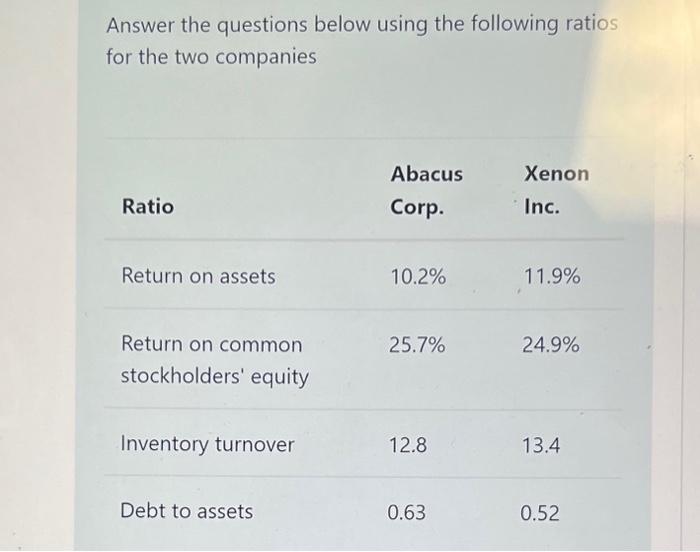

Question: Answer the questions below using the following ratios for the two companies - Return on assets = net income / average total assets - Rate

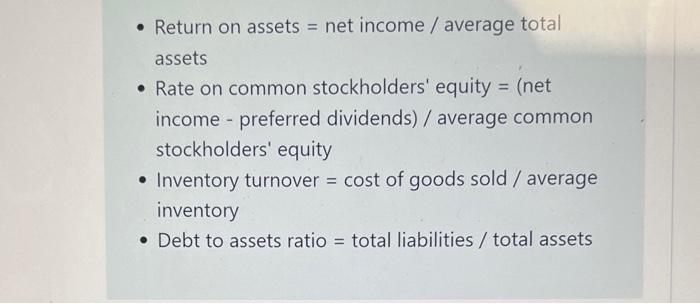

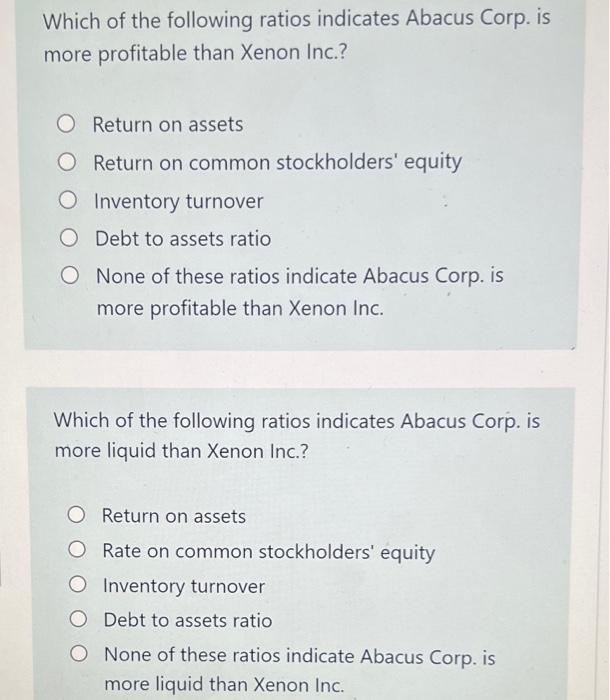

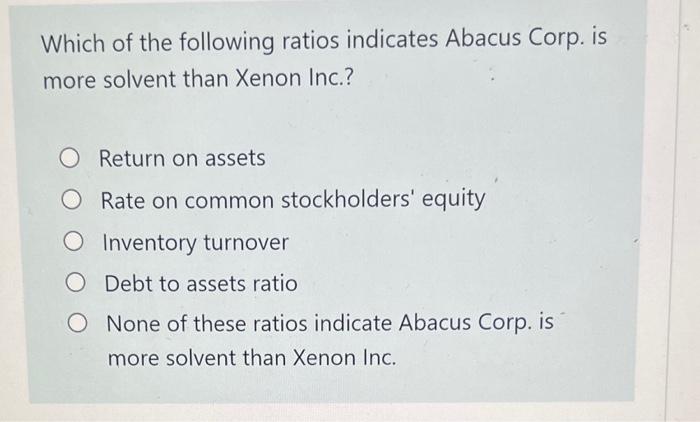

Answer the questions below using the following ratios for the two companies - Return on assets = net income / average total assets - Rate on common stockholders' equity = (net income - preferred dividends) / average common stockholders' equity - Inventory turnover = cost of goods sold / average inventory - Debt to assets ratio = total liabilities / total assets Which of the following ratios indicates Abacus Corp. is more profitable than Xenon Inc.? Return on assets Return on common stockholders' equity Inventory turnover Debt to assets ratio None of these ratios indicate Abacus Corp. is more profitable than Xenon Inc. Which of the following ratios indicates Abacus Corp. is more liquid than Xenon Inc.? Return on assets Rate on common stockholders' equity Inventory turnover Debt to assets ratio None of these ratios indicate Abacus Corp. is more liquid than Xenon Inc. Which of the following ratios indicates Abacus Corp. is more solvent than Xenon Inc.? Return on assets Rate on common stockholders' equity Inventory turnover Debt to assets ratio None of these ratios indicate Abacus Corp. is more solvent than Xenon Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts