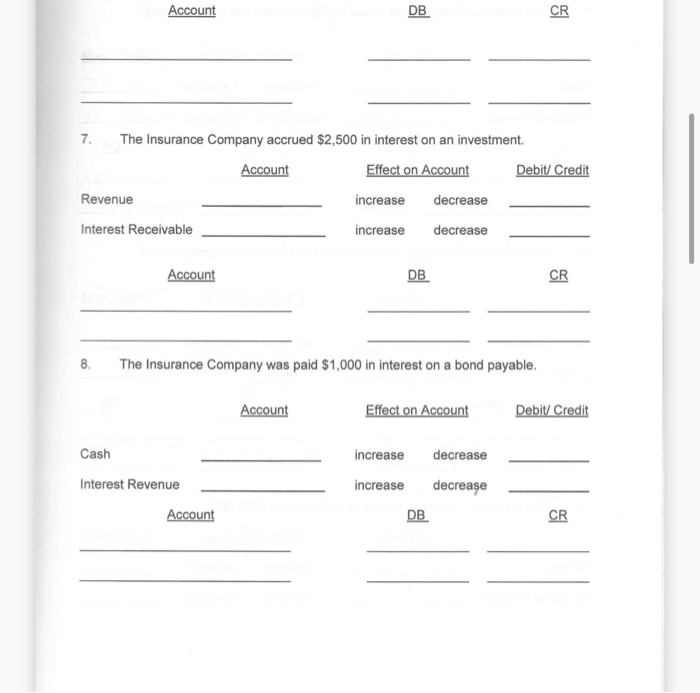

Question: answer these problem please thank you! Account DB CR 7. The Insurance Company accrued $2,500 in interest on an investment. Account Effect on Account Debit/Credit

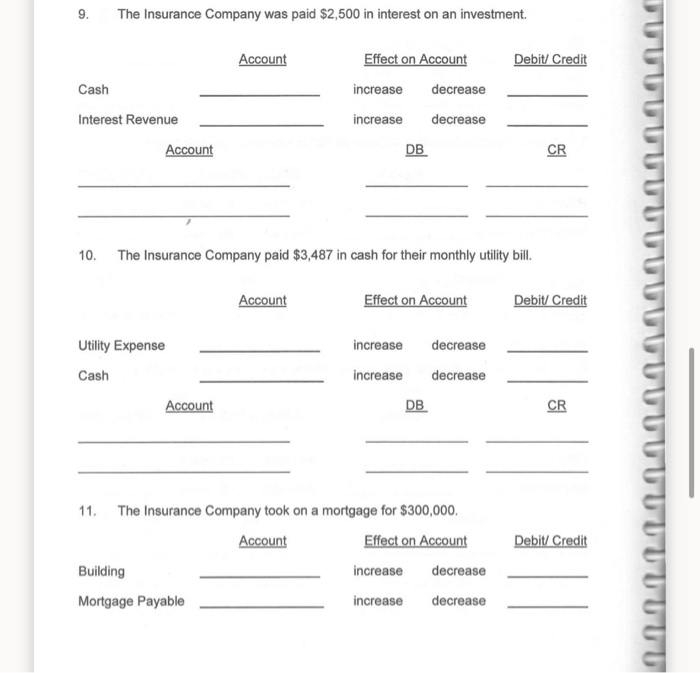

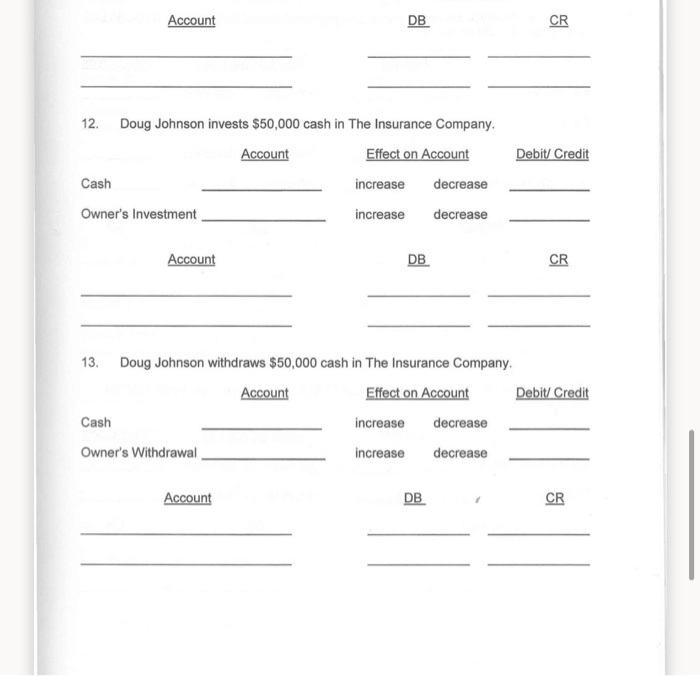

Account DB CR 7. The Insurance Company accrued $2,500 in interest on an investment. Account Effect on Account Debit/Credit Revenue increase decrease Interest Receivable increase decrease Account DB CR 8. The Insurance Company was paid $1,000 in interest on a bond payable. Account Effect on Account Debit/Credit Cash increase decrease Interest Revenue increase decrease DB Account CR 9. The Insurance Company was paid $2,500 in interest on an investment. Account Debit/Credit Effect on Account increase decrease Cash increase decrease Interest Revenue Account DB CR 10. The Insurance Company paid $3,487 in cash for their monthly utility bill. Account Effect on Account Debit Credit increase decrease Utility Expense Cash increase decrease DB Account CR UUUU Debit/Credit 11. The Insurance Company took on a mortgage for $300,000 Account Effect on Account Building increase decrease Mortgage Payable increase decrease Account DB CR Debit/ Credit 12. Doug Johnson invests $50,000 cash in The Insurance Company. Account Effect on Account Cash increase decrease Owner's Investment increase decrease Account DB CR 13. Doug Johnson withdraws $50,000 cash in The Insurance Company. Account Effect on Account Debit/Credit Cash increase decrease Owner's Withdrawal increase decrease Account DB CR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts