Question: answer the questions below using the problem above. show all calculations please and equations... asap 4) (20 points) The company you work for is considering

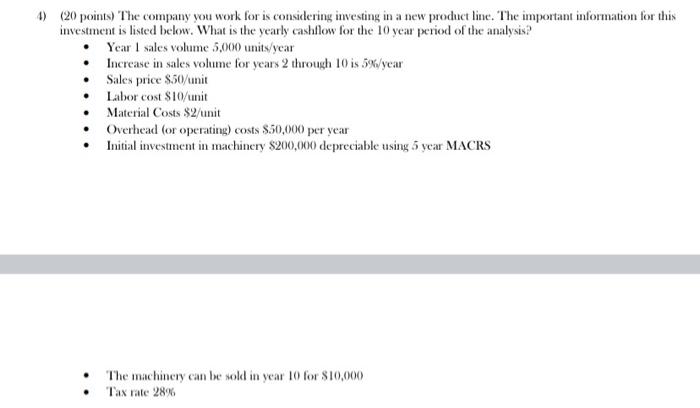

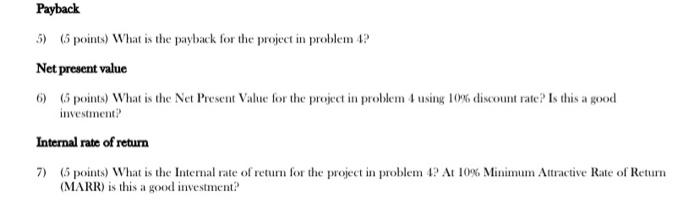

4) (20 points) The company you work for is considering investing in a new product line. The important information for this investment is listed below. What is the yearly cashllow for the 10 year period of the analysis? - Year 1 sales volume 5,000 units/year - Increase in sales volume for years 2 through 10 is 5%/y ear - Sales price $50/ unit - Labor cost $10/ unit - Matcrial Costs $2/ unit - Overhead (or operating) costs $50,000 per year - Initial investment in machinery $200,000 depreciable using 5 ycar MACRS - The machinery can be sold in year 10 for $10,000 - Tax rate 28\% 5) (5 points) What is the payback for the project in problem 4 ? Net present value 6) (5 points) What is the Net Present Value for the project in problem 4 using 10% discount rate? Is this a good investment? Internal rate of return 7) ( 5 points) What is the Internal rate of return for the project in problem 4? At 10% Minimum Attractive Rate of Return (MARR) is this a good investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts