Question: Answer the Questions Below using the Following Information. We have the Option to Invest in a Rental Property with a Plan to Sell the Property

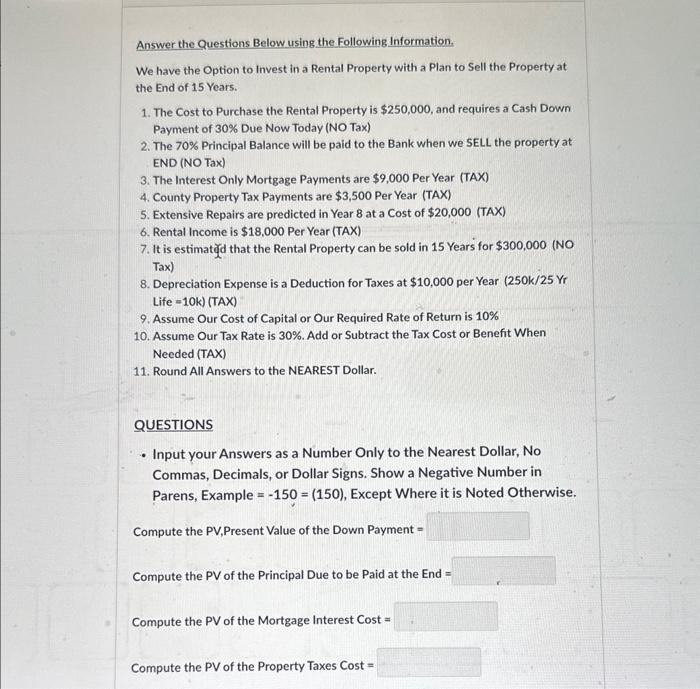

Answer the Questions Below using the Following Information. We have the Option to Invest in a Rental Property with a Plan to Sell the Property at the End of 15 Years. 1. The Cost to Purchase the Rental Property is $250,000, and requires a Cash Down Payment of 30% Due Now Today (NO Tax) 2. The 70% Principal Balance will be paid to the Bank when we SELL the property at END (NO Tax) 3. The Interest Only Mortgage Payments are $9,000 Per Year (TAX) 4. County Property Tax Payments are $3,500 Per Year (TAX) 5. Extensive Repairs are predicted in Year 8 at a Cost of $20,000 (TAX) 6. Rental Income is $18,000 Per Year (TAX) 7. It is estimat d that the Rental Property can be sold in 15 Years for $300,000 (NO Tax) 8. Depreciation Expense is a Deduction for Taxes at $10,000 per Year (250k/25Yr Life =10K ) (TAX) 9. Assume Our Cost of Capital or Our Required Rate of Return is 10% 10. Assume Our Tax Rate is 30%. Add or Subtract the Tax Cost or Benefit When Needed (TAX) 11. Round All Answers to the NEAREST Dollar. QUESTIONS - Input your Answers as a Number Only to the Nearest Dollar, No Commas, Decimals, or Dollar Signs. Show a Negative Number in Parens, Example =150=(150), Except Where it is Noted Otherwise. Compute the PV,Present Value of the Down Payment = Compute the PV of the Principal Due to be Paid at the End = Compute the PV of the Mortgage Interest Cost = Compute the PV of the Property Taxes Cost =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts