Question: answer this question with the relevant case law and apply the IRAC method Anita runs a business selling dried savoury banana chips. Her business is

answer this question with the relevant case law and apply the IRAC method

answer this question with the relevant case law and apply the IRAC method

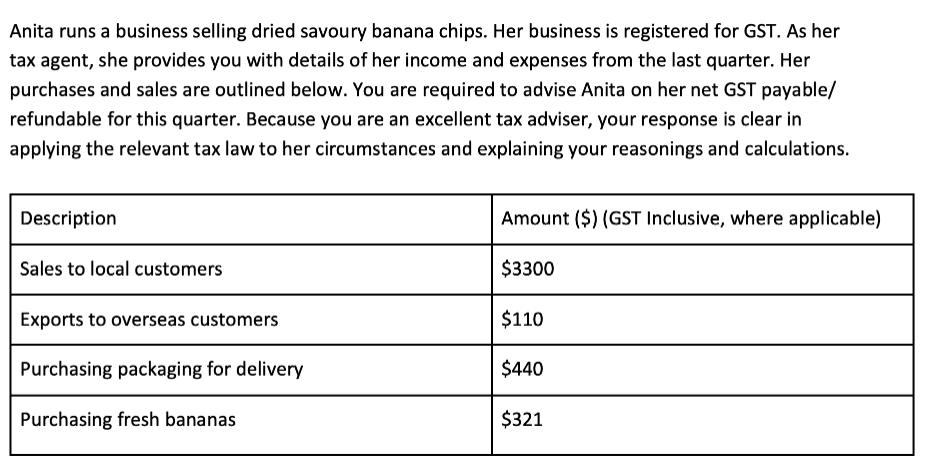

Anita runs a business selling dried savoury banana chips. Her business is registered for GST. As her tax agent, she provides you with details of her income and expenses from the last quarter. Her purchases and sales are outlined below. You are required to advise Anita on her net GST payable/ refundable for this quarter. Because you are an excellent tax adviser, your response is clear in applying the relevant tax law to her circumstances and explaining your reasonings and calculations. Description Sales to local customers Exports to overseas customers Purchasing packaging for delivery Purchasing fresh bananas Amount ($) (GST Inclusive, where applicable) $3300 $110 $440 $321

Step by Step Solution

There are 3 Steps involved in it

To calculate Anitas net GST payable or refundable for this quarter we need to consider both her GSTi... View full answer

Get step-by-step solutions from verified subject matter experts