Question: answer this please Question 6 of 6 - / 23 E View Policies Current Attempt in Progress Linda Stansbury is a licensed dentist. During the

answer this please

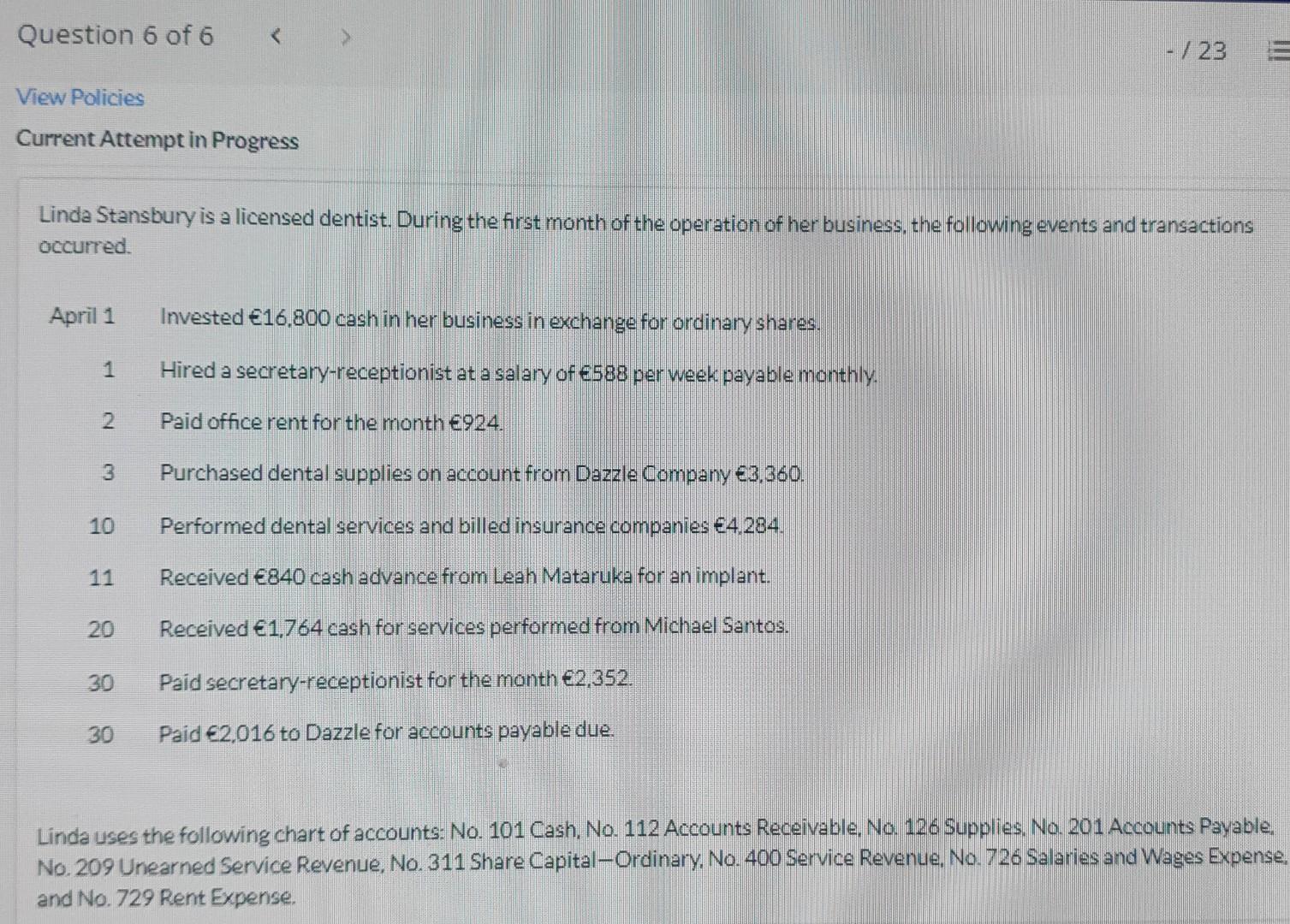

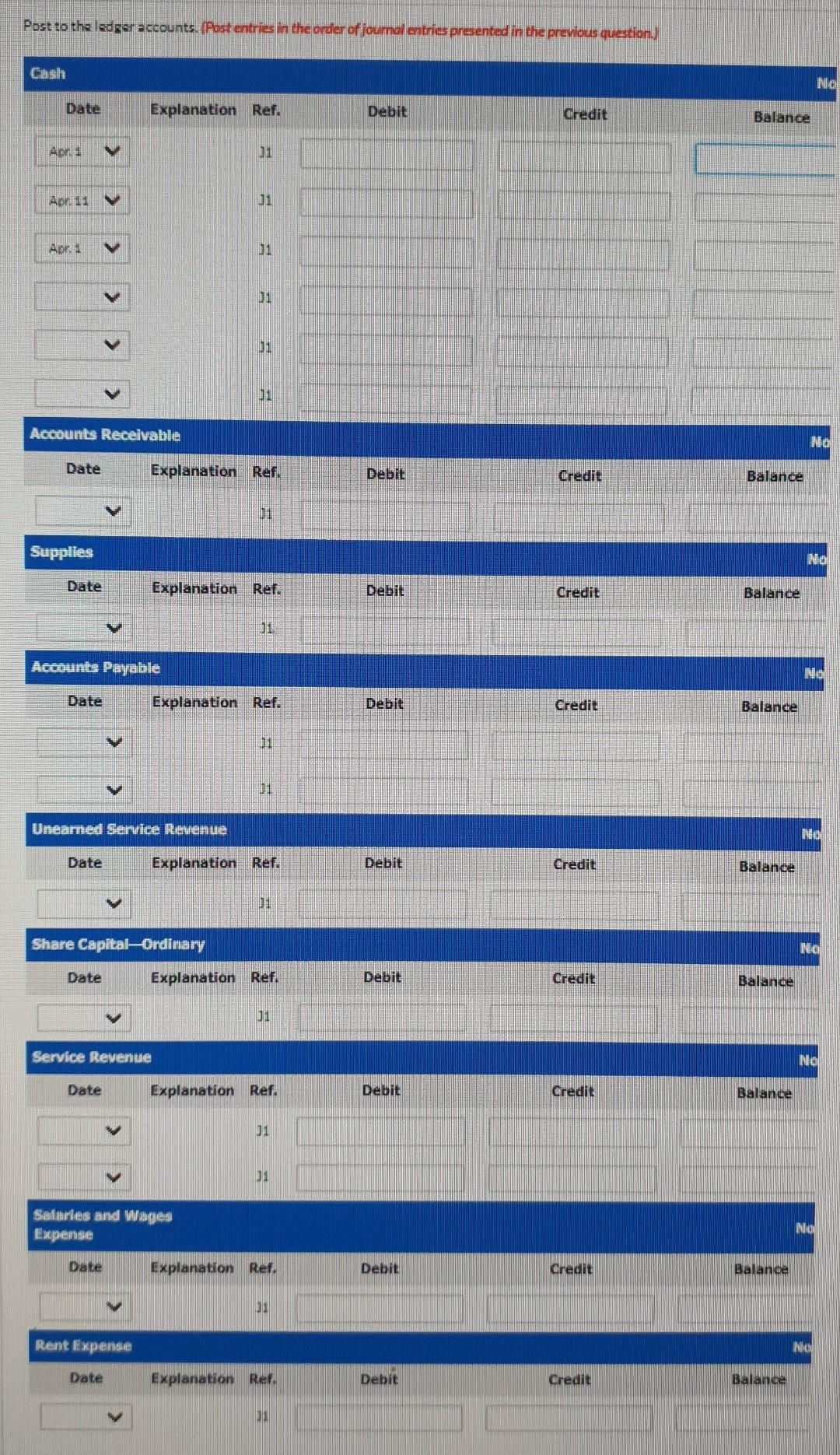

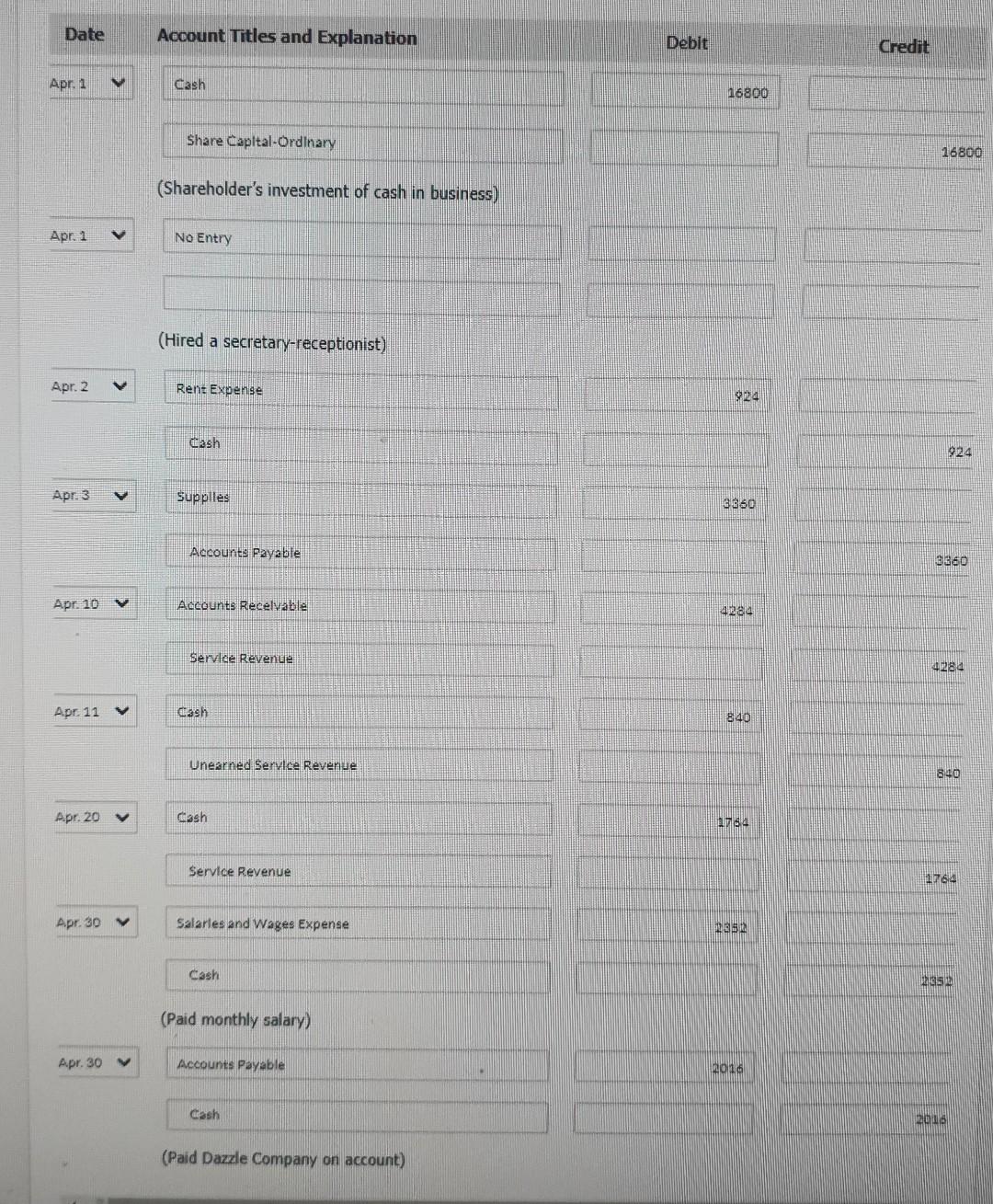

Question 6 of 6 - / 23 E View Policies Current Attempt in Progress Linda Stansbury is a licensed dentist. During the first month of the operation of her business, the following events and transactions Occurred. April 1 Invested 16,800 cash in her business in exchange for ordinary shares. 1 Hired a secretary-receptionist at a salary of 588 per week payable monthly. 2 Paid office rent for the month 924. 3 Purchased dental supplies on account from Dazzle Company 3.360. 10 Performed dental services and billed insurance companies 4,284. 11 Received 840 cash advance from Leah Mataruka for an implant. 20 Received 1,764 cash for services performed from Michael Santos. 30 Paid secretary-receptionist for the month 2,352. 30 Paid 2,016 to Dazzle for accounts payable due. Linda uses the following chart of accounts: No. 101 Cash, No. 112 Accounts Receivable, No 126 Supplies, No. 201 Accounts Payable, No. 209 Unearned Service Revenue, No. 311 Share Capital-Ordinary. No. 400 Service Revenue, No. 726 Salaries and Wages Expense. and No. 729 Rent Expense. Post to the ledger accounts. (Post entries in the order of joumul entries presented in the previous question.) NG Date Explanation Ref. Debit Credit Balance Apr1 21 Apr 15 Apr1 1 1 1 Accounts Receivable Na Date Explanation Ref. Debit Credit Balance 11 Supplies NO Date Explanation Ref. Debit Credit Balance Acounts Payable Ne Date Explanation Ref. Debit Credit Balance 11 Unearned Service Revenue No Date Explanation Ref. Debit Credit Balance Share Capital-Ordinary Me Date Explanation Ref. Debit Credit Balance 1 Service Revenue Na Date Explanation Ref. Debit Credit Balance 01 31 Salaries and Wages Espense NEN Date Explanation Ref. Debit Credit Balance Rent Expense INHO Date Explanation Ref. Debit Credit Balance Date Account Titles and Explanation Debit Credit Apr. 1 Cash 16800 Share Capital-Ordinary 16800 (Shareholder's investment of cash in business) Apr. 1 No Entry (Hired a secretary-receptionist) Apr. 2 V Rent Expense 24 Cash 9124 Apr. 3 Supplles 3860 Accounts Payable 8860 Apr. 10 Accounts Recevable 438 service Revenue 4284 Apr. 11 cash 810 Unearned Service Revenue 840 Apr. 20 v cash 1784 Service Revenue 1764 Apr. 30 Salaries and Wages Expense 2352 Cash 205 (Paid monthly salary) Apr. 30 Accounts Payable 2016 Cash 2016 (Paid Dazzle Company on account)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts