Question: Answer the questions in the textbox. Work has been entered in each cell; I am just not sure how to answer the questions. Suppose you

Answer the questions in the textbox. Work has been entered in each cell; I am just not sure how to answer the questions.

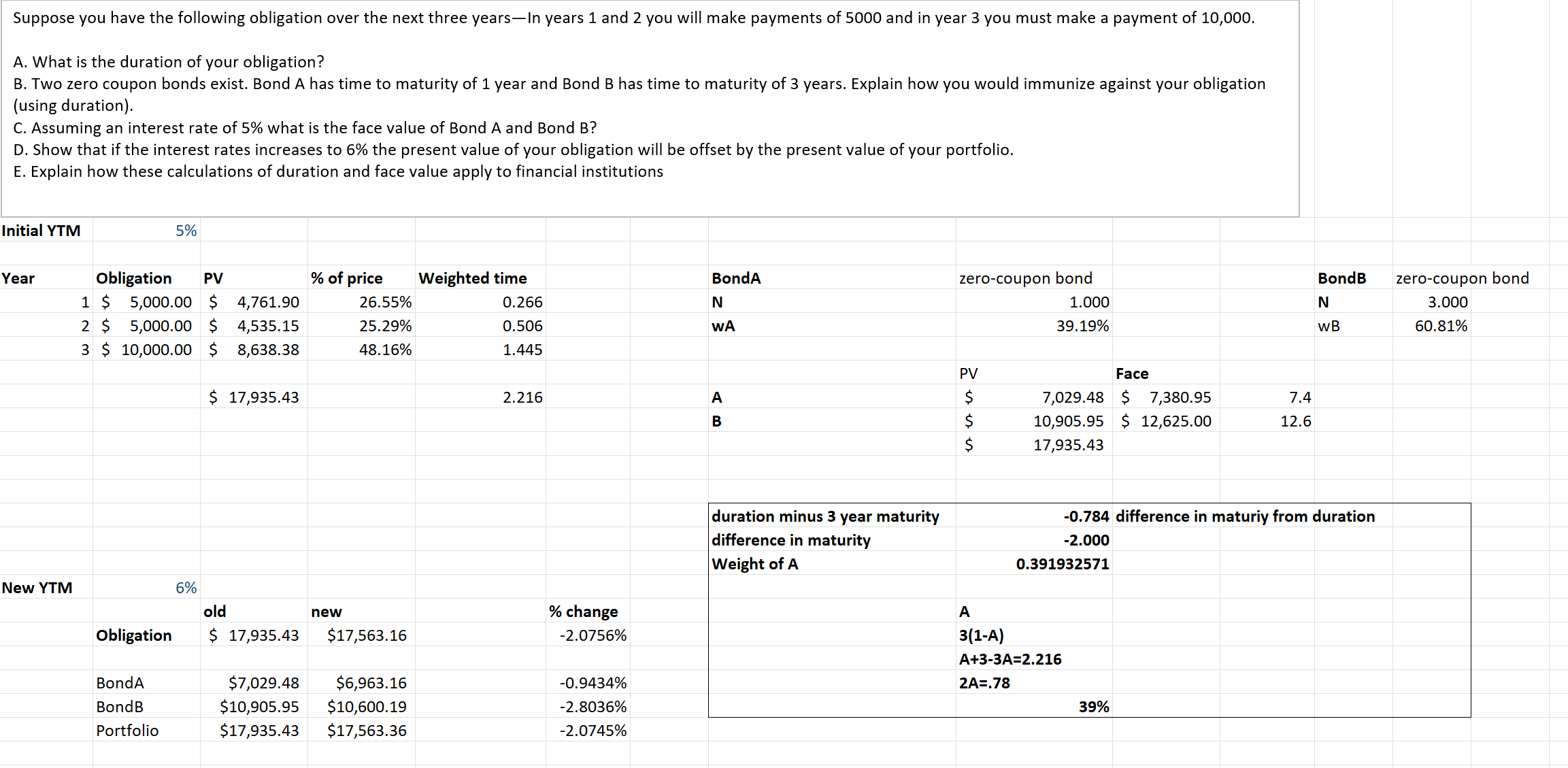

Suppose you have the following obligation over the next three years-In years 1 and 2 you will make payments of 5000 and in year 3 you must make a payment of 10,000. A. What is the duration of your obligation? B. Two zero coupon bonds exist. Bond A has time to maturity of 1 year and Bond B has time to maturity of 3 years. Explain how you would immunize against your obligation (using duration). C. Assuming an interest rate of 5% what is the face value of Bond A and Bond B ? D. Show that if the interest rates increases to 6% the present value of your obligation will be offset by the present value of your portfolio. E. Explain how these calculations of duration and face value apply to financial institutions Suppose you have the following obligation over the next three years-In years 1 and 2 you will make payments of 5000 and in year 3 you must make a payment of 10,000. A. What is the duration of your obligation? B. Two zero coupon bonds exist. Bond A has time to maturity of 1 year and Bond B has time to maturity of 3 years. Explain how you would immunize against your obligation (using duration). C. Assuming an interest rate of 5% what is the face value of Bond A and Bond B ? D. Show that if the interest rates increases to 6% the present value of your obligation will be offset by the present value of your portfolio. E. Explain how these calculations of duration and face value apply to financial institutions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts