Question: Answer this as soon as possible urgent needed The capital asset pricing model can be used to describe equilibrium in terms of either return or

Answer this as soon as possible

Answer this as soon as possible

urgent needed

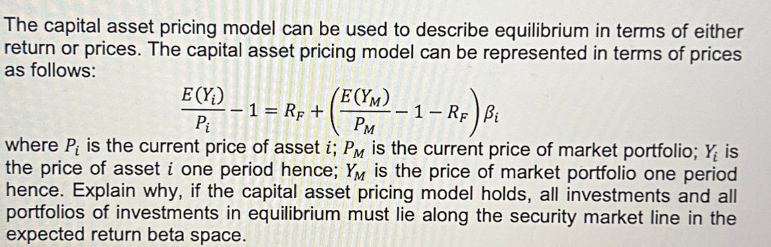

The capital asset pricing model can be used to describe equilibrium in terms of either return or prices. The capital asset pricing model can be represented in terms of prices as follows: PiE(Yi)1=RF+(PME(YM)1RF)i where Pi is the current price of asset i;PM is the current price of market portfolio; Yi is the price of asset i one period hence; YM is the price of market portfolio one period hence. Explain why, if the capital asset pricing model holds, all investments and all portfolios of investments in equilibrium must lie along the security market line in the expected return beta space. The capital asset pricing model can be used to describe equilibrium in terms of either return or prices. The capital asset pricing model can be represented in terms of prices as follows: PiE(Yi)1=RF+(PME(YM)1RF)i where Pi is the current price of asset i;PM is the current price of market portfolio; Yi is the price of asset i one period hence; YM is the price of market portfolio one period hence. Explain why, if the capital asset pricing model holds, all investments and all portfolios of investments in equilibrium must lie along the security market line in the expected return beta space

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts