Question: Answer this 2 part problem correctly with work and within a reasonable time for thumbs up! Thanks I will be able to see instantly if

I will be able to see instantly if the answer is correct or not. thanks so much

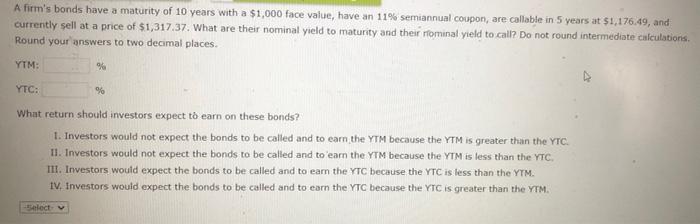

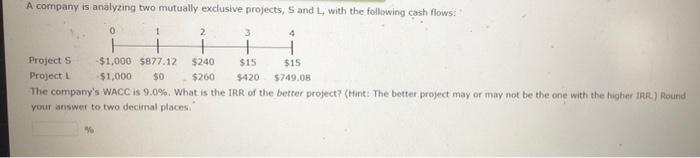

A firm's bonds have a maturity of 10 years with a $1,000 face value, have an 11% semiannual coupon, are collable in 5 years at $1,176.49, and currently sell at a price of $1,317.37. What are their nominal yield to maturity and their hominal yield to call? Do not round intermediate calculations. Round your answers to two decimal places. YTM: % YTC: % What return should investors expect to earn on these bonds? 1. Investors would not expect the bonds to be called and to earn the YTM because the YTM is greater than the YTC. 11. Investors would not expect the bonds to be called and to earn the YTM because the YTM is less than the YTC. III. Investors would expect the bonds to be called and to eam the YTC because the YTC is less than the YTM IV. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. select A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0 1 2 4 1 Projects -$1,000 $877.12 $240 $15 $15 Project -$1,000 $0 $260 $420 $249.00 The company's WACC is 9.0%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR) Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts