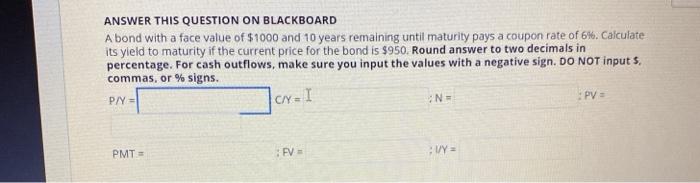

Question: ANSWER THIS QUESTION ON BLACKBOARD A bond with a face value of $1000 and 10 years remaining until maturity pays a coupon rate of 6%.

ANSWER THIS QUESTION ON BLACKBOARD A bond with a face value of $1000 and 10 years remaining until maturity pays a coupon rate of 6%. Calculate its yield to maturity if the current price for the bond is $950. Round answer to two decimals in percentage. For cash outflows, make sure you input the values with a negative sign, DO NOT input s. commas, or % signs. Icral PV = P/Y= NE PMT= EV :VY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts