents into a spreadsheet.) Asset Beta 0.8 -0.3 0.7 Print Done a. What impact would a 16% increase in the market return be expected to have on each asset's return? b. What impact would a 7% decrease in the market return be expected to have on each asset's return? c. If you believed that the market return would increase in the near future, which asset would you prefer? d. If you believed that the market return would decrease in the near future, which asset would you prefer? a. the market return increased by 16%, the impact to the return of asset Ais an increase and a negative for a decrease in the return.) % Round to one decimal place. Enter a pos Enter your answer in the answer box and then click Check Answer Clear All heck A parts remaininn javascript:doExercise(7 P8-21 (slmillar to Question Help * Betas Answer the questions below for assets A to D shown in the table: BEB a. What impact would a 16% increase in the market return be expected to have on each asset's return? b. What impact would a 7% decrease in the market retum be expected to have on each asset's return? c. If you believed that the market return would increase in the near future, which asset would you prefer? d. If you believed that the market return would decrease in the near future, which asset would a. If the market return increased by 16%, the impact to the return of asset A is an increase and a negative for a decrease in the return.) you prefer? Round to one decimal place. Enter a positive percentage for % ncor Enter your answer in the answer box and then click Check Answer parts remaininn Clear All javascript doExercise(7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts