Question: Answer the ten (10) questions given the following data set: ABC purchases a new delivery truck on January 1,2022 . The cost of the truck

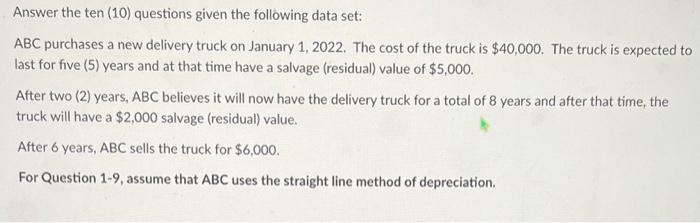

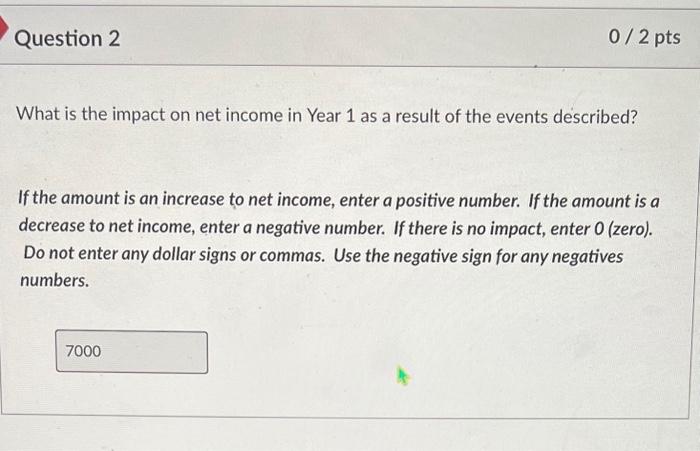

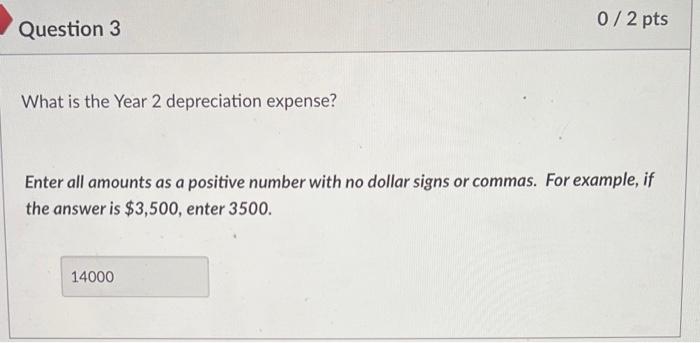

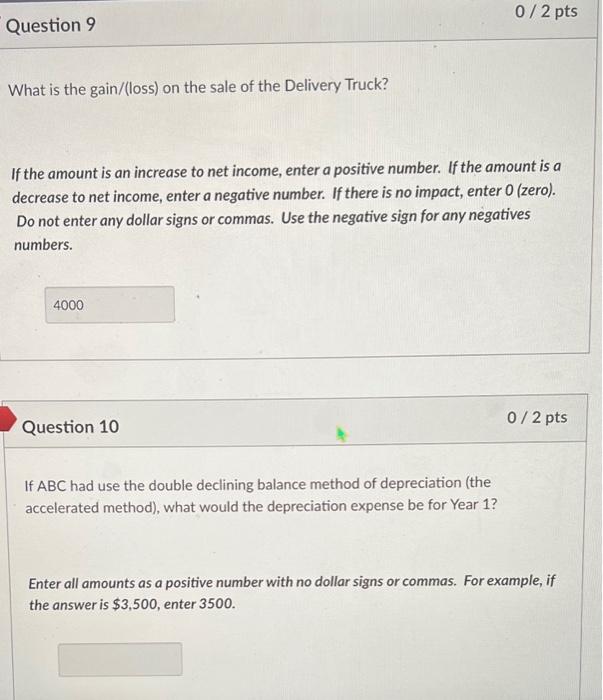

Answer the ten (10) questions given the following data set: ABC purchases a new delivery truck on January 1,2022 . The cost of the truck is $40,000. The truck is expected to last for five (5) years and at that time have a salvage (residual) value of $5,000. After two (2) years, ABC believes it will now have the delivery truck for a total of 8 years and after that time, the truck will have a $2,000 salvage (residual) value. After 6 years, ABC sells the truck for $6,000. For Question 1-9, assume that ABC uses the straight line method of depreciation. If the amount is an increase to net income, enter a positive number. If the amount is a decrease to net income, enter a negative number. If there is no impact, enter 0 (zero). Do not enter any dollar signs or commas. Use the negative sign for any negatives numbers. What is the Year 2 depreciation expense? Enter all amounts as a positive number with no dollar signs or commas. For example, if the answer is $3,500, enter 3500 . What is the gain/(loss) on the sale of the Delivery Truck? If the amount is an increase to net income, enter a positive number. If the amount is a decrease to net income, enter a negative number. If there is no impact, enter 0 (zero). Do not enter any dollar signs or commas. Use the negative sign for any negatives numbers. Question 10 0/2 pts If ABC had use the double declining balance method of depreciation (the accelerated method), what would the depreciation expense be for Year 1 ? Enter all amounts as a positive number with no dollar signs or commas. For example, if the answer is $3,500, enter 3500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts