Question: Answer this and fill in the Journey Entry Part 2: Now that youve analyzed the effect of each of the transactions on the Accounting Equation,

Answer this and fill in the Journey Entry

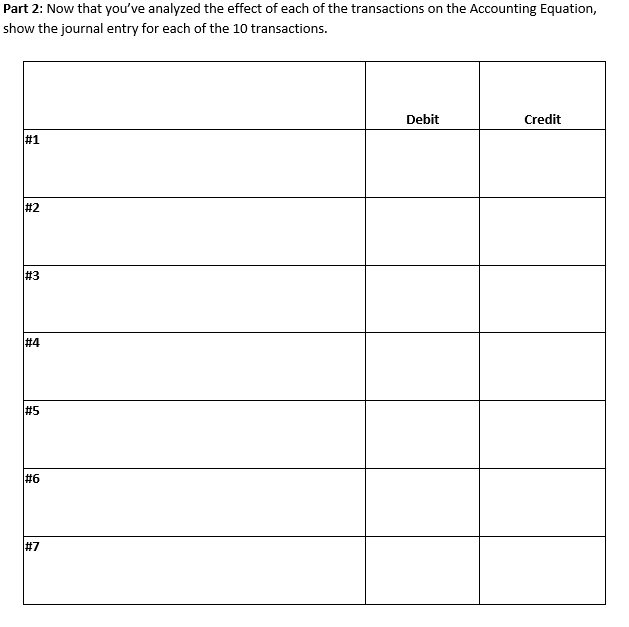

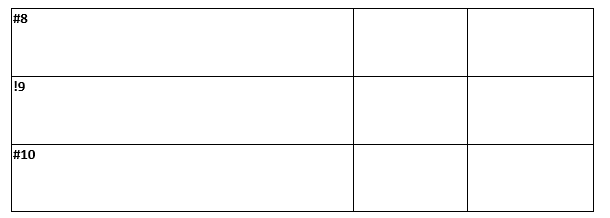

Part 2: Now that youve analyzed the effect of each of the transactions on the Accounting Equation, show the journal entry for each of the 10 transactions.

Notes:

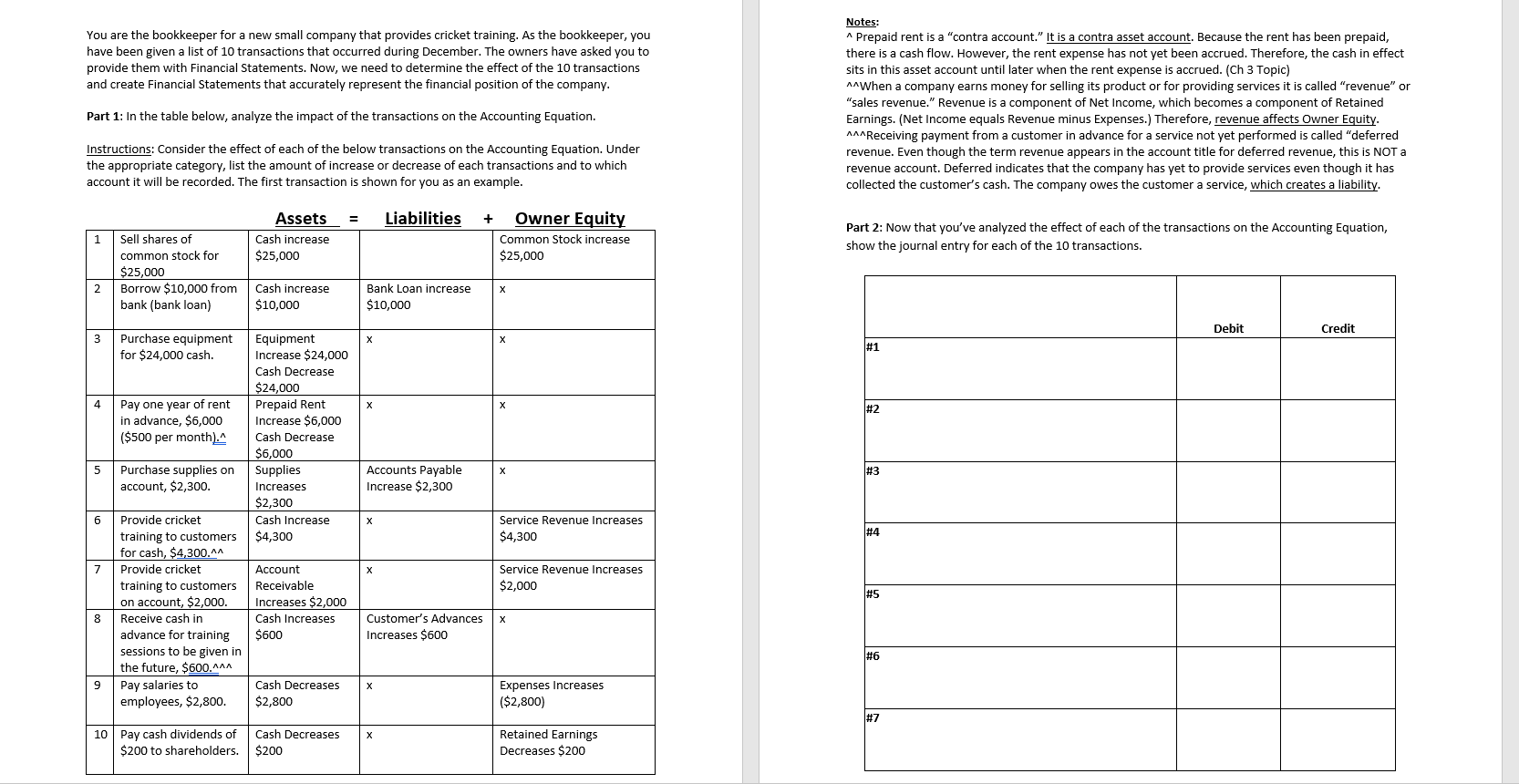

^ Prepaid rent is a contra account. It is a contra asset account. Because the rent has been prepaid, there is a cash flow. However, the rent expense has not yet been accrued. Therefore, the cash in effect sits in this asset account until later when the rent expense is accrued. (Ch 3 Topic)

^^When a company earns money for selling its product or for providing services it is called revenue or sales revenue. Revenue is a component of Net Income, which becomes a component of Retained Earnings. (Net Income equals Revenue minus Expenses.) Therefore, revenue affects Owner Equity.

^^^Receiving payment from a customer in advance for a service not yet performed is called deferred revenue. Even though the term revenue appears in the account title for deferred revenue, this is NOT a revenue account. Deferred indicates that the company has yet to provide services even though it has collected the customers cash. The company owes the customer a service, which creates a liability.

Completed Part 1 to answer Part 2:

Part 2: Now that vou've analvzed the effect of each of the transactions on the Accounting Eauation. he \begin{tabular}{|l|l|l|l|} \hline#8 & & \\ \hline!9 & & & \\ \hline#10 & & \\ \hline \end{tabular} Notes: You are the bookkeeper for a new small company that provides cricket training. As the bookkeeper, you " Prepaid rent is a "contra account." It is a contra asset account. Because the rent has been prepaid, have been given a list of 10 transactions that occurred during December. The owners have asked you to there is a cash flow. However, the rent expense has not yet been accrued. Therefore, the cash in effect provide them with Financial Statements. Now, we need to determine the effect of the 10 transactions sits in this asset account until later when the rent expense is accrued. (Ch 3 Topic) and create Financial Statements that accurately represent the financial position of the company. ^^When a company earns money for selling its product or for providing services it is called "revenue" or "sales revenue." Revenue is a component of Net Income, which becomes a component of Retained Part 1: In the table below, analyze the impact of the transactions on the Accounting Equation. Earnings. (Net Income equals Revenue minus Expenses.) Therefore, revenue affects Owner Equity. Receiving payment from a customer in advance for a service not yet performed is called "deferred Instructions: Consider the effect of each of the below transactions on the Accounting Equation. Under revenue. Even though the term revenue appears in the account title for deferred revenue, this is NOT a the appropriate category, list the amount of increase or decrease of each transactions and to which revenue account. Deferred indicates that the company has yet to provide services even though it has account it will be recorded. The first transaction is shown for you as an example. collected the customer's cash. The company owes the customer a service, which creates a liability. Part 2: Now that you've analyzed the effect of each of the transactions on the Accounting Equation, show the journal entry for each of the 10 transactions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts