Question: answer this question: ---------------------------------------- here are the references in ppt slides (a):page 11 in LN04 (b) 4-6 in LN02 c: 10 in LN02 d :14

answer this question:

----------------------------------------

here are the references in ppt slides

(a):page 11 in LN04

(b) 4-6 in LN02

c: 10 in LN02

d :14 in ln02

e: page 17,18

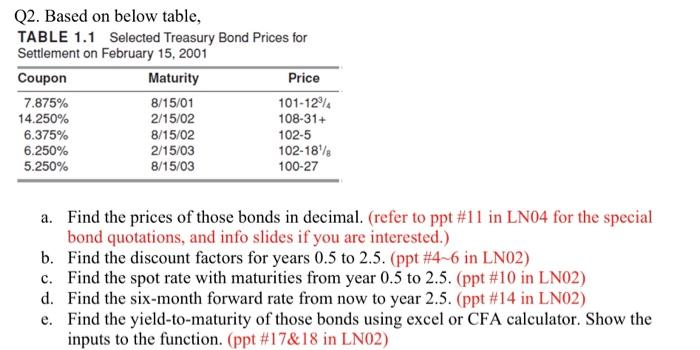

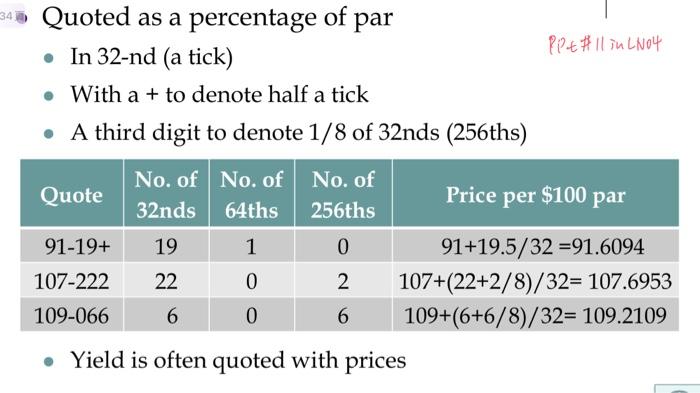

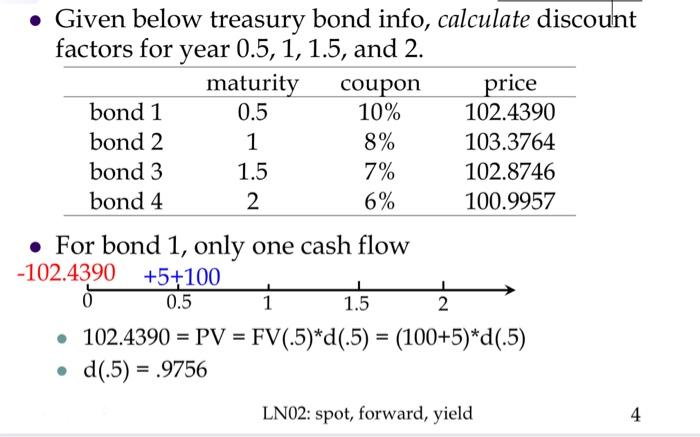

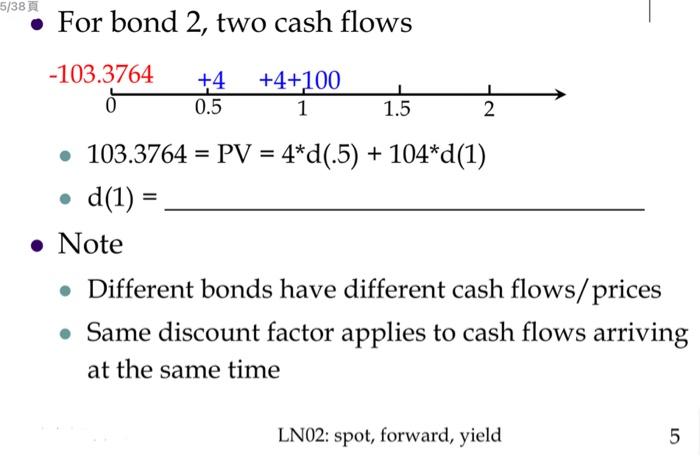

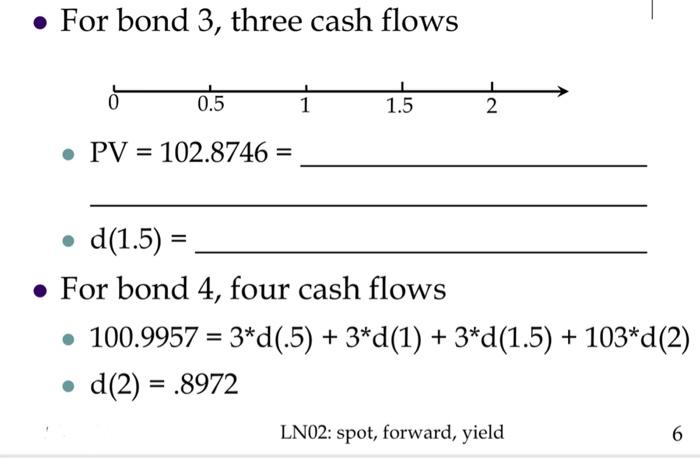

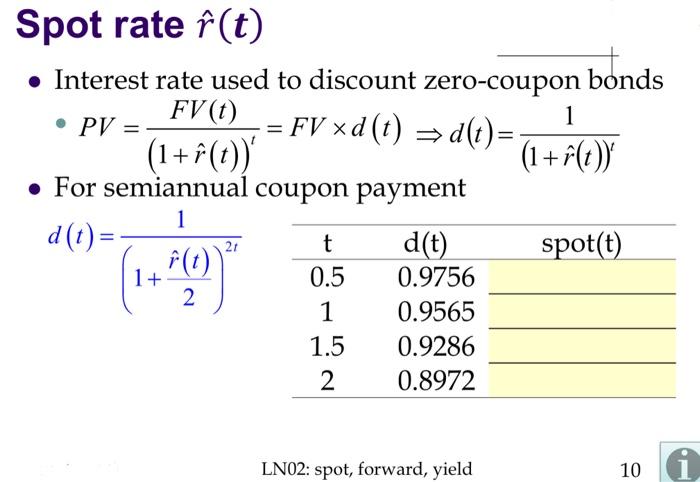

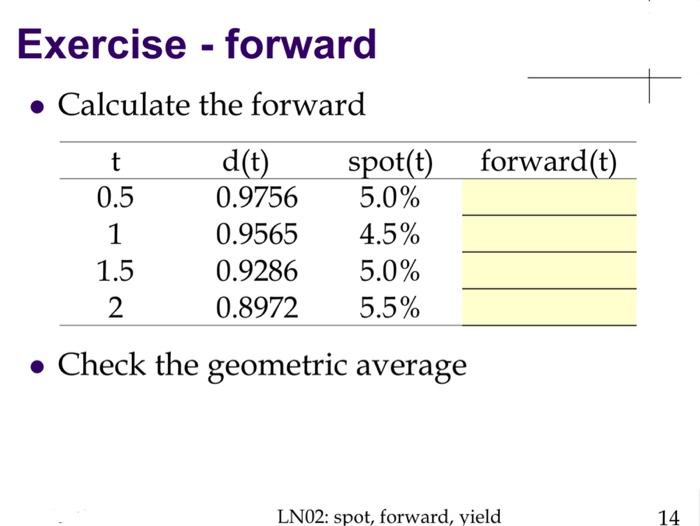

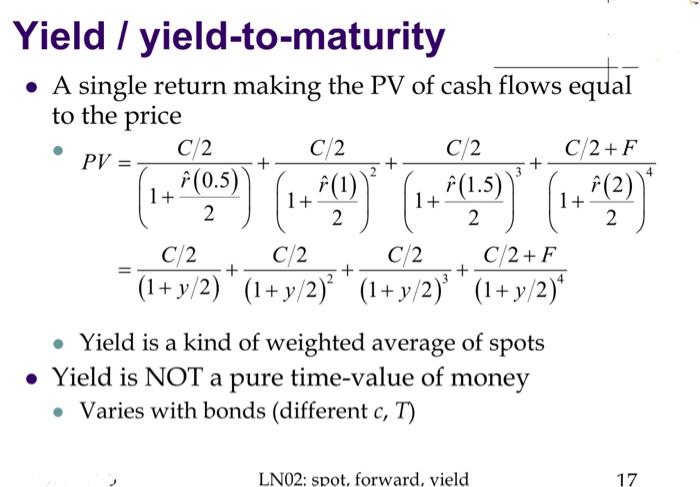

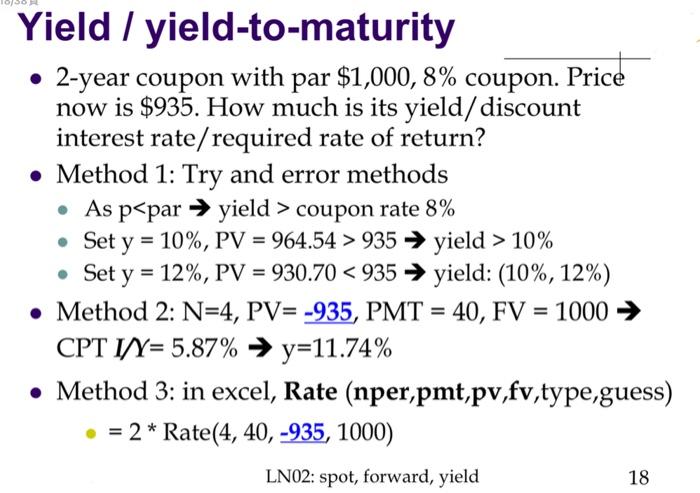

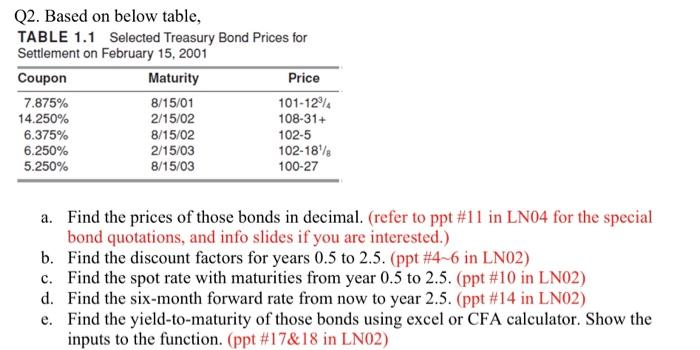

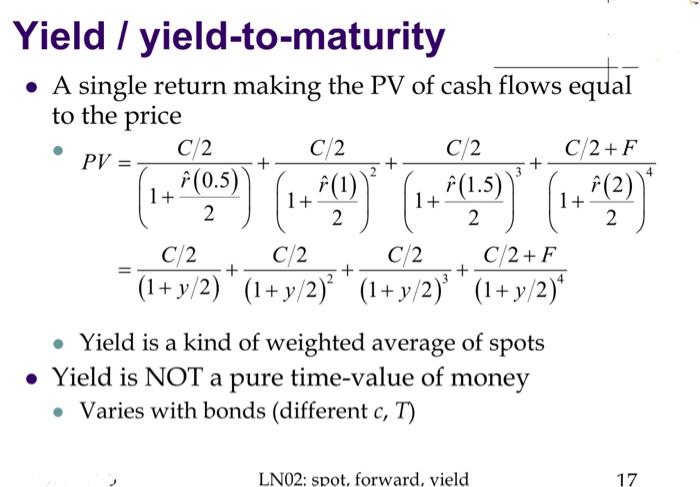

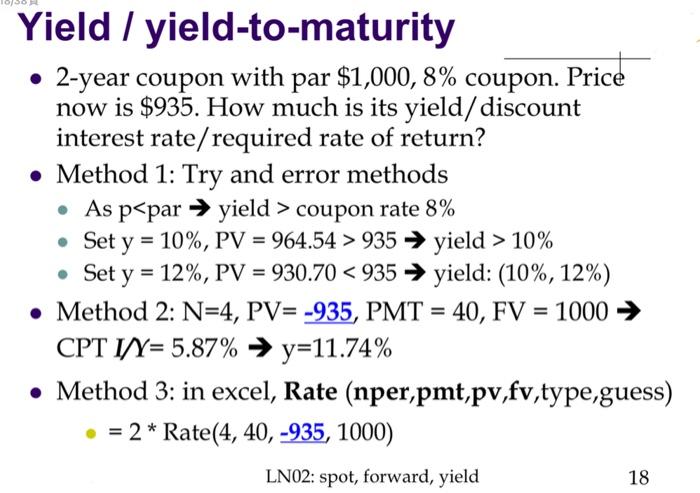

Q2. Based on below table, TABLE 1.1 Selected Treasury Bond Prices for Settlement on February 15, 2001 Coupon Maturity Price 7.875% 8/15/01 101-12/4 14.250% 2/15/02 108-31+ 6.375% 8/15/02 102-5 6.250% 2/15/03 102-18 5.250% 8/15/03 100-27 a. Find the prices of those bonds in decimal. (refer to ppt #11 in LN04 for the special bond quotations, and info slides if you are interested.) b. Find the discount factors for years 0.5 to 2.5. (ppt #4~6 in LN02) c. Find the spot rate with maturities from year 0.5 to 2.5. (ppt #10 in LN02) d. Find the six-month forward rate from now to year 2.5. (ppt #14 in LN02) e. Find the yield-to-maturity of those bonds using excel or CFA calculator. Show the inputs to the function. (ppt #17&18 in LN02) 345 Quoted as a percentage of par In 32-nd (a tick) Ppt #11 in LN04 . With a + to denote half a tick A third digit to denote 1/8 of 32nds (256ths) No. of No. of No. of Quote Price per $100 par 32nds 64ths 256ths 91-19+ 19 1 0 91+19.5/32 =91.6094 107-222 22 0 2 107+(22+2/8)/32= 107.6953 109-066 6 6 0 6 109+(6+6/8)/32= 109.2109 Yield is often quoted with prices Given below treasury bond info, calculate discount factors for year 0.5, 1, 1.5, and 2. maturity coupon price bond 1 0.5 10% 102.4390 bond 2 1 8% 103.3764 bond 3 1.5 7% 102.8746 bond 4 2 6% 100.9957 For bond 1, only one cash flow -102.4390 +5+100 o 0.5 1 1.5 2 102.4390 = PV = FV(.5)*d(.5) = (100+5)*d(.5) d(.5) = .9756 = LN02: spot, forward, yield 4 4 5/38 For bond 2, two cash flows -103.3764 +4 +4+100 0.5 1 1.5 2 = = 103.3764 = PV = 4*d(.5) + 104*d(1) . d(1) = Note Different bonds have different cash flows/prices Same discount factor applies to cash flows arriving at the same time LN02: spot, forward, yield 5 For bond 3, three cash flows 0.5 1 1.5 2 PV = 102.8746 = . d(1.5) = For bond 4, four cash flows 100.9957 = 3*d(.5) + 3*d(1) + 3*d(1.5) + 103*d(2) d(2) = .8972 + = LN02: spot, forward, yield 6 = Spot rate f(t) Interest rate used to discount zero-coupon bonds FV(t) PV = = FV xd (t) =d(t)= 1 (1+F() (1+r(6) For semiannual coupon payment 1 d(t)= t d(t) spot(t) f(t) 0.5 0.9756 2 1 0.9565 1.5 0.9286 2 0.8972 21 (1+O LN02: spot, forward, yield 10 Exercise - forward Calculate the forward forward(t) t 0.5 1 1.5 2 d(t) 0.9756 0.9565 0.9286 0.8972 spot(t) 5.0% 4.5% 5.0% 5.5% . Check the geometric average LN02: spot, forward, yield 14 Yield / yield-to-maturity A single return making the PV of cash flows equal to the price C2 C/2 C/2 C/2+F PV = (0.5) (1) f(1.5) () 1+ 2 + + 1+ FO) (- 0,35) (12 1+ 1+ 2 2 C/2 C/2 C/2 C/2+F + + + (1+ y/2) (1+y/2)? " (1+y/2) (1 + y/2)* y Yield is a kind of weighted average of spots Yield is NOT a pure time-value of money Varies with bonds (different c, T) LN02: spot, forward, vield 17 Yield / yield-to-maturity 2-year coupon with par $1,000,8% coupon. Price now is $935. How much is its yield/ discount interest rate/required rate of return? Method 1: Try and error methods As p coupon rate 8% % Set y = 10%, PV = 964.54 > 935 yield > 10% Set y = 12%, PV = 930.70 y=11.74% Method 3: in excel, Rate (nper,pmt,pv,fv,type,guess) . = 2 * Rate(4, 40, -935, 1000) = = = = LN02: spot, forward, yield 18 Q2. Based on below table, TABLE 1.1 Selected Treasury Bond Prices for Settlement on February 15, 2001 Coupon Maturity Price 7.875% 8/15/01 101-12/4 14.250% 2/15/02 108-31+ 6.375% 8/15/02 102-5 6.250% 2/15/03 102-18 5.250% 8/15/03 100-27 a. Find the prices of those bonds in decimal. (refer to ppt #11 in LN04 for the special bond quotations, and info slides if you are interested.) b. Find the discount factors for years 0.5 to 2.5. (ppt #4~6 in LN02) c. Find the spot rate with maturities from year 0.5 to 2.5. (ppt #10 in LN02) d. Find the six-month forward rate from now to year 2.5. (ppt #14 in LN02) e. Find the yield-to-maturity of those bonds using excel or CFA calculator. Show the inputs to the function. (ppt #17&18 in LN02) 345 Quoted as a percentage of par In 32-nd (a tick) Ppt #11 in LN04 . With a + to denote half a tick A third digit to denote 1/8 of 32nds (256ths) No. of No. of No. of Quote Price per $100 par 32nds 64ths 256ths 91-19+ 19 1 0 91+19.5/32 =91.6094 107-222 22 0 2 107+(22+2/8)/32= 107.6953 109-066 6 6 0 6 109+(6+6/8)/32= 109.2109 Yield is often quoted with prices Given below treasury bond info, calculate discount factors for year 0.5, 1, 1.5, and 2. maturity coupon price bond 1 0.5 10% 102.4390 bond 2 1 8% 103.3764 bond 3 1.5 7% 102.8746 bond 4 2 6% 100.9957 For bond 1, only one cash flow -102.4390 +5+100 o 0.5 1 1.5 2 102.4390 = PV = FV(.5)*d(.5) = (100+5)*d(.5) d(.5) = .9756 = LN02: spot, forward, yield 4 4 5/38 For bond 2, two cash flows -103.3764 +4 +4+100 0.5 1 1.5 2 = = 103.3764 = PV = 4*d(.5) + 104*d(1) . d(1) = Note Different bonds have different cash flows/prices Same discount factor applies to cash flows arriving at the same time LN02: spot, forward, yield 5 For bond 3, three cash flows 0.5 1 1.5 2 PV = 102.8746 = . d(1.5) = For bond 4, four cash flows 100.9957 = 3*d(.5) + 3*d(1) + 3*d(1.5) + 103*d(2) d(2) = .8972 + = LN02: spot, forward, yield 6 = Spot rate f(t) Interest rate used to discount zero-coupon bonds FV(t) PV = = FV xd (t) =d(t)= 1 (1+F() (1+r(6) For semiannual coupon payment 1 d(t)= t d(t) spot(t) f(t) 0.5 0.9756 2 1 0.9565 1.5 0.9286 2 0.8972 21 (1+O LN02: spot, forward, yield 10 Exercise - forward Calculate the forward forward(t) t 0.5 1 1.5 2 d(t) 0.9756 0.9565 0.9286 0.8972 spot(t) 5.0% 4.5% 5.0% 5.5% . Check the geometric average LN02: spot, forward, yield 14 Yield / yield-to-maturity A single return making the PV of cash flows equal to the price C2 C/2 C/2 C/2+F PV = (0.5) (1) f(1.5) () 1+ 2 + + 1+ FO) (- 0,35) (12 1+ 1+ 2 2 C/2 C/2 C/2 C/2+F + + + (1+ y/2) (1+y/2)? " (1+y/2) (1 + y/2)* y Yield is a kind of weighted average of spots Yield is NOT a pure time-value of money Varies with bonds (different c, T) LN02: spot, forward, vield 17 Yield / yield-to-maturity 2-year coupon with par $1,000,8% coupon. Price now is $935. How much is its yield/ discount interest rate/required rate of return? Method 1: Try and error methods As p coupon rate 8% % Set y = 10%, PV = 964.54 > 935 yield > 10% Set y = 12%, PV = 930.70 y=11.74% Method 3: in excel, Rate (nper,pmt,pv,fv,type,guess) . = 2 * Rate(4, 40, -935, 1000) = = = = LN02: spot, forward, yield 18