Question: Answer these 2 problems. E8-23A Decide whether to discontinue a product line (Learning Objective 4) Top managers of Vermont Flooring are alarmed by their operating

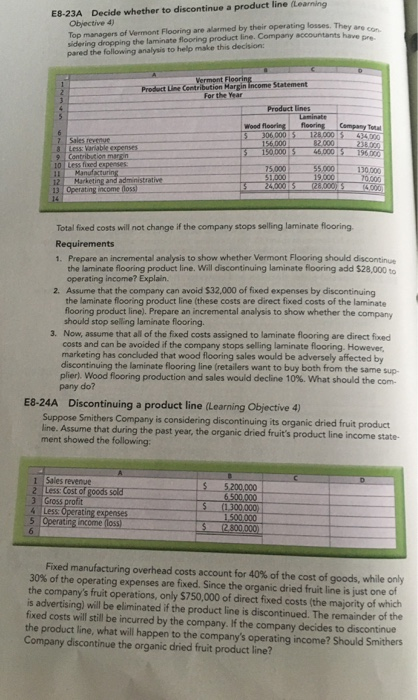

E8-23A Decide whether to discontinue a product line (Learning Objective 4) Top managers of Vermont Flooring are alarmed by their operating losses. They sidering dropping the laminate flooring product line. Company accountants have pared the following analysis to help make this decision: Vermont Flooring Product Line Contribution Margin Income Statement For the Year Product lines Laminate od flooring flooring Company Total 306000 128.000 434000 7 Sales revenue 156000 22.000 238000 8 Les Variable expenses 150 000 46000 1960 9 Contribution maron 10 Les fixed expenses 75.000 55.000 130.000 11 Manufacturing 51000 19.000 70.000 12 Marketing and administrative 24100015 200001 00 13 Operating income (loss Total fixed costs will not change if the company stops selling laminate flooring Requirements 1. Prepare an incremental analysis to show whether Vermont Flooring should discontinue the laminate flooring product line. Will discontinuing laminate flooring add $28.000 operating income? Explain. 2. Assume that the company can avoid $32,000 of fixed expenses by discontinuing the laminate flooring product line (these costs are direct fixed costs of the laminate flooring product line). Prepare an incremental analysis to show whether the company should stop selling laminate flooring. 3. Now, assume that all of the fixed costs assigned to laminate flooring are direct foxed costs and can be avoided if the company stops selling laminate flooring. However, marketing has concluded that wood flooring sales would be adversely affected by discontinuing the laminate flooring line (retailers want to buy both from the same sup plier). Wood flooring production and sales would decline 10%. What should the com- pany do? E8-24A Discontinuing a product line (Learning Objective 4) Suppose Smithers Company is considering discontinuing its organic dried fruit product line. Assume that during the past year, the organic dried fruit's product line income state- ment showed the following: 1 Sales revenue 2 Less: Cost of goods sold 3 Gross profit 4 Less Operating expenses 5 Operating income loss) 5.200.000 6.500.000 (1.300.000 1.500.000 227300.000 Fixed manufacturing overhead costs account for 40% of the cost of goods, while only 30% of the operating expenses are foxed. Since the organic dried fruit line is just one of the company's fruit operations, only $750,000 of direct foxed costs (the majority of which is advertising) will be eliminated if the product line is discontinued. The remainder of the fixed costs will still be incurred by the company. If the company decides to discontinue the product line, what will happen to the company's operating income? Should Smithers Company discontinue the organic dried fruit product line

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts