Question: Answer these questions clearly explaining your responses. Please ensure that your responses are in detail. Let T denote the complete future lifetime of a newborn

Answer these questions clearly explaining your responses. Please ensure that your responses are in detail.

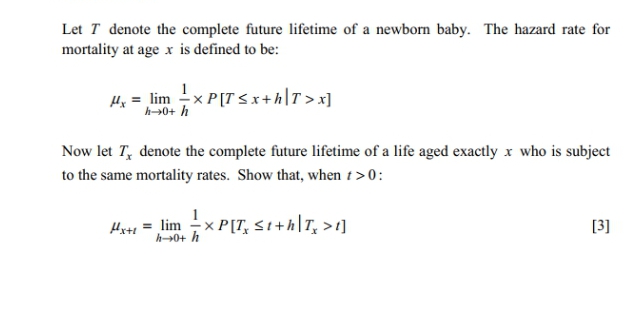

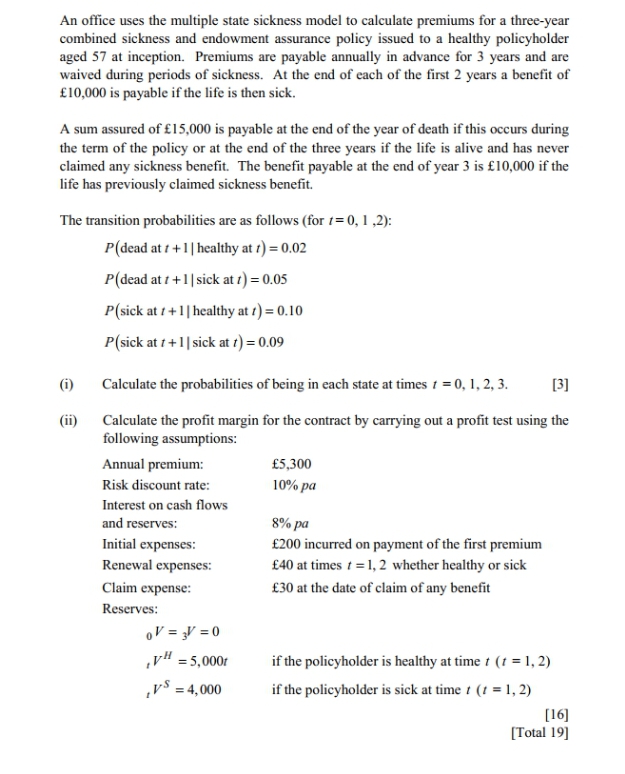

Let T denote the complete future lifetime of a newborn baby. The hazard rate for mortality at age x is defined to be: My = lim -XP[ T Sx+h T > x ] h-o+ h Now let 7, denote the complete future lifetime of a life aged exactly x who is subject to the same mortality rates. Show that, when / > 0: Arty = lim -XP[T, SithT, >! ] [3] 4 0+ hAn office uses the multiple state sickness model to calculate premiums for a three-year combined sickness and endowment assurance policy issued to a healthy policyholder aged 57 at inception. Premiums are payable annually in advance for 3 years and are waived during periods of sickness. At the end of each of the first 2 years a benefit of f10,000 is payable if the life is then sick. A sum assured of $15,000 is payable at the end of the year of death if this occurs during the term of the policy or at the end of the three years if the life is alive and has never claimed any sickness benefit. The benefit payable at the end of year 3 is $10,000 if the life has previously claimed sickness benefit. The transition probabilities are as follows (for ( = 0, 1 ,2): P(dead at / + 1 | healthy at /) = 0.02 P(dead at t + 1 | sick at /) = 0.05 P(sick at / + 1 | healthy at () = 0.10 P( sick at ( + 1 | sick at /) = 0.09 (i) Calculate the probabilities of being in each state at times / = 0, 1, 2, 3. [3] (ii) Calculate the profit margin for the contract by carrying out a profit test using the following assumptions: Annual premium: $5,300 Risk discount rate: 10% pa Interest on cash flows and reserves: 8% pa Initial expenses: E200 incurred on payment of the first premium Renewal expenses: E40 at times / = 1, 2 whether healthy or sick Claim expense: E30 at the date of claim of any benefit Reserves: oV = =0 V = 5,000r if the policyholder is healthy at time t ( = 1, 2) V =4,000 if the policyholder is sick at time / (t = 1, 2) [16] [Total 19]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts