Question: answer the second part do not answer the first part assets is equal to modine durau ilities. Example 56.2 An investor has a single liability

answer the second part do not answer the first part

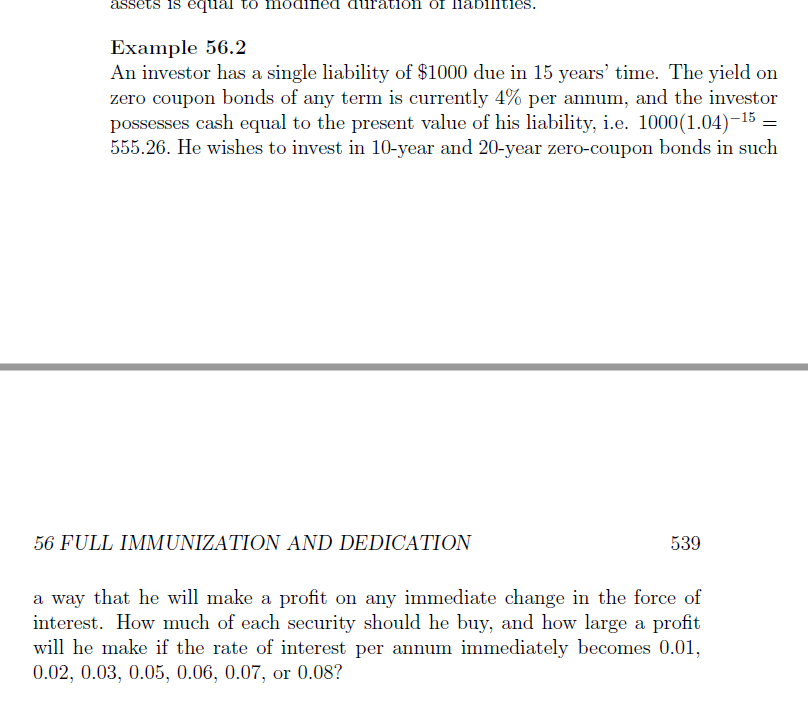

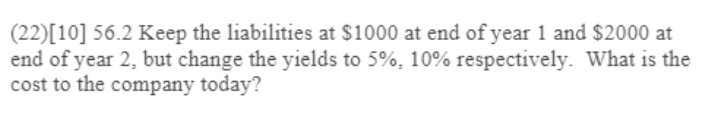

assets is equal to modine durau ilities. Example 56.2 An investor has a single liability of $1000 due in 15 years' time. The yield on zero coupon bonds of any term is currently 4% per annum, and the investor possesses cash equal to the present value of his liability, i.e. 1000(1.04)15 = 555.26. He wishes to invest in 10-year and 20-year zero-coupon bonds in such 56 FULL IMMUNIZATION AND DEDICATION 539 a way that he will make a profit on any immediate change in the force of interest. How much of each security should he buy, and how large a profit will he make if the rate of interest per annum immediately becomes 0.01, 0.02, 0.03, 0.05, 0.06, 0.07, or 0.08? (22)[10] 56.2 Keep the liabilities at $1000 at end of year 1 and $2000 at end of year 2, but change the yields to 5%, 10% respectively. What is the cost to the company today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts