Question: Answer the questions provided below using the information provided? Information: On May 15th, 2021, Saola purchased 159,290 shares of ZHT, Inc.'s 354,000 outstanding shares for

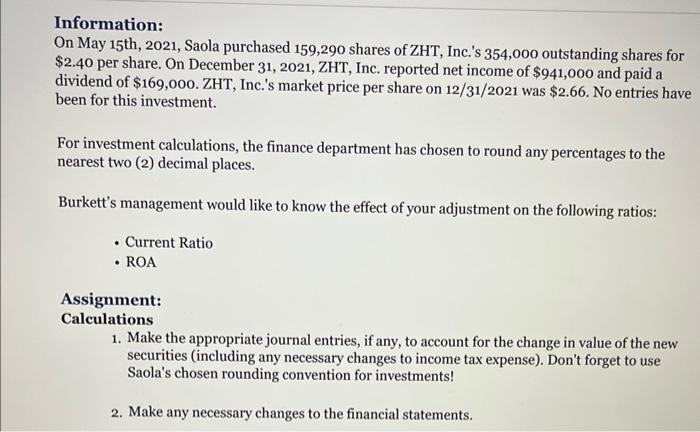

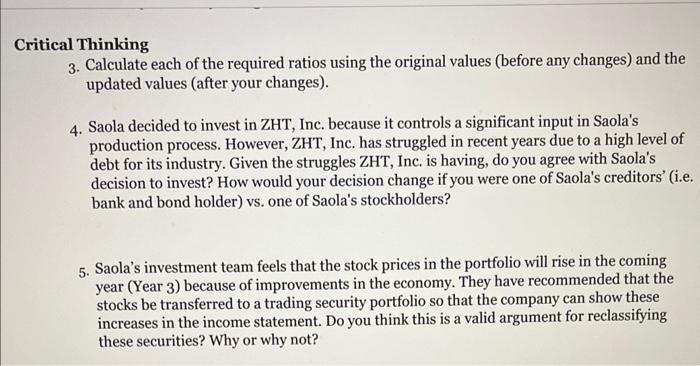

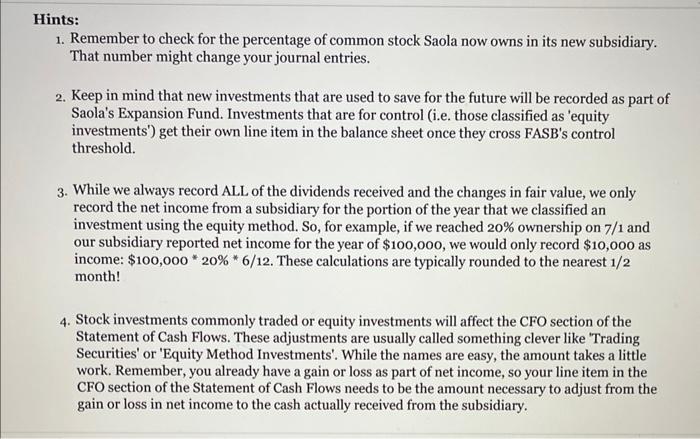

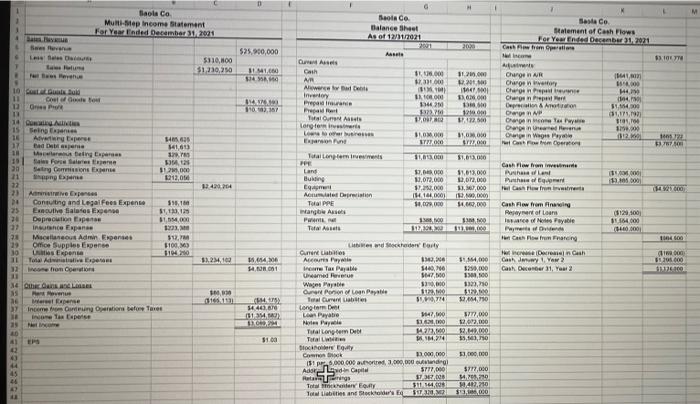

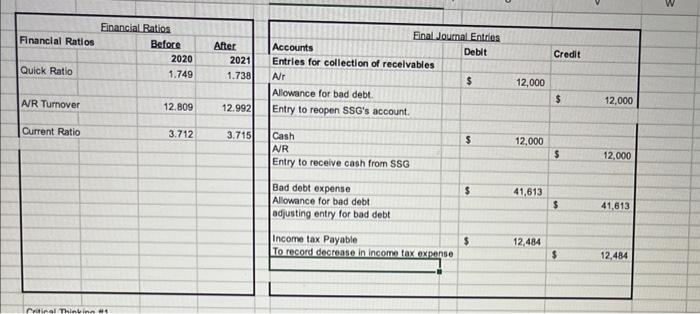

Information: On May 15th, 2021, Saola purchased 159,290 shares of ZHT, Inc.'s 354,000 outstanding shares for $2.40 per share. On December 31,2021,ZHT, Inc. reported net income of $941,000 and paid a dividend of $169,000. ZHT, Inc.'s market price per share on 12/31/2021 was $2.66. No entries have been for this investment. For investment calculations, the finance department has chosen to round any percentages to the nearest two (2) decimal places. Burkett's management would like to know the effect of your adjustment on the following ratios: - Current Ratio - ROA Assignment: Calculations 1. Make the appropriate journal entries, if any, to account for the change in value of the new securities (including any necessary changes to income tax expense). Don't forget to use Saola's chosen rounding convention for investments! 2. Make any necessary changes to the financial statements. 3. Calculate each of the required ratios using the original values (before any changes) and the updated values (after your changes). 4. Saola decided to invest in ZHT, Inc. because it controls a significant input in Saola's production process. However, ZHT, Inc. has struggled in recent years due to a high level of debt for its industry. Given the struggles ZHT, Inc. is having, do you agree with Saola's decision to invest? How would your decision change if you were one of Saola's creditors' (i.e. bank and bond holder) vs. one of Saola's stockholders? 5. Saola's investment team feels that the stock prices in the portfolio will rise in the coming year (Year 3 ) because of improvements in the economy. They have recommended that the stocks be transferred to a trading security portfolio so that the company can show these increases in the income statement. Do you think this is a valid argument for reclassifying these securities? Why or why not? 1. Remember to check for the percentage of common stock Saola now owns in its new subsidiary. That number might change your journal entries. 2. Keep in mind that new investments that are used to save for the future will be recorded as part of Saola's Expansion Fund. Investments that are for control (i.e. those classified as 'equity investments') get their own line item in the balance sheet once they cross FASB's control threshold. 3. While we always record ALL of the dividends received and the changes in fair value, we only record the net income from a subsidiary for the portion of the year that we classified an investment using the equity method. So, for example, if we reached 20% ownership on 7/1 and our subsidiary reported net income for the year of $100,000, we would only record $10,000 as income: $100,00020%6/12. These calculations are typically rounded to the nearest 1/2 month! 4. Stock investments commonly traded or equity investments will affect the CFO section of the Statement of Cash Flows. These adjustments are usually called something clever like 'Trading Securities' or 'Equity Method Investments'. While the names are easy, the amount takes a little work. Remember, you already have a gain or loss as part of net income, so your line item in the CFO section of the Statement of Cash Flows needs to be the amount necessary to adjust from the gain or loss in net income to the cash actually received from the subsidiary. Information: On May 15th, 2021, Saola purchased 159,290 shares of ZHT, Inc.'s 354,000 outstanding shares for $2.40 per share. On December 31,2021,ZHT, Inc. reported net income of $941,000 and paid a dividend of $169,000. ZHT, Inc.'s market price per share on 12/31/2021 was $2.66. No entries have been for this investment. For investment calculations, the finance department has chosen to round any percentages to the nearest two (2) decimal places. Burkett's management would like to know the effect of your adjustment on the following ratios: - Current Ratio - ROA Assignment: Calculations 1. Make the appropriate journal entries, if any, to account for the change in value of the new securities (including any necessary changes to income tax expense). Don't forget to use Saola's chosen rounding convention for investments! 2. Make any necessary changes to the financial statements. 3. Calculate each of the required ratios using the original values (before any changes) and the updated values (after your changes). 4. Saola decided to invest in ZHT, Inc. because it controls a significant input in Saola's production process. However, ZHT, Inc. has struggled in recent years due to a high level of debt for its industry. Given the struggles ZHT, Inc. is having, do you agree with Saola's decision to invest? How would your decision change if you were one of Saola's creditors' (i.e. bank and bond holder) vs. one of Saola's stockholders? 5. Saola's investment team feels that the stock prices in the portfolio will rise in the coming year (Year 3 ) because of improvements in the economy. They have recommended that the stocks be transferred to a trading security portfolio so that the company can show these increases in the income statement. Do you think this is a valid argument for reclassifying these securities? Why or why not? 1. Remember to check for the percentage of common stock Saola now owns in its new subsidiary. That number might change your journal entries. 2. Keep in mind that new investments that are used to save for the future will be recorded as part of Saola's Expansion Fund. Investments that are for control (i.e. those classified as 'equity investments') get their own line item in the balance sheet once they cross FASB's control threshold. 3. While we always record ALL of the dividends received and the changes in fair value, we only record the net income from a subsidiary for the portion of the year that we classified an investment using the equity method. So, for example, if we reached 20% ownership on 7/1 and our subsidiary reported net income for the year of $100,000, we would only record $10,000 as income: $100,00020%6/12. These calculations are typically rounded to the nearest 1/2 month! 4. Stock investments commonly traded or equity investments will affect the CFO section of the Statement of Cash Flows. These adjustments are usually called something clever like 'Trading Securities' or 'Equity Method Investments'. While the names are easy, the amount takes a little work. Remember, you already have a gain or loss as part of net income, so your line item in the CFO section of the Statement of Cash Flows needs to be the amount necessary to adjust from the gain or loss in net income to the cash actually received from the subsidiary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts