Question: Answer the questions that follow: a. Name the primary commodity or asset for the contract Sugar b. Name the exchange (in full) on which the

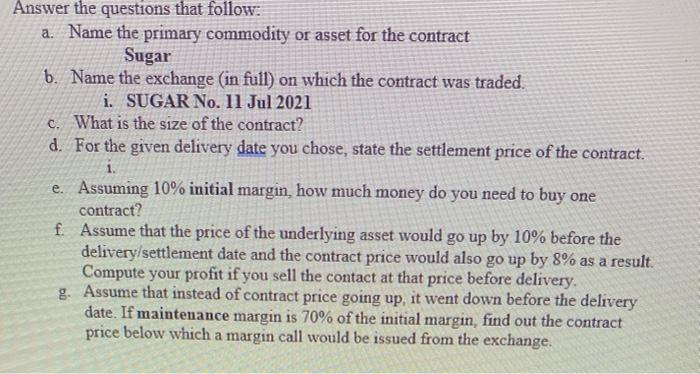

Answer the questions that follow: a. Name the primary commodity or asset for the contract Sugar b. Name the exchange (in full) on which the contract was traded. i. SUGAR No. 11 Jul 2021 c. What is the size of the contract? d. For the given delivery date you chose, state the settlement price of the contract. i. e. Assuming 10% initial margin, how much money do you need to buy one contract? f. Assume that the price of the underlying asset would go up by 10% before the delivery/settlement date and the contract price would also go up by 8% as a result. Compute your profit if you sell the contact at that price before delivery. g. Assume that instead of contract price going up, it went down before the delivery date. If maintenance margin is 70% of the initial margin, find out the contract price below which a margin call would be issued from the exchange. OUTES COMO Sugar No. 11 World Jul 2021 SEN21 (US:ICE Futures US) 10 SD IM OM YID Y MED 17.73 0,64 3.74% 17.56 B2,000 Open 430,064 Day Bay 17.05 - 17.79 17 165 Wees 10.51-1779 stan 4 ASMANDDOURIME COMPARE - Open 17 Settlement Price 107 D 1 Day SUNN OVERVIEW MOVANCE CHURTING CONTRACTS CASH PROCES FUTURES SETTLEMENT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts