Question: Answer the Questions step by step based on the pictures given below. Thank you QUESTION 1. Prepare a reconciliation of the bank statement balance to

Answer the Questions step by step based on the pictures given below. Thank you

QUESTION

1. Prepare a reconciliation of the bank statement balance to the corrected general ledger balance.

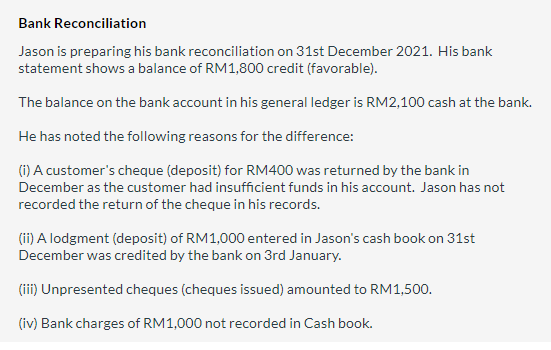

Bank Reconciliation Jason is preparing his bank reconciliation on 31st December 2021. His bank statement shows a balance of RM1,800 credit (favorable). The balance on the bank account in his general ledger is RM2,100 cash at the bank. He has noted the following reasons for the difference: (i) A customer's cheque (deposit) for RM400 was returned by the bank in December as the customer had insufficient funds in his account. Jason has not recorded the return of the cheque in his records. (ii) A lodgment (deposit) of RM1,000 entered in Jason's cash book on 31st December was credited by the bank on 3rd January. (iii) Unpresented cheques (cheques issued) amounted to RM1,500. (iv) Bank charges of RM1,000 not recorded in Cash book

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts