Question: answer this fast these are 3 mcq answer all three deposit in the mind Blue 15. George wishes to invest $100,000 of non-registered funds in

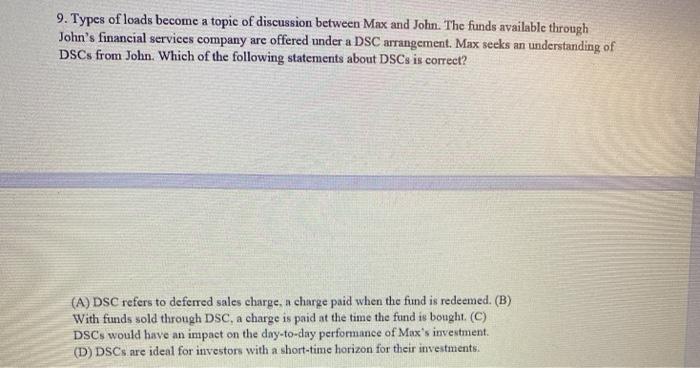

deposit in the mind Blue 15. George wishes to invest $100,000 of non-registered funds in a fixed income security, from which he plans to draw an income eventually. He is considering a guaranteed investment certificate (GIC). His life insurance agent suggests that he consider investing in a deferred annuity as an alternative. Which of the following statements best describes a difference between a GIC and a deferred annuity that George may wish to consider when making his choice? The value of his deferred annuity will be backed by Austris in the event of the financial institution's bankruptcy while he will have no similar guarantee if he purchases a GIC. (A) (B) The value of his deferred annuity is protected from his creditors during his lifetime and after his death if the proceeds are paid to a named beneficiary, while the value of his GIC will be subject to seizure by his creditors at any time while he is alive and after his death, The death benefit value of his deferred annuity is never subject to probate fees while the value of a GIC will always be included in the value of the estate for the purpose of calculating probate fees (D) George can withdraw the value of his deferred annuity prior to the end of the deposit term without penalty, while he would be charged a market value adjustment for an carly withdrawal from GIC 17. Ralph is age 55. He is a senior manager at an auto parts supplier. He earns $120,000 a year in salary and he is a member of a defined benefit pension plan under which he contributes 5% of his salary. The benefit is 2% of salary multiplied by Ralph's number of years of service. Ralph places $10,000 a year in a non-registered investment. He intends to use these funds to supplement his retirement income. Ralph wants the remainder to go to his adult son, Ed, directly if he dies before Ed. He is choosing between an individual variable insurance contract (IVIC) and a mutual fund investment as the best way of completing his plans. Which of the following statements is correct? 1 A mutual fund plan will allow him to appoint Ed as a successor owner. 2 If he appoints a named beneficiary under the IVIC, proceeds will be paid to the beneficiary outside the provisions of the will. 3 Either plan requires a deemed disposition at his death with the taxable capital gain being reportable in his final return even if there is a named beneficiary. As a life insurance policy, any proceeds of the IVIC are not subject to tax on death, while the mutual fund is deemed disposed of at its fair market value at death. 4 (A) 1 only. (B) 1 and 2 only (C) 2 and 4 only (D) 2 and 3 only. 15. George wishes to invest $100,000 of non-registered funds in a fixed income security, from which he plans to draw an income eventually. He is considering a guaranteed investment certificate (GIC). His life insurance agent suggests that he consider investing in a deferred annuity as an alternative. Which of the following statements best describes a difference between a GIC and a deferred annuity that George may wish to consider when making his choice? (A) The value of his deferred annuity will be backed by Assuris, in the event of the financial institution's bankruptcy while he will have no similar guarantee if he purchases a GIC. (B) The value of his deferred annuity is protected from his creditors during his lifetime and after his death if the proceeds are paid to a named beneficiary, while the value of his GIC will be subject to seizure by his creditors at any time while he is alive and after his death. The death benefit value of his deferred annuity is never subject to probate fees while the value of a GIC will always be included in the value of the estate for the purpose of calculating probate fees. George can withdraw the value of his deferred annuity prior to the end of the deposit term without penalty, while he would be charged a market value adjustment for an early withdrawal from GIC 17. Ralph is age 55. He is a senior manager at an auto parts supplier. He carns $120,000 a year in salary and he is a member of a defined benefit pension plan under which he contributes 5% of his salary. The benefit is 2% of salary multiplied by Ralph's number of years of service. Ralph places $10,000 a year in a non-registered investment. He intends to use these funds to supplement his retirement income. Ralph wants the remainder to go to his adult son, Ed, directly if he dies before Ed. He is choosing between an individual variable insurance contract (IVIC) and a mutual fund investment as the best way of completing his plans. Which of the following statements is correct? 1.A mutual fund plan will allow him to appoint Ed as a successor owner. 2. If he appoints a named beneficiary under the IVIC, proceeds will be paid to the beneficiary outside the provisions of the will. Either plan requires a deemed disposition at his death with the taxable capital gain being reportable in his final return even if there is a named beneficiary, 4 As a life insurance policy, any proceeds of the IVIC are not subject to tax on death, while the mutual fund is deemed disposed of at its fair market value at death. 3 (A) 1 only. (B) 1 and 2 only (C) 2 and 4 only (D) 2 and 3 only 9. Types of loads become a topic of discussion between Max and John. The funds available through John's financial services company are offered under a DSC arrangement. Max seeks an understanding of DSCs from John. Which of the following statements about DSCs is correct? (A) DSC refers to deferred sales charge, a charge paid when the fund is redeemed. (B) With funds sold through DSC, a charge is paid at the time the fund is bought (C) DSCs would have an impact on the day-to-day performance of Max's investment. (D) DSCs are ideal for investors with a short-time horizon for their investments deposit in the mind Blue 15. George wishes to invest $100,000 of non-registered funds in a fixed income security, from which he plans to draw an income eventually. He is considering a guaranteed investment certificate (GIC). His life insurance agent suggests that he consider investing in a deferred annuity as an alternative. Which of the following statements best describes a difference between a GIC and a deferred annuity that George may wish to consider when making his choice? The value of his deferred annuity will be backed by Austris in the event of the financial institution's bankruptcy while he will have no similar guarantee if he purchases a GIC. (A) (B) The value of his deferred annuity is protected from his creditors during his lifetime and after his death if the proceeds are paid to a named beneficiary, while the value of his GIC will be subject to seizure by his creditors at any time while he is alive and after his death, The death benefit value of his deferred annuity is never subject to probate fees while the value of a GIC will always be included in the value of the estate for the purpose of calculating probate fees (D) George can withdraw the value of his deferred annuity prior to the end of the deposit term without penalty, while he would be charged a market value adjustment for an carly withdrawal from GIC 17. Ralph is age 55. He is a senior manager at an auto parts supplier. He earns $120,000 a year in salary and he is a member of a defined benefit pension plan under which he contributes 5% of his salary. The benefit is 2% of salary multiplied by Ralph's number of years of service. Ralph places $10,000 a year in a non-registered investment. He intends to use these funds to supplement his retirement income. Ralph wants the remainder to go to his adult son, Ed, directly if he dies before Ed. He is choosing between an individual variable insurance contract (IVIC) and a mutual fund investment as the best way of completing his plans. Which of the following statements is correct? 1 A mutual fund plan will allow him to appoint Ed as a successor owner. 2 If he appoints a named beneficiary under the IVIC, proceeds will be paid to the beneficiary outside the provisions of the will. 3 Either plan requires a deemed disposition at his death with the taxable capital gain being reportable in his final return even if there is a named beneficiary. As a life insurance policy, any proceeds of the IVIC are not subject to tax on death, while the mutual fund is deemed disposed of at its fair market value at death. 4 (A) 1 only. (B) 1 and 2 only (C) 2 and 4 only (D) 2 and 3 only. 15. George wishes to invest $100,000 of non-registered funds in a fixed income security, from which he plans to draw an income eventually. He is considering a guaranteed investment certificate (GIC). His life insurance agent suggests that he consider investing in a deferred annuity as an alternative. Which of the following statements best describes a difference between a GIC and a deferred annuity that George may wish to consider when making his choice? (A) The value of his deferred annuity will be backed by Assuris, in the event of the financial institution's bankruptcy while he will have no similar guarantee if he purchases a GIC. (B) The value of his deferred annuity is protected from his creditors during his lifetime and after his death if the proceeds are paid to a named beneficiary, while the value of his GIC will be subject to seizure by his creditors at any time while he is alive and after his death. The death benefit value of his deferred annuity is never subject to probate fees while the value of a GIC will always be included in the value of the estate for the purpose of calculating probate fees. George can withdraw the value of his deferred annuity prior to the end of the deposit term without penalty, while he would be charged a market value adjustment for an early withdrawal from GIC 17. Ralph is age 55. He is a senior manager at an auto parts supplier. He carns $120,000 a year in salary and he is a member of a defined benefit pension plan under which he contributes 5% of his salary. The benefit is 2% of salary multiplied by Ralph's number of years of service. Ralph places $10,000 a year in a non-registered investment. He intends to use these funds to supplement his retirement income. Ralph wants the remainder to go to his adult son, Ed, directly if he dies before Ed. He is choosing between an individual variable insurance contract (IVIC) and a mutual fund investment as the best way of completing his plans. Which of the following statements is correct? 1.A mutual fund plan will allow him to appoint Ed as a successor owner. 2. If he appoints a named beneficiary under the IVIC, proceeds will be paid to the beneficiary outside the provisions of the will. Either plan requires a deemed disposition at his death with the taxable capital gain being reportable in his final return even if there is a named beneficiary, 4 As a life insurance policy, any proceeds of the IVIC are not subject to tax on death, while the mutual fund is deemed disposed of at its fair market value at death. 3 (A) 1 only. (B) 1 and 2 only (C) 2 and 4 only (D) 2 and 3 only 9. Types of loads become a topic of discussion between Max and John. The funds available through John's financial services company are offered under a DSC arrangement. Max seeks an understanding of DSCs from John. Which of the following statements about DSCs is correct? (A) DSC refers to deferred sales charge, a charge paid when the fund is redeemed. (B) With funds sold through DSC, a charge is paid at the time the fund is bought (C) DSCs would have an impact on the day-to-day performance of Max's investment. (D) DSCs are ideal for investors with a short-time horizon for their investments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts