Question: Answer the Red X QUESTION 5 Partially correct 16.67 points out of 20.00 P Flag question Analyzing Inventory Disclosure Comparing LIFO and FIFO The current

Answer the Red X

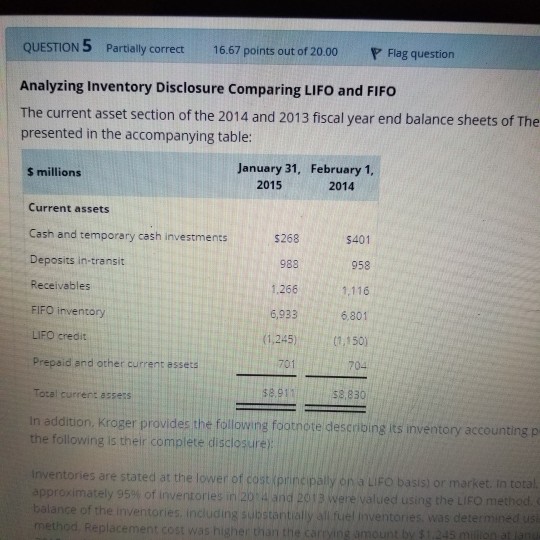

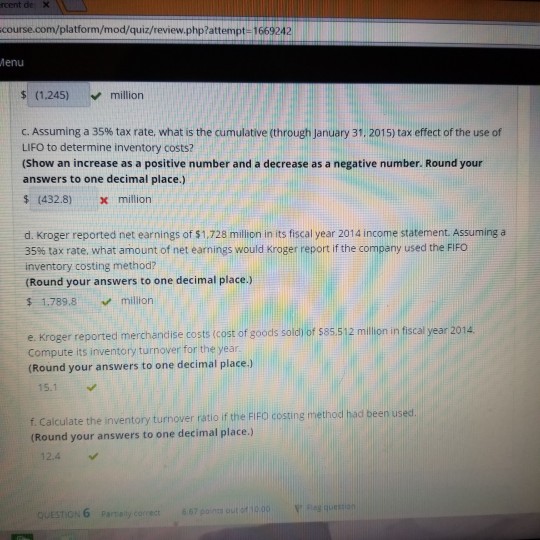

QUESTION 5 Partially correct 16.67 points out of 20.00 P Flag question Analyzing Inventory Disclosure Comparing LIFO and FIFO The current asset section of the 2014 and 2013 fiscal year end balance sheets of The presented in the accompanying table: January 31, 2015 February 1, 2014 $ millions Current assets Cash and temporary cash investments Deposits in-transit Receivables FIFO inventory LIFO credit Prepaid and other current assets Total current assers $401 958 1.116 6,801 (1,245)1,50) 704 $8,830 $268 988 1.266 6,933 701 $8.911 addition. Kroger provides the following footnote describing its inventory accounting p the following is their complete disclosure) inventories are stated at the lower of cost (pri ncpaly ona LiFo basis) or market in tota the LIFO method 95% of inventories in 2004, and 2013 were valued of the i rn

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts