Question: Answer them quicklyband correctly for automatic thumbs up!!! Susmel Inc. is considering a project that has the following cash flow data. What is the project's

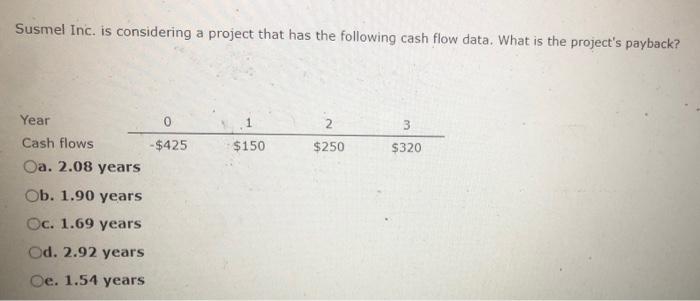

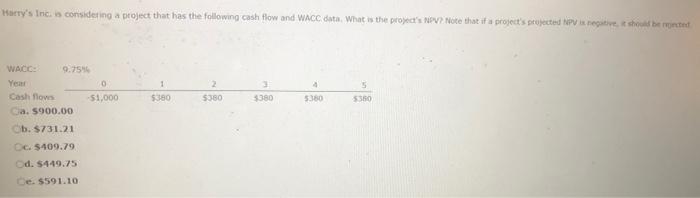

Susmel Inc. is considering a project that has the following cash flow data. What is the project's payback? 0 3 Year Cash flows Oa. 2.08 years 2 $250 -$425 $150 $320 Ob. 1.90 years Oc. 1.69 years Od. 2.92 years Oe. 1.54 years Harry's Inc. is considering a project that has the following cash flow and WACC data, What is the project's NOV? Note that if a project's projected NPV in negative, so bere WACC 9.75 0 Cash flows 51,000 ca. 5900.00 b. 5731.21 1 $380 2 5380 . 5380 3380 5550 Cc. $409.79 d. 5449.75 Le 5591.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts