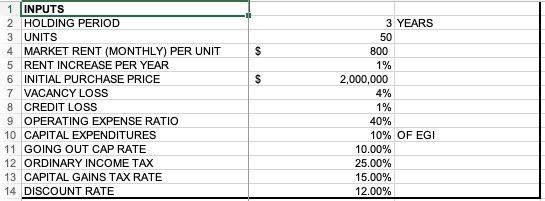

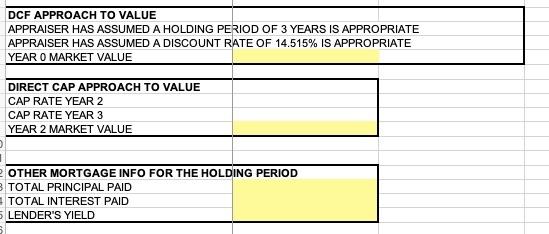

Question: answer the yellow highlighted questions based on the information in the first photo $ $ 1 INPUTS 2 HOLDING PERIOD 3 UNITS 4 MARKET RENT

$ $ 1 INPUTS 2 HOLDING PERIOD 3 UNITS 4 MARKET RENT (MONTHLY) PER UNIT 5 RENT INCREASE PER YEAR 6 INITIAL PURCHASE PRICE 7 VACANCY LOSS 8 CREDIT LOSS 9 OPERATING EXPENSE RATIO 10 CAPITAL EXPENDITURES 11 GOING OUT CAP RATE 12 ORDINARY INCOME TAX 13 CAPITAL GAINS TAX RATE 14 DISCOUNT RATE 3 YEARS 50 800 1% 2,000,000 4% 1% 40% 10% OF EGI 10.00% 25.00% 15.00% 12.00% DCF APPROACH TO VALUE APPRAISER HAS ASSUMED A HOLDING PERIOD OF 3 YEARS IS APPROPRIATE APPRAISER HAS ASSUMED A DISCOUNT RATE OF 14.515% IS APPROPRIATE YEAR O MARKET VALUE DIRECT CAP APPROACH TO VALUE CAP RATE YEAR 2 CAP RATE YEAR 3 YEAR 2 MARKET VALUE OTHER MORTGAGE INFO FOR THE HOLDING PERIOD TOTAL PRINCIPAL PAID TOTAL INTEREST PAID LENDER'S YIELD $ $ 1 INPUTS 2 HOLDING PERIOD 3 UNITS 4 MARKET RENT (MONTHLY) PER UNIT 5 RENT INCREASE PER YEAR 6 INITIAL PURCHASE PRICE 7 VACANCY LOSS 8 CREDIT LOSS 9 OPERATING EXPENSE RATIO 10 CAPITAL EXPENDITURES 11 GOING OUT CAP RATE 12 ORDINARY INCOME TAX 13 CAPITAL GAINS TAX RATE 14 DISCOUNT RATE 3 YEARS 50 800 1% 2,000,000 4% 1% 40% 10% OF EGI 10.00% 25.00% 15.00% 12.00% DCF APPROACH TO VALUE APPRAISER HAS ASSUMED A HOLDING PERIOD OF 3 YEARS IS APPROPRIATE APPRAISER HAS ASSUMED A DISCOUNT RATE OF 14.515% IS APPROPRIATE YEAR O MARKET VALUE DIRECT CAP APPROACH TO VALUE CAP RATE YEAR 2 CAP RATE YEAR 3 YEAR 2 MARKET VALUE OTHER MORTGAGE INFO FOR THE HOLDING PERIOD TOTAL PRINCIPAL PAID TOTAL INTEREST PAID LENDER'S YIELD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts