Question: Answer this que as soon as possible....with proper calculations SQ # 4: Sufi hotels last year's (31 December 2019) tax charge was estimated to be

Answer this que as soon as possible....with proper calculations

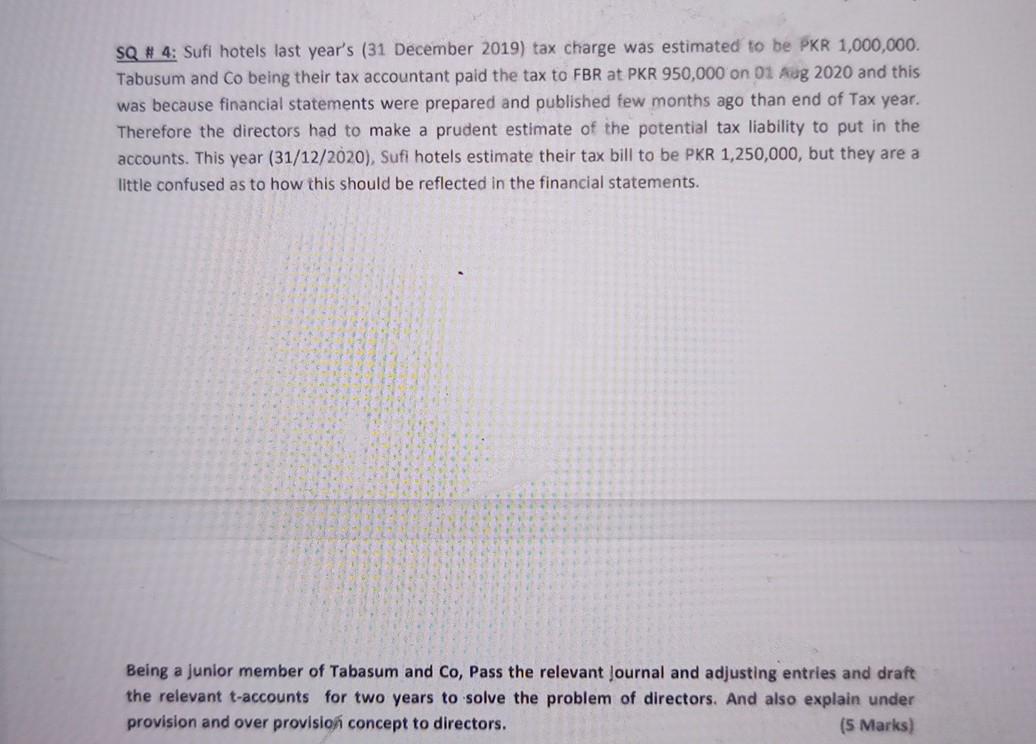

SQ # 4: Sufi hotels last year's (31 December 2019) tax charge was estimated to be PKR 1,000,000 Tabusum and Co being their tax accountant paid the tax to FBR at PKR 950,000 on 01 Aug 2020 and this was because financial statements were prepared and published few months ago than end of Tax year. Therefore the directors had to make a prudent estimate of the potential tax liability to put in the accounts. This year (31/12/2020), Sufi hotels estimate their tax bill to be PKR 1,250,000, but they are a little confused as to how this should be reflected in the financial statements. Being a junior member of Tabasum and Co, Pass the relevant Journal and adjusting entries and draft the relevant t-accounts for two years to solve the problem of directors. And also explain under provision and over provision concept to directors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts