Question: answer this please I CHNIS 4. How would the current and quick ratios of a service business compare? 5. A. Why is a high inventory

answer this please

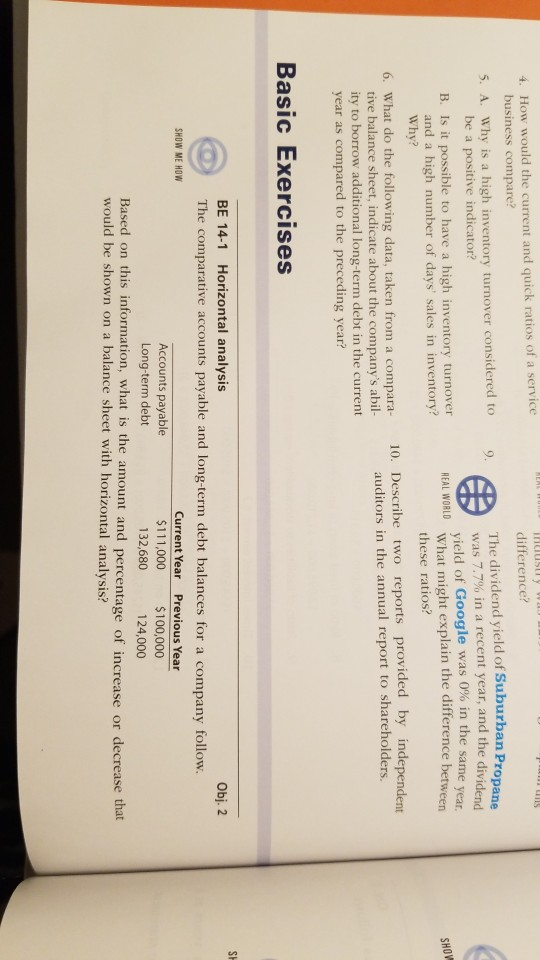

I CHNIS 4. How would the current and quick ratios of a service business compare? 5. A. Why is a high inventory turnover considered to be a positive indicator? B. Is it possible to have a high inventory turnover and a high number of days' sales in inventory? Why? 6. What do the following data, taken from a compara. tive balance sheet, indicate about the company's abil- ity to borrow additional long-term debt in the current year as compared to the preceding year? SU difference? 9. The dividend yield of Suburban Prop was 7.7% in a recent year, and the dividend yield of Google was 0% in the same year, REAL WORLD What might explain the difference between these ratios? 10. Describe two reports provided by independent auditors in the annual report to shareholders. SHOW Basic Exercises SHOW ME HOW BE 14-1 Horizontal analysis Obj. 2 The comparative accounts payable and long-term debt balances for a company follow. Current Year Previous Year Accounts payable $111,000 $100,000 Long-term debt 132,680 124,000 Based on this information, what is the amount and percentage of increase or decrease that would be shown on a balance sheet with horizontal analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts