Question: answer this question correctly and i will leave a quick like. One of your new employees notes that your debt has a lower cost of

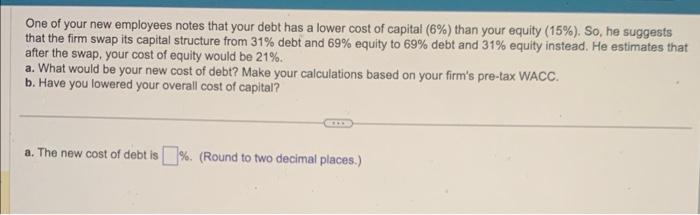

One of your new employees notes that your debt has a lower cost of capital (6%) than your equity (15\%), So, he suggests that the firm swap its capital structure from 31% debt and 69% equity to 69% debt and 31% equity instead. He estimates that after the swap, your cost of equity would be 21%. a. What would be your new cost of debt? Make your calculations based on your firm's pre-tax WACC. b. Have you lowered your overall cost of capital? a. The new cost of debt is \%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts