Question: answer the questions provided A and b Question 2 (a) Suppose a factor model is appropriate to describe the returns on a stock. The current

answer the questions provided A and b

answer the questions provided A and b

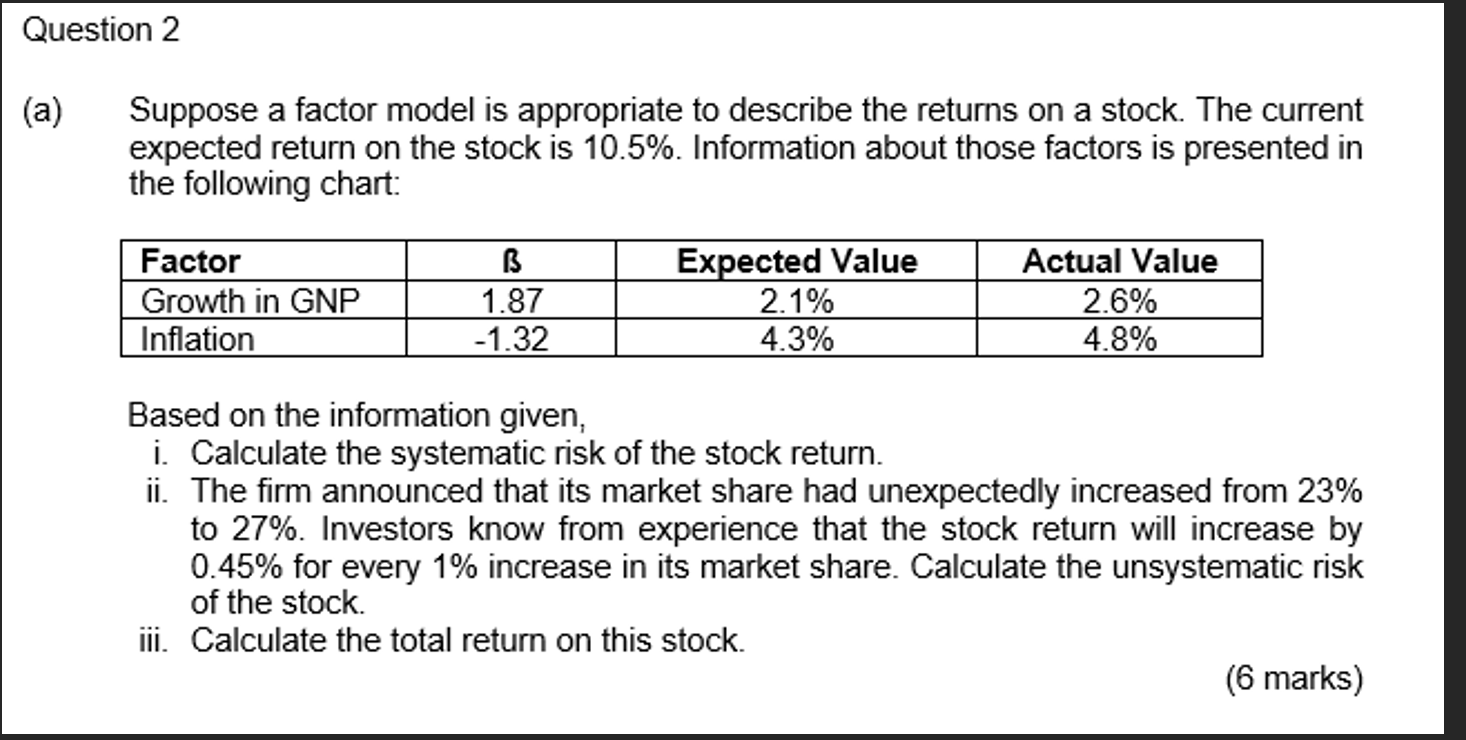

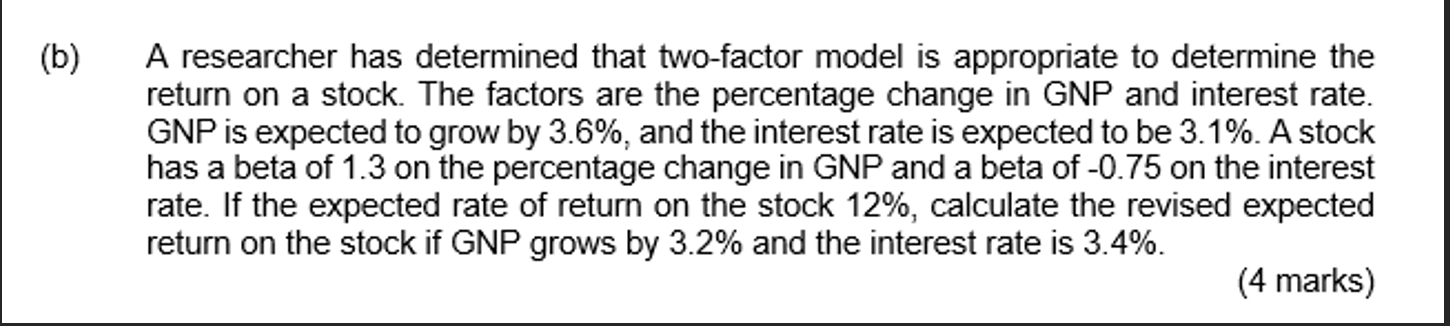

Question 2 (a) Suppose a factor model is appropriate to describe the returns on a stock. The current expected return on the stock is 10.5%. Information about those factors is presented in the following chart: Factor Growth in GNP Inflation B 1.87 -1.32 Expected Value 2.1% 4.3% Actual Value 2.6% 4.8% Based on the information given, i. Calculate the systematic risk of the stock return. ii. The firm announced that its market share had unexpectedly increased from 23% to 27%. Investors know from experience that the stock return will increase by 0.45% for every 1% increase in its market share. Calculate the unsystematic risk of the stock. iii. Calculate the total return on this stock. (6 marks) (b) A researcher has determined that two-factor model is appropriate to determine the return on a stock. The factors are the percentage change in GNP and interest rate. GNP is expected to grow by 3.6%, and the interest rate is expected to be 3.1%. A stock has a beta of 1.3 on the percentage change in GNP and a beta of -0.75 on the interest rate. If the expected rate of return on the stock 12%, calculate the revised expected return on the stock if GNP grows by 3.2% and the interest rate is 3.4%. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts