Question: Answer this question based on the following information: 3-month rate = 1% 52-week maturity risk premium = 1.5% 10-year maturity risk premium = 2.5% Default

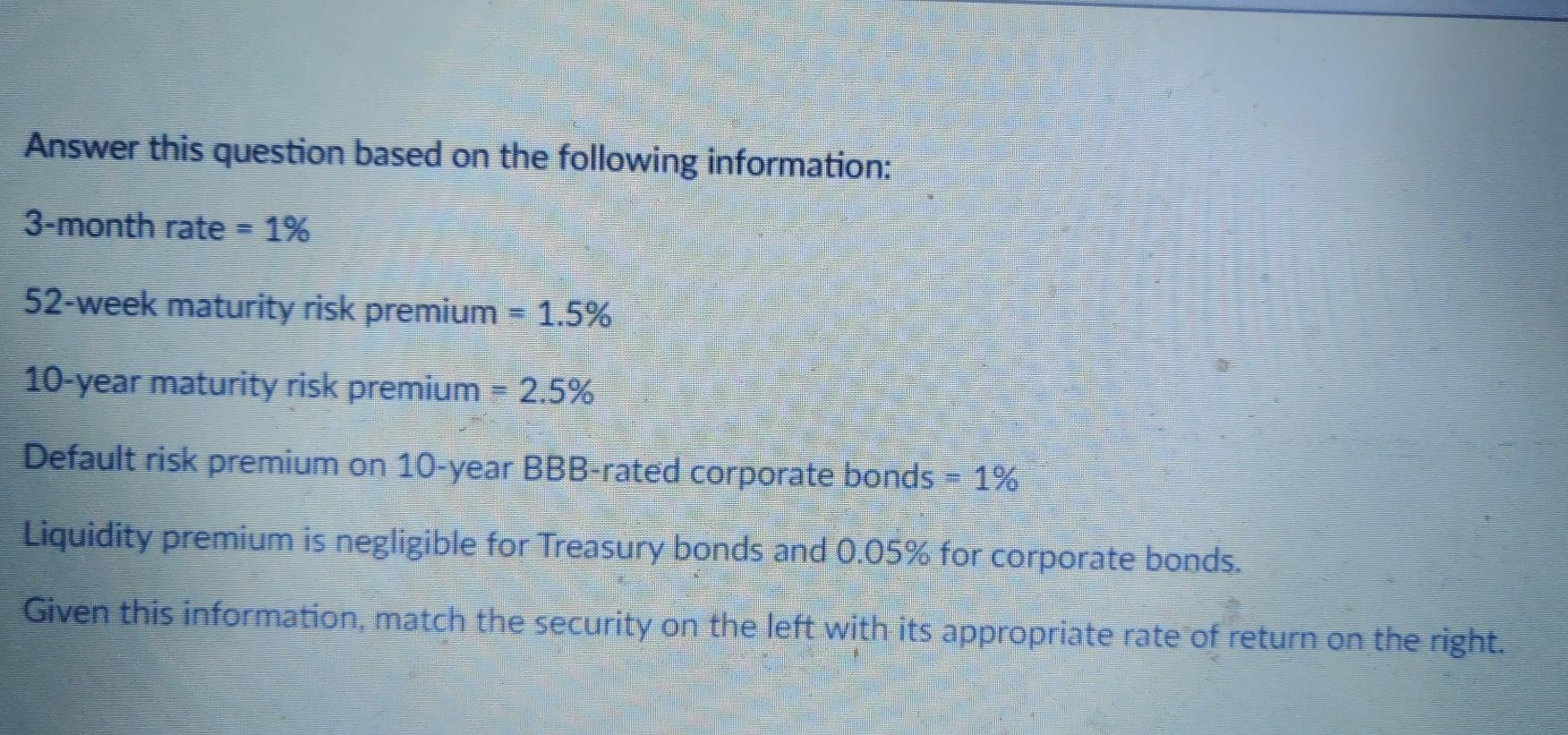

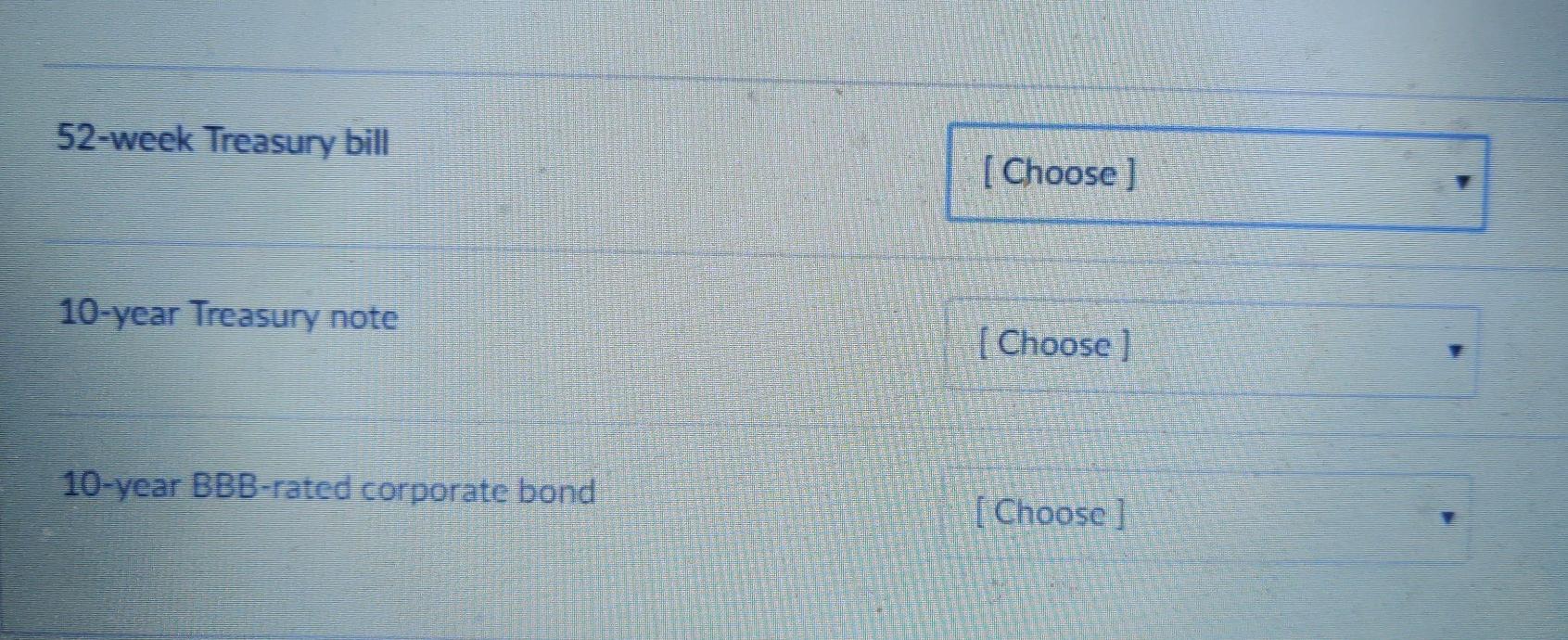

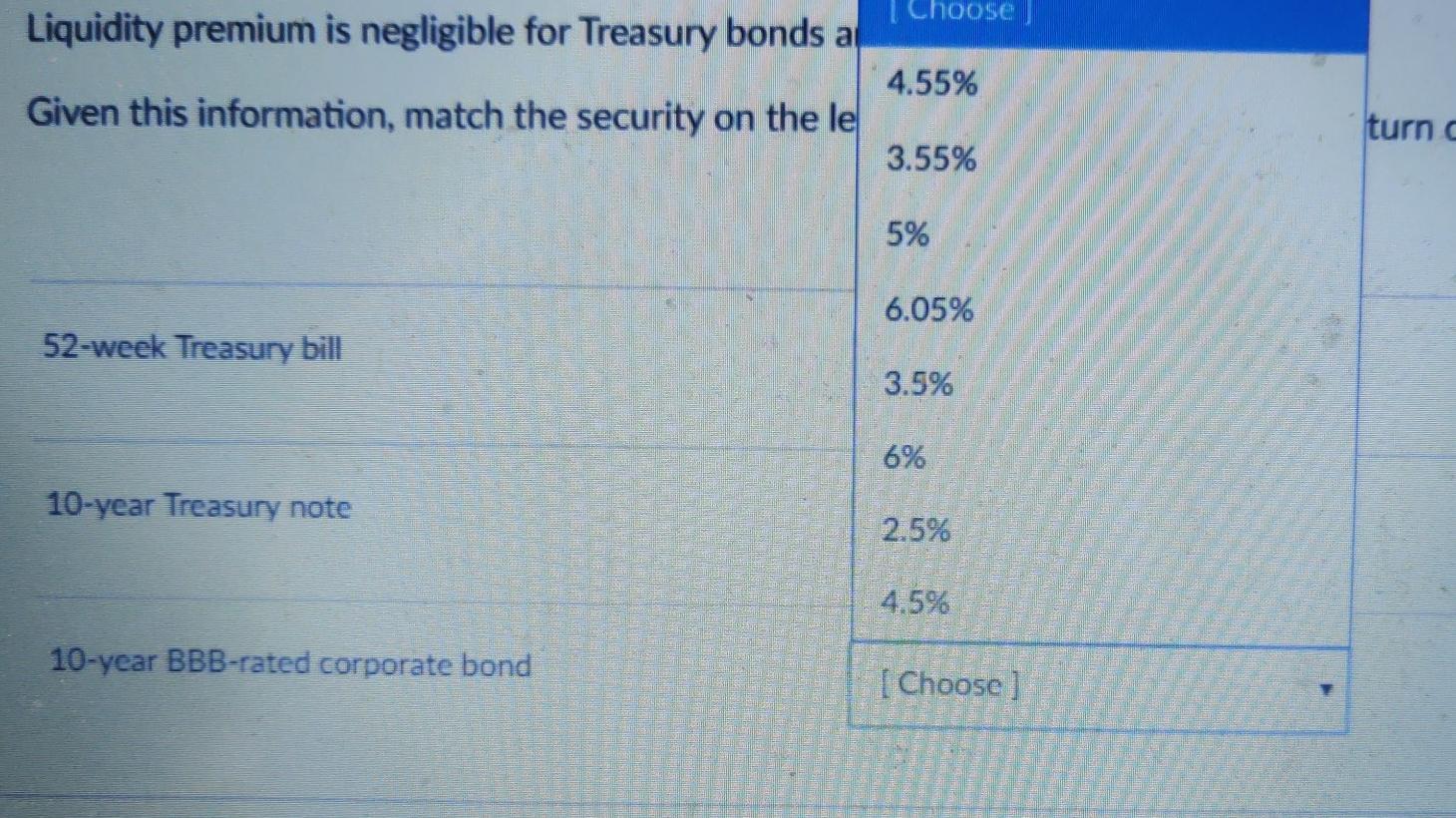

Answer this question based on the following information: 3-month rate = 1% 52-week maturity risk premium = 1.5% 10-year maturity risk premium = 2.5% Default risk premium on 10-year BBB-rated corporate bonds = 1% Liquidity premium is negligible for Treasury bonds and 0.05% for corporate bonds. Given this information, match the security on the left with its appropriate rate of return on the right. 52-week Treasury bill [Choose] 10-year Treasury note [ Choose ] 10-year BBB-rated corporate bond [ Choose ] I choose Liquidity premium is negligible for Treasury bonds a 4.55% Given this information, match the security on the le turn c 3.55% 5% 6.05% 52-week Treasury bill 3.596 6% 10-year Treasury note 2.5% 4.5% 10-year BBB-rated corporate bond [ Choose]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts