Question: answer these in 2 hours You join a financial institution and you have $50,000 in Account A and $50,000 in Account B. You are about

answer these in 2 hours

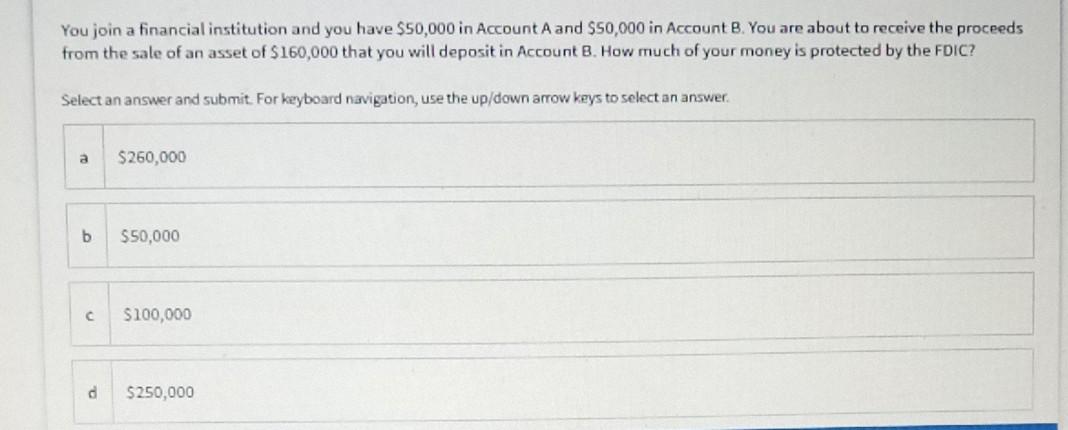

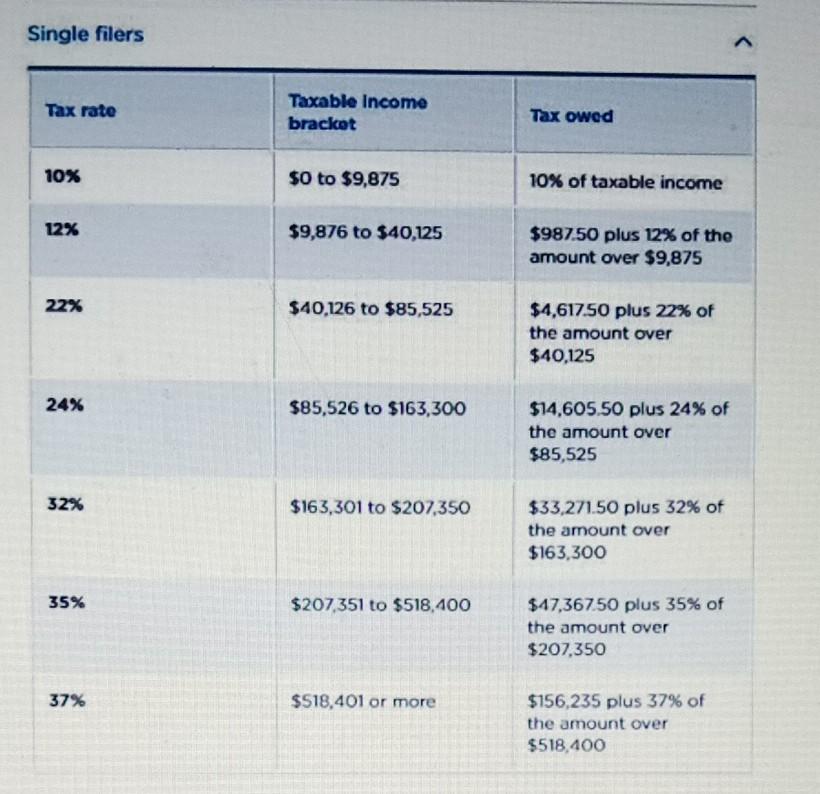

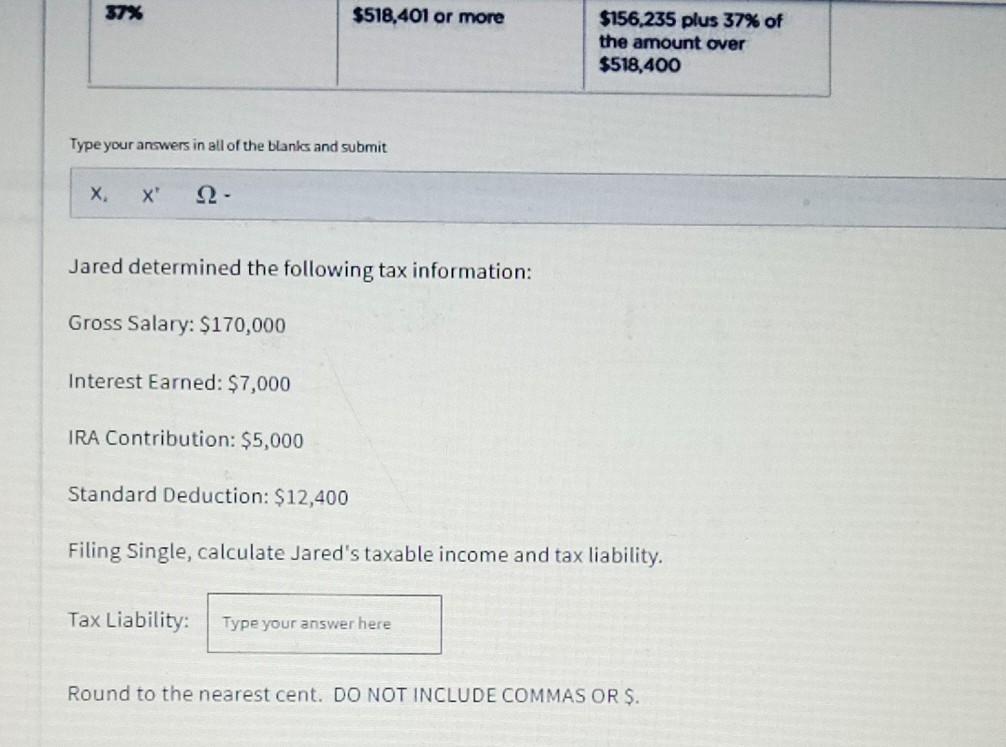

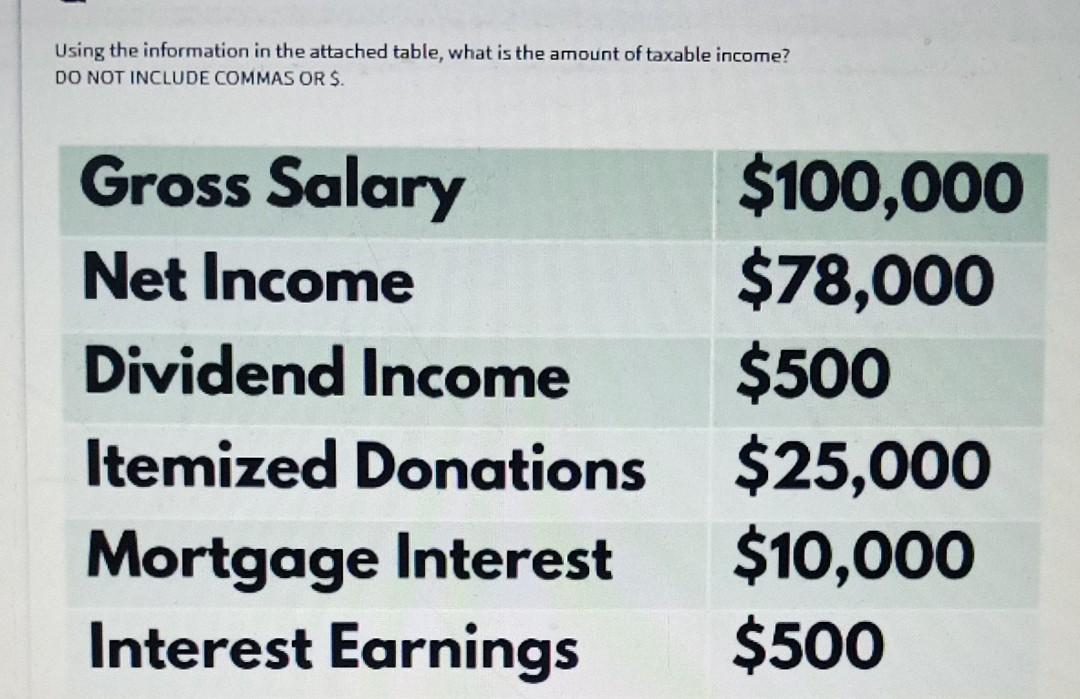

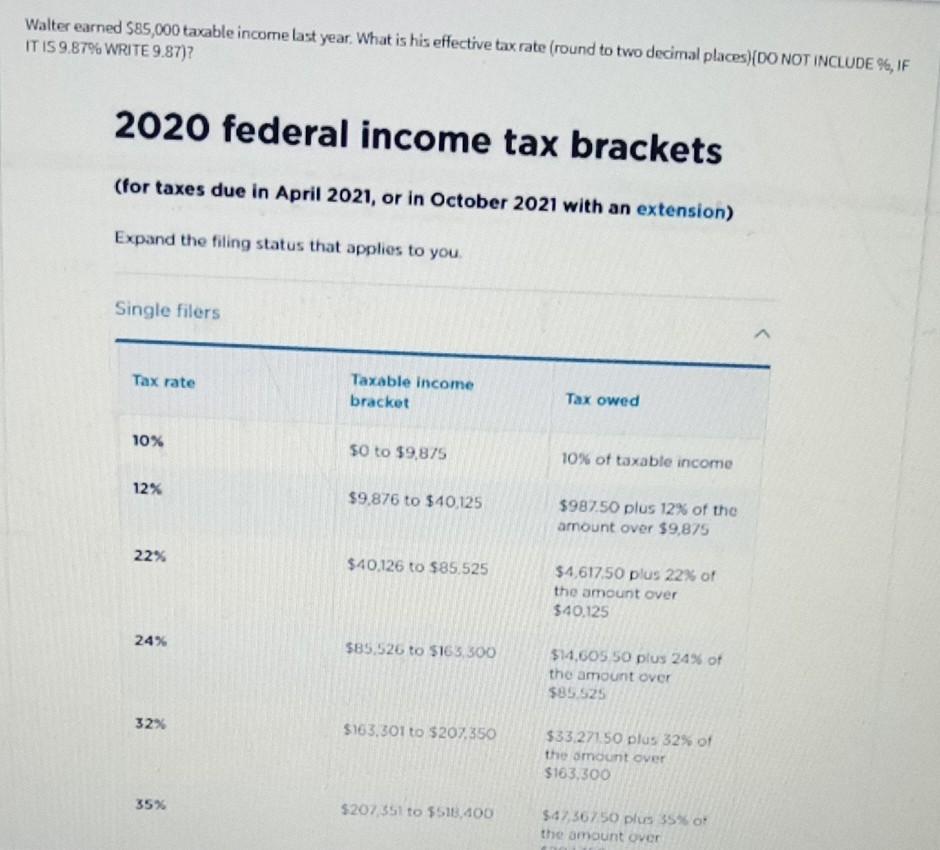

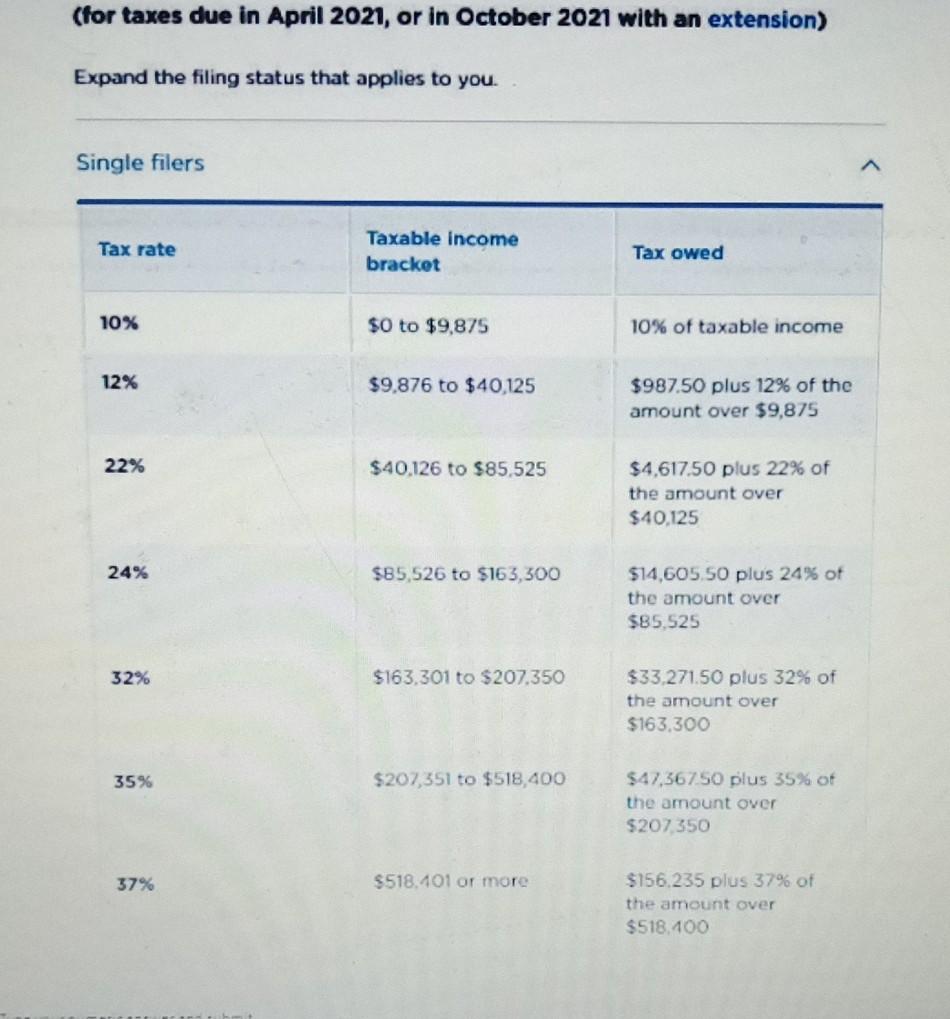

You join a financial institution and you have $50,000 in Account A and $50,000 in Account B. You are about to receive the proceeds from the sale of an asset of $160,000 that you will deposit in Account B. How much of your money is protected by the FDIC? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer a $260,000 b $50,000 $100,000 d $250,000 Single filers Tax rate Taxable income bracket Tax owed 10% $0 to $9,875 10% of taxable income 12% $9,876 to $40,125 $987.50 plus 12% of the amount over $9,875 22% $40,126 to $85,525 $4,617.50 plus 22% of the amount over $40,125 24% $85,526 to $163,300 $14,605.50 plus 24% of the amount over $85,525 32% $163,301 to $207,350 $33,271.50 plus 32% of the amount over $163,300 35% $207,351 to $518,400 $47,367.50 plus 35% of the amount over $207,350 37% $518,401 or more $156,235 plus 37% of the amount over $518,400 37% $518,401 or more $156,235 plus 37% of the amount over $518,400 Type your answers in all of the blanks and submit X X' . Jared determined the following tax information: Gross Salary: $170,000 Interest Earned: $7,000 IRA Contribution: $5,000 Standard Deduction: $12,400 Filing Single, calculate Jared's taxable income and tax liability. Tax Liability: Type your answer here Round to the nearest cent. DO NOT INCLUDE COMMAS OR $. Using the information in the attached table, what is the amount of taxable income? DO NOT INCLUDE COMMAS OR $. Gross Salary Net Income Dividend Income Itemized Donations Mortgage Interest Interest Earnings $100,000 $78,000 $500 $25,000 $10,000 $500 Walter earned $85,000 taxable income last year. What is his effective tax rate (round to two decimal places)(DO NOT INCLUDE %, IF IT IS 9.87% WRITE 9.87)? 2020 federal income tax brackets (for taxes due in April 2021, or in October 2021 with an extension) Expand the filing status that applies to you Single filers Tax rate Taxable income bracket Tax owed 10% 50 to $9.875 10% of taxable income 12% $9,876 to $40,125 $987.50 plus 12% of the amount over $9,875 22% $40,126 to $85.525 $4,617.50 plus 22% of the amount over $40,125 24% $85.526 to 5163 300 $14,605 50 plus 24% of the amount over $85 525 32% $163.301 to $207,350 $33,271 50 plus 32% of the amount over $163,300 35% $207 351 to $518,400 $47,367.50 plus 35% 0 the amount Over (for taxes due in April 2021, or in October 2021 with an extension) Expand the filing status that applies to you. Single filers Tax rate Taxable income bracket Tax owed 10% $0 to $9,875 10% of taxable income 12% $9,876 to $40,125 $987.50 plus 12% of the amount over $9,875 22% $40,126 to $85.525 $4,617.50 plus 22% of the amount over $40,125 24% $85,526 to $163,300 $14,605.50 plus 24% of the amount over $85.525 32% $163,301 to $207.350 $33,271.50 plus 32% of the amount over $163.300 35% $207,351 to $518,400 $47,36750 plus 35% of the amount over $207,350 37% $518.401 or more $156.235 plus 37% of the amount over $518,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts