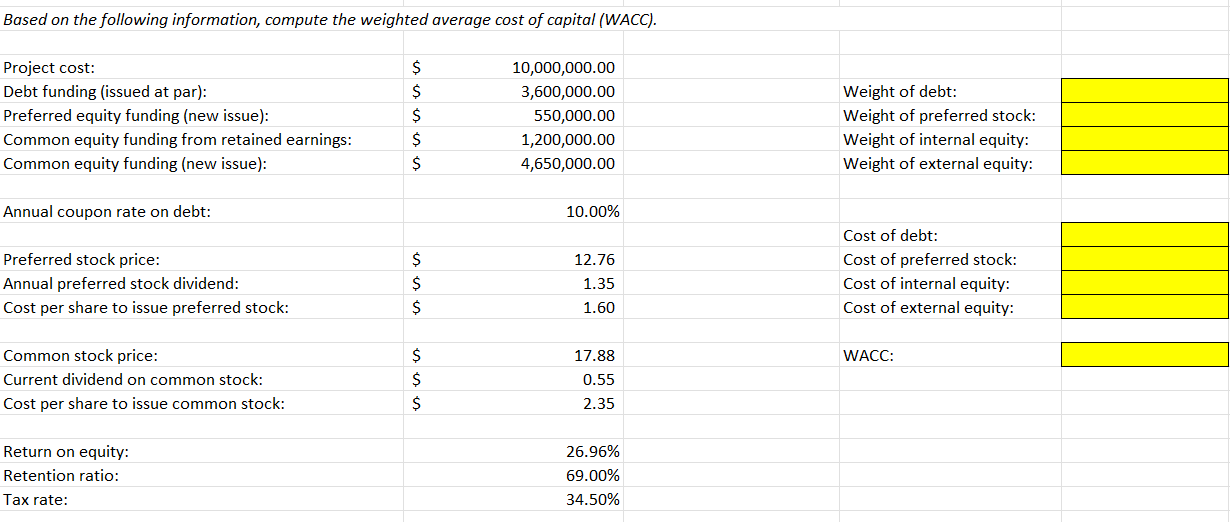

Question: answer the yellow blanks please: Based on the following information, compute the weighted average cost of capital (WACC). begin{tabular}{l|rr} Project cost: & $ & 10,000,000.00

answer the yellow blanks please:

Based on the following information, compute the weighted average cost of capital (WACC). \begin{tabular}{l|rr} Project cost: & $ & 10,000,000.00 \\ Debt funding (issued at par): & $ & 3,600,000.00 \\ Preferred equity funding (new issue): & $ & 550,000.00 \\ Common equity funding from retained earnings: & $ & 1,200,000.00 \\ Common equity funding (new issue): & $ & 4,650,000.00 \end{tabular} Weight of debt: Weight of preferred stock: Weight of internal equity: Weight of external equity: Annual coupon rate on debt: 10.00% Cost of debt: Preferred stock price: Annual preferred stock dividend: Cost per share to issue preferred stock: Common stock price: Current dividend on common stock: Cost per share to issue common stock: $$$17.880.552.35 WACC: Return on equity: 26.96% Retention ratio: 69.00% Tax rate: 34.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts