Question: answer these mcqs please answer all questions i post this third time 1 2 3 & 4 We are evaluating a project that costs $786,000,

answer these mcqs please answer all questions i post this third time

1

2

3 & 4

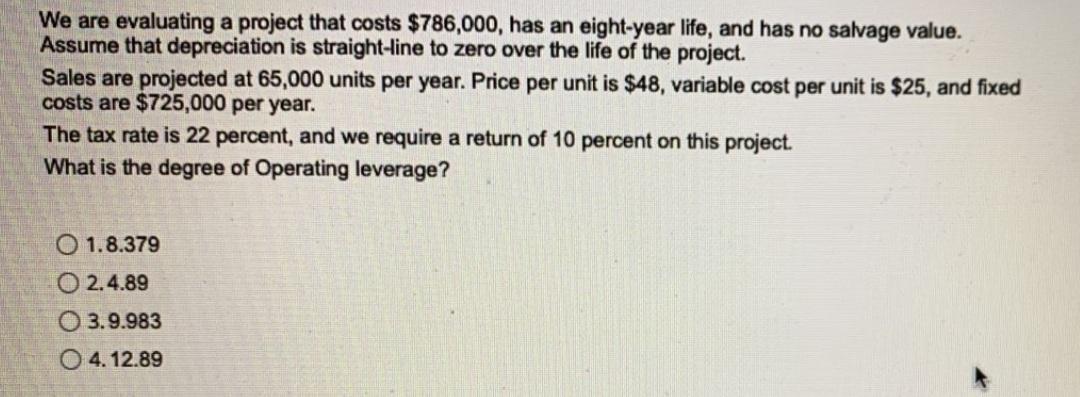

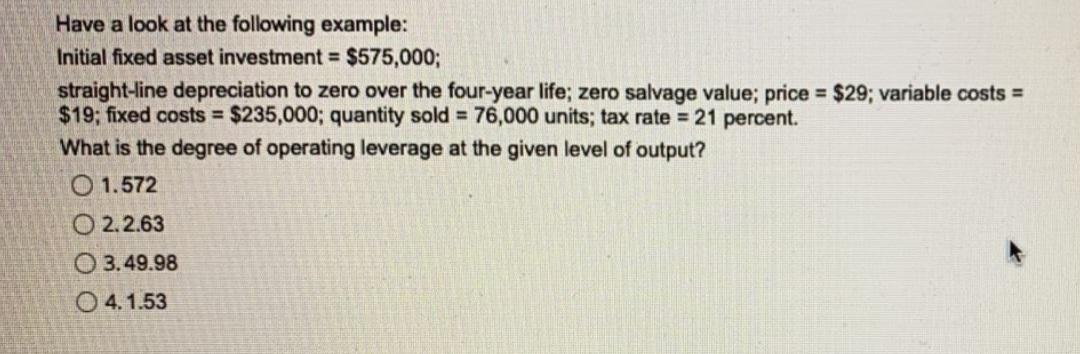

We are evaluating a project that costs $786,000, has an eight-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 65,000 units per year. Price per unit is $48, variable cost per unit is $25, and fixed costs are $725,000 per year. The tax rate is 22 percent, and we require a return of 10 percent on this project. What is the degree of Operating leverage? O 1.8.379 0 2.4.89 3.9.983 04.12.89 Have a look at the following example: Initial fixed asset investment = $575,000; straight-line depreciation to zero over the four-year life; zero salvage value; price = $29; variable costs = $19; fixed costs = $235,000; quantity sold = 76,000 units; tax rate = 21 percent. What is the degree of operating leverage at the given level of output? O 1.572 O 2.2.63 O 3.49.98 4.1.53 For the operating break even- O 1. None of these O 2. NI=0 O 3. OCF=0 04. NPV=0 O 5. IRR=0 QUESTION 2 Calculate the financial break even for the following details; 1. required return =9% 2. accounting break even 10% 2. cash break even 50 (without tax) 130 Units O 260 Units 560 Units None of these We are evaluating a project that costs $786,000, has an eight-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 65,000 units per year. Price per unit is $48, variable cost per unit is $25, and fixed costs are $725,000 per year. The tax rate is 22 percent, and we require a return of 10 percent on this project. What is the degree of Operating leverage? O 1.8.379 0 2.4.89 3.9.983 04.12.89 Have a look at the following example: Initial fixed asset investment = $575,000; straight-line depreciation to zero over the four-year life; zero salvage value; price = $29; variable costs = $19; fixed costs = $235,000; quantity sold = 76,000 units; tax rate = 21 percent. What is the degree of operating leverage at the given level of output? O 1.572 O 2.2.63 O 3.49.98 4.1.53 For the operating break even- O 1. None of these O 2. NI=0 O 3. OCF=0 04. NPV=0 O 5. IRR=0 QUESTION 2 Calculate the financial break even for the following details; 1. required return =9% 2. accounting break even 10% 2. cash break even 50 (without tax) 130 Units O 260 Units 560 Units None of these

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts