Question: answer this plz Show ALL necessary workings (a) When absorption costing was used, how much fixed manufacturing overhead was deferred in finished goods inventory? (5

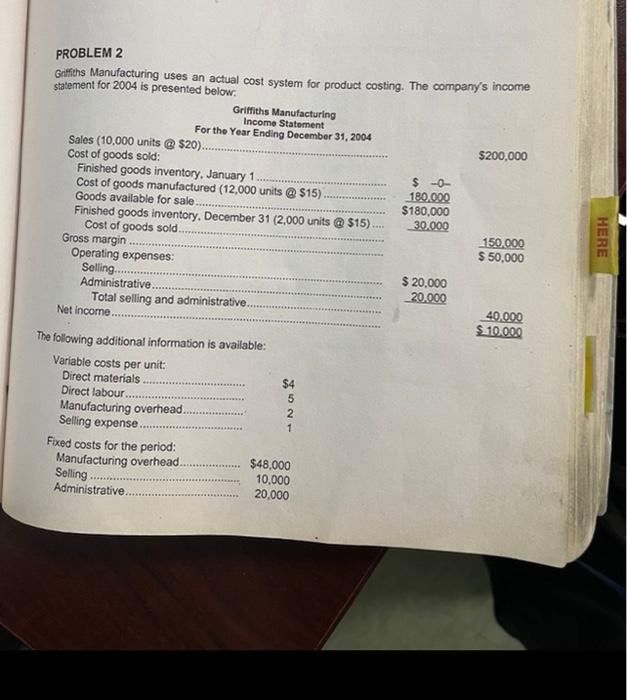

HERE PROBLEM 2 Griffiths Manufacturing uses an actual cost system for product costing. The company's income statement for 2004 is presented below. Griffiths Manufacturing Income Statement For the Year Ending December 31, 2004 Sales (10,000 units @ $20).... $200,000 Cost of goods sold: Finished goods inventory, January 1 $ 0- Cost of goods manufactured (12,000 units @ $15) 180.000 Goods available for sale $180,000 Finished goods inventory, December 31 (2,000 units @ $15) 30.000 Cost of goods sold 150.000 Gross margin $ 50,000 Operating expenses Selling...... $ 20,000 Administrative 20.000 Total selling and administrative. 40.000 Net Income $ 10.000 The following additional information is available: Variable costs per unit: Direct materials $4 Direct labour. 5 Manufacturing overhead. 2 Selling expense Fixed costs for the period: Manufacturing overhead. $48,000 Selling 10,000 Administrative 20,000 - No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts