Question: answer these problems In our progressive example, B&T Enterprises is considering the replacement of a 2-year-old kiln with a new one to meet emerging market

answer these problems

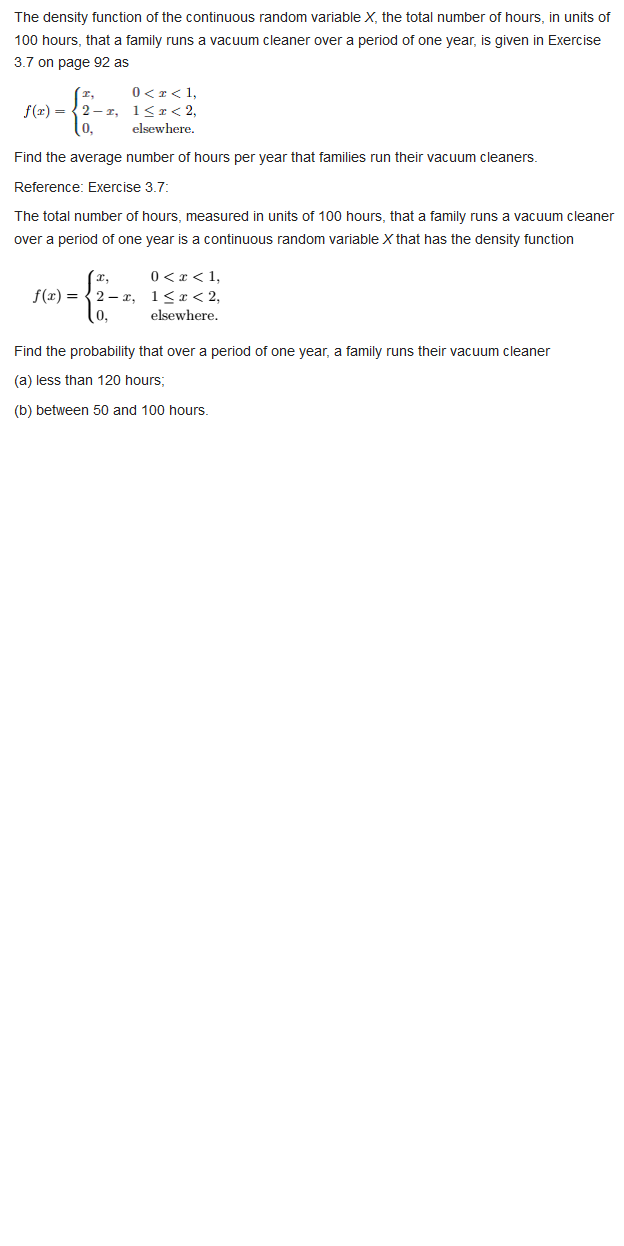

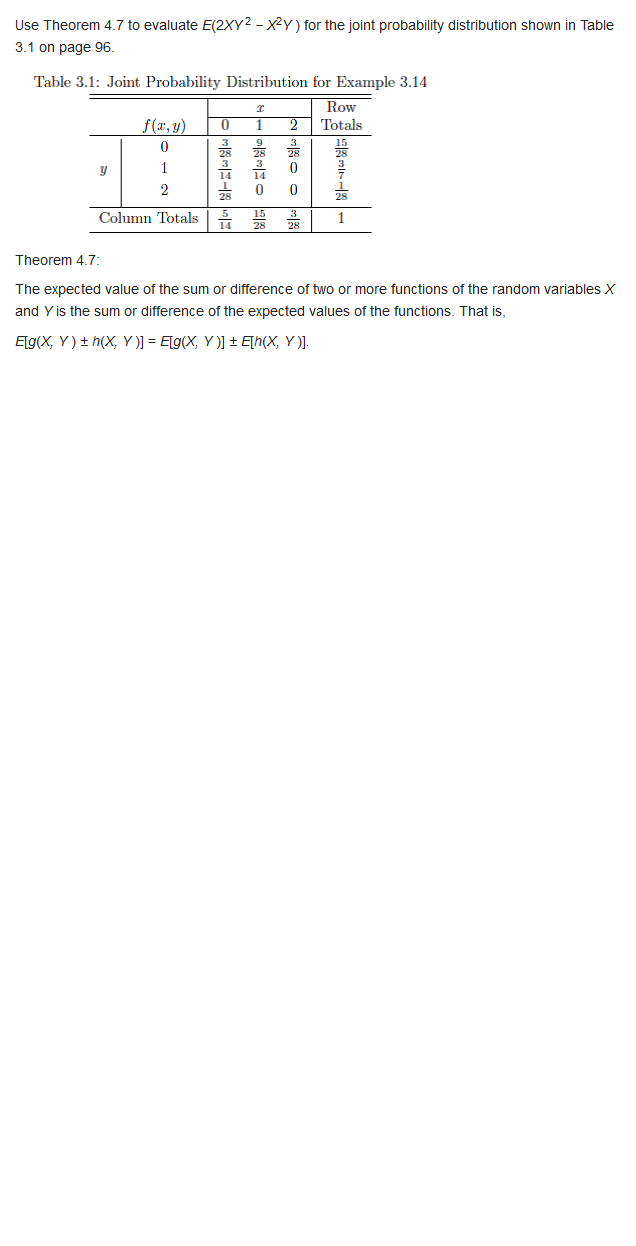

In our progressive example, B&T Enterprises is considering the replacement of a 2-year-old kiln with a new one to meet emerging market needs. When the current tunnel kiln was pur- chased 2 years ago for $25 million, an ESL study indicated that the minimum cost life was be- tween 3 and 5 years of the expected 8-year life. The analysis was not very conclusive because the total AW cost curve was flat for most years between 2 and 6, indicating insensitivity of the ESL to changing costs. Now, the same type of question arises for the proposed graphite hearth model that costs $38 million new: What are the ESL and the estimated total AW of costs? The Manager of Critical Equipment at B&T estimates that the market value after only 1 year will drop to $25 million and then retain 75% of the previous year's value over the 12-year expected life. Use this market value series and i = 15% per year to illustrate that an ESL analysis and marginal cost analysis result in exactly the same total AW of cost series.An engineer with Haliburton calculated the AW values shown for a presently owned machine by using estimates be obtained from the vendor and company records. Retention AW Value. Period, Years 5 per Year -RI, OOD -87,DOD -890OD -95,000 A challenger has an economic service life of 7 years with an AW of $ 86,000 per year. Assume that used machines like the one presently owned will always be available and that the MARR is 12%% per year. If all future costs remain as esti- mated for the analysis, the company should pur- chase the challenger: [a) Now (b) After 2 years [o) After 3 years () Never\f\f\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts