Question: Answer the questions below with the appororiate IRC formatted structure. 9. Corporation RST owns 18% of the stock of Corporation DEF and receives a $10,000

Answer the questions below with the appororiate IRC formatted structure.

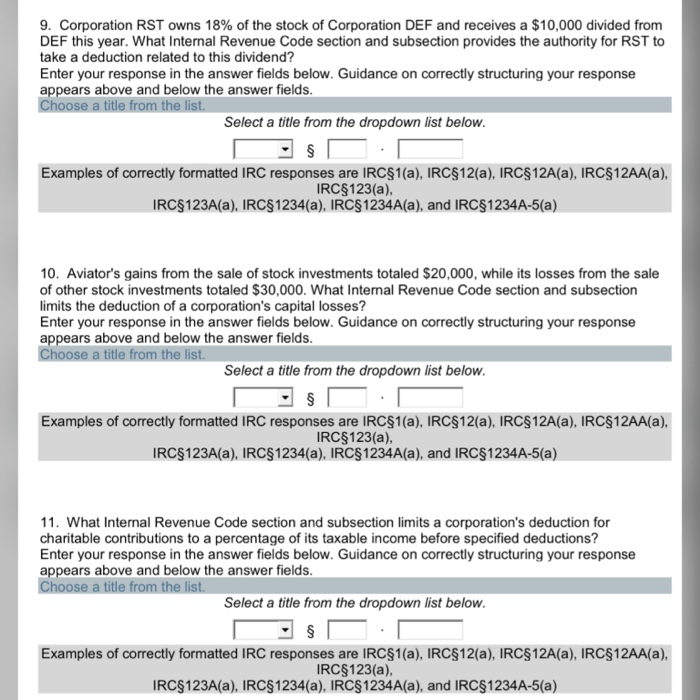

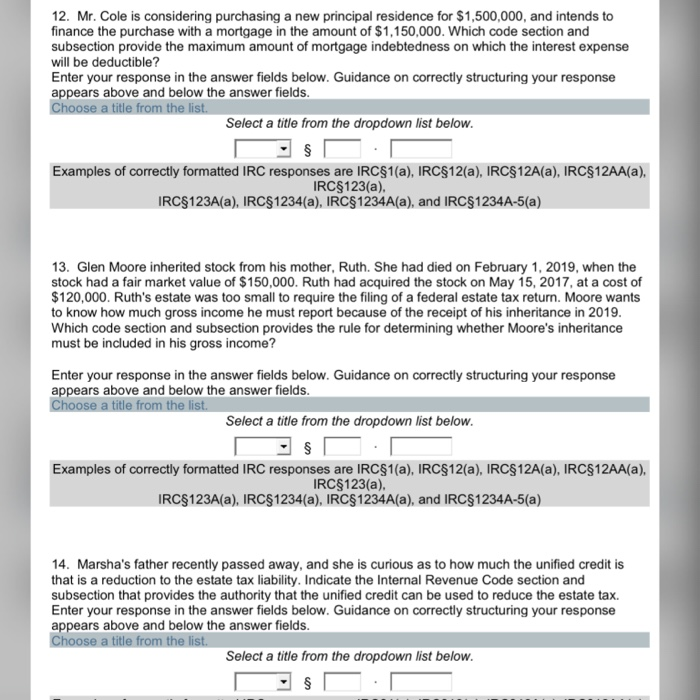

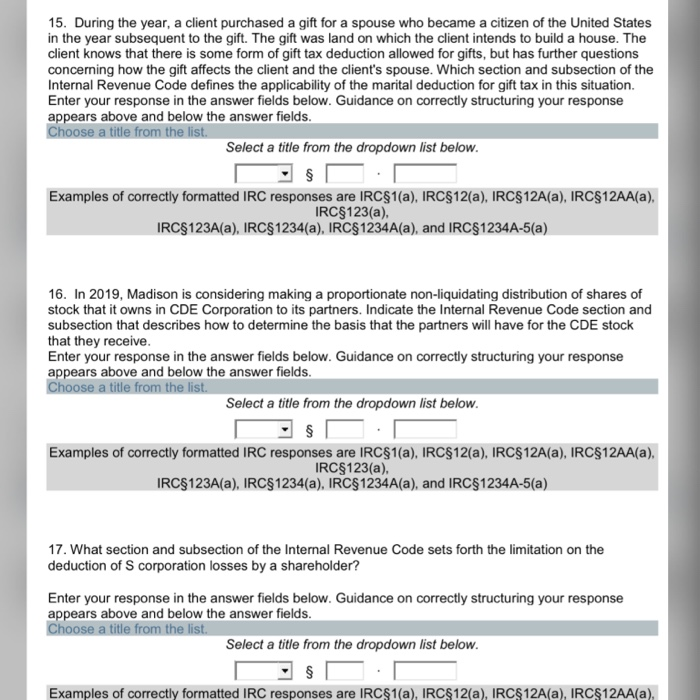

9. Corporation RST owns 18% of the stock of Corporation DEF and receives a $10,000 divided from DEF this year. What Internal Revenue Code section and subsection provides the authority for RST to take a deduction related to this dividend? Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. $ Examples of correctly formatted IRC responses are IRC$1(a), IRC12(a), IRC$12A(a), IRCR12AA(a), IRC$123(a). IRC9123A(a), IRC91234(a), IRC91234A(a), and IRC91234A-5(a) 10. Aviator's gains from the sale of stock investments totaled $20,000, while its losses from the sale of other stock investments totaled $30,000. What Internal Revenue Code section and subsection limits the deduction of a corporation's capital losses? Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. $ Examples of correctly formatted IRC responses are IRC$1(a), IRC$12(a), IRC12A(a), IRC312AA(a), IRC$123(a), IRCR123A(a), IRCR1234(a), IRCR1234A(a), and IRC$1234A-5(a) 11. What Internal Revenue Code section and subsection limits a corporation's deduction for charitable contributions to a percentage of its taxable income before specified deductions? Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. S Examples of correctly formatted IRC responses are IRC$1(a), IRC912(a), IRC$12A(a), IRC$12AA(a), IRC9123(a) IRC$123A(a), IRCR1234(a), IRCR1234A(a), and IRC$1234A-5(a) 12. Mr. Cole is considering purchasing a new principal residence for $1,500,000, and intends to finance the purchase with a mortgage in the amount of $1,150,000. Which code section and subsection provide the maximum amount of mortgage indebtedness on which the interest expense will be deductible? Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. $ Examples of correctly formatted IRC responses are IRC$1(a), IRC$12(a), IRC$12A(a), IRC$12AA(a), IRCR123(a). IRC$123A(a), IRC$1234(a), IRC91234A(a), and IRC91234A-5(a) 13. Glen Moore inherited stock from his mother, Ruth. She had died on February 1, 2019, when the stock had a fair market value of $150,000. Ruth had acquired the stock on May 15, 2017, at a cost of $120,000. Ruth's estate was too small to require the filing of a federal estate tax return. Moore wants to know how much gross income he must report because of the receipt of his inheritance in 2019. Which code section and subsection provides the rule for determining whether Moore's inheritance must be included in his gross income? Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. $ Examples of correctly formatted IRC responses are IRC91(a), IRC12(a), IRCG12A(a), IRC912AA(a), IRC$123(a). IRC9123A(a), IRC$1234(a), IRC$1234A(a), and IRC91234A-5(a) 14. Marsha's father recently passed away, and she is curious as to how much the unified credit is that is a reduction to the estate tax liability. Indicate the Internal Revenue Code section and subsection that provides the authority that the unified credit can be used to reduce the estate tax. Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. $ 15. During the year, a client purchased a gift for a spouse who became a citizen of the United States in the year subsequent to the gift. The gift was land on which the client intends to build a house. The client knows that there is some form of gift tax deduction allowed for gifts, but has further questions concerning how the gift affects the client and the client's spouse. Which section and subsection of the Internal Revenue Code defines the applicability of the marital deduction for gift tax in this situation. Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. $ Examples of correctly formatted IRC responses are IRC$1(a), IRC$12(a), IRC12A(a), IRC12AA(a), IRC8123(a), IRC8123A(a), IRC1234(a), IRC91234A(a), and IRC81234A-5(a) 16. In 2019, Madison is considering making a proportionate non-liquidating distribution of shares of stock that it owns in CDE Corporation to its partners. Indicate the Internal Revenue Code section and subsection that describes how to determine the basis that the partners will have for the CDE stock that they receive. Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. $ Examples of correctly formatted IRC responses are IRC$1(a), IRC12(a), IRC$12A(a), IRC12AA(a), IRC9123(a) IRC123A(a), IRC$1234(a), IRC31234A(a), and IRC1234A-5(a) 17. What section and subsection of the Internal Revenue Code sets forth the limitation on the deduction of corporation losses by a shareholder? Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. $ Examples of correctly formatted IRC responses are IRC$1(a), IRC 12(a), IRC 12A(a), IRC 12AA(a), 9. Corporation RST owns 18% of the stock of Corporation DEF and receives a $10,000 divided from DEF this year. What Internal Revenue Code section and subsection provides the authority for RST to take a deduction related to this dividend? Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. $ Examples of correctly formatted IRC responses are IRC$1(a), IRC12(a), IRC$12A(a), IRCR12AA(a), IRC$123(a). IRC9123A(a), IRC91234(a), IRC91234A(a), and IRC91234A-5(a) 10. Aviator's gains from the sale of stock investments totaled $20,000, while its losses from the sale of other stock investments totaled $30,000. What Internal Revenue Code section and subsection limits the deduction of a corporation's capital losses? Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. $ Examples of correctly formatted IRC responses are IRC$1(a), IRC$12(a), IRC12A(a), IRC312AA(a), IRC$123(a), IRCR123A(a), IRCR1234(a), IRCR1234A(a), and IRC$1234A-5(a) 11. What Internal Revenue Code section and subsection limits a corporation's deduction for charitable contributions to a percentage of its taxable income before specified deductions? Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. S Examples of correctly formatted IRC responses are IRC$1(a), IRC912(a), IRC$12A(a), IRC$12AA(a), IRC9123(a) IRC$123A(a), IRCR1234(a), IRCR1234A(a), and IRC$1234A-5(a) 12. Mr. Cole is considering purchasing a new principal residence for $1,500,000, and intends to finance the purchase with a mortgage in the amount of $1,150,000. Which code section and subsection provide the maximum amount of mortgage indebtedness on which the interest expense will be deductible? Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. $ Examples of correctly formatted IRC responses are IRC$1(a), IRC$12(a), IRC$12A(a), IRC$12AA(a), IRCR123(a). IRC$123A(a), IRC$1234(a), IRC91234A(a), and IRC91234A-5(a) 13. Glen Moore inherited stock from his mother, Ruth. She had died on February 1, 2019, when the stock had a fair market value of $150,000. Ruth had acquired the stock on May 15, 2017, at a cost of $120,000. Ruth's estate was too small to require the filing of a federal estate tax return. Moore wants to know how much gross income he must report because of the receipt of his inheritance in 2019. Which code section and subsection provides the rule for determining whether Moore's inheritance must be included in his gross income? Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. $ Examples of correctly formatted IRC responses are IRC91(a), IRC12(a), IRCG12A(a), IRC912AA(a), IRC$123(a). IRC9123A(a), IRC$1234(a), IRC$1234A(a), and IRC91234A-5(a) 14. Marsha's father recently passed away, and she is curious as to how much the unified credit is that is a reduction to the estate tax liability. Indicate the Internal Revenue Code section and subsection that provides the authority that the unified credit can be used to reduce the estate tax. Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. $ 15. During the year, a client purchased a gift for a spouse who became a citizen of the United States in the year subsequent to the gift. The gift was land on which the client intends to build a house. The client knows that there is some form of gift tax deduction allowed for gifts, but has further questions concerning how the gift affects the client and the client's spouse. Which section and subsection of the Internal Revenue Code defines the applicability of the marital deduction for gift tax in this situation. Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. $ Examples of correctly formatted IRC responses are IRC$1(a), IRC$12(a), IRC12A(a), IRC12AA(a), IRC8123(a), IRC8123A(a), IRC1234(a), IRC91234A(a), and IRC81234A-5(a) 16. In 2019, Madison is considering making a proportionate non-liquidating distribution of shares of stock that it owns in CDE Corporation to its partners. Indicate the Internal Revenue Code section and subsection that describes how to determine the basis that the partners will have for the CDE stock that they receive. Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. $ Examples of correctly formatted IRC responses are IRC$1(a), IRC12(a), IRC$12A(a), IRC12AA(a), IRC9123(a) IRC123A(a), IRC$1234(a), IRC31234A(a), and IRC1234A-5(a) 17. What section and subsection of the Internal Revenue Code sets forth the limitation on the deduction of corporation losses by a shareholder? Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Choose a title from the list. Select a title from the dropdown list below. $ Examples of correctly formatted IRC responses are IRC$1(a), IRC 12(a), IRC 12A(a), IRC 12AA(a)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock