Question: Answer this using a Texas BAII Plus Calculator and listing out the keys Rudolph Investments specializes in buying Christmas tree ornaments production facilities. It is

Answer this using a Texas BAII Plus Calculator and listing out the keys

Answer this using a Texas BAII Plus Calculator and listing out the keys

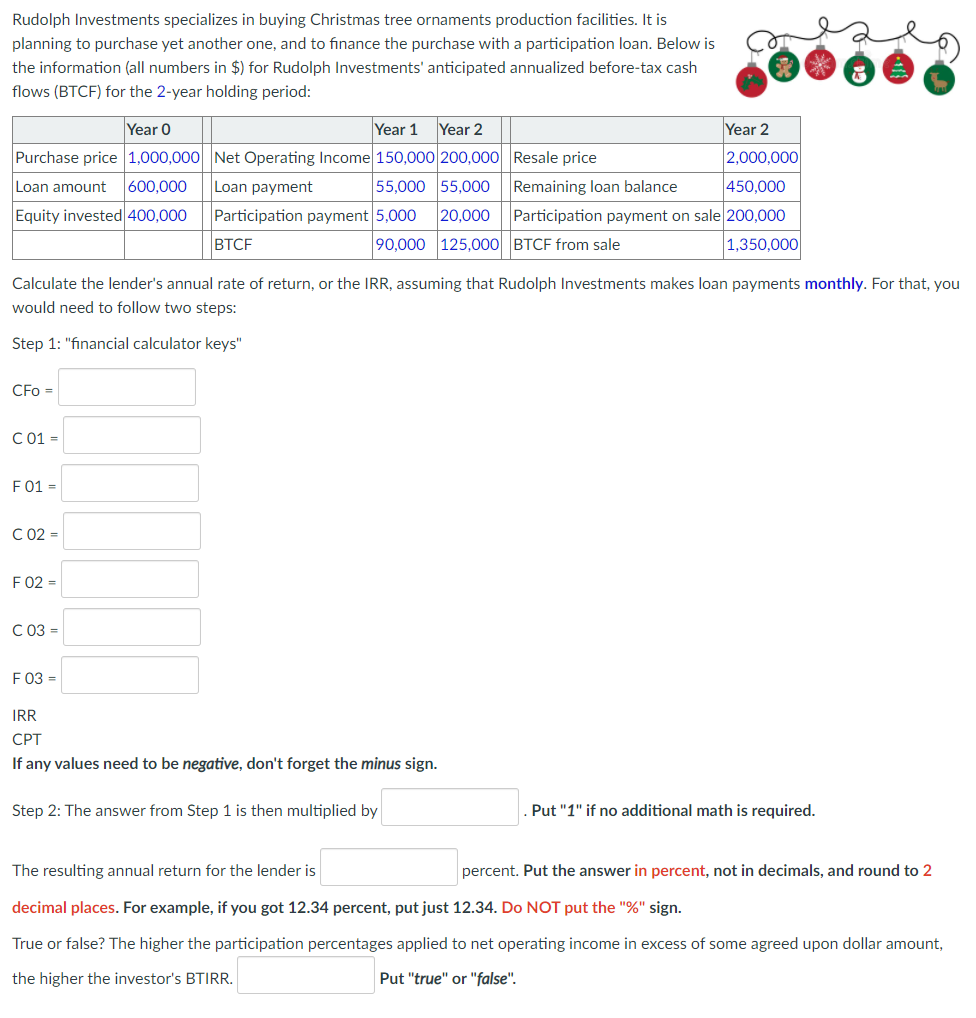

Rudolph Investments specializes in buying Christmas tree ornaments production facilities. It is planning to purchase yet another one, and to finance the purchase with a participation loan. Below is the information (all numbers in $) for Rudolph Investments' anticipated annualized before-tax cash flows (BTCF) for the 2-year holding period: Year o Year 1 Year 2 Year 2 Purchase price 1,000,000 Net Operating Income 150,000 200,000 Resale price 2,000,000 Loan amount 600,000 Loan payment 55,000 55,000 Remaining loan balance 450.000 Equity invested 400,000 Participation payment 5,000 20,000 Participation payment on sale 200,000 BTCF 90,000 125,000 BTCF from sale 1,350,000 Calculate the lender's annual rate of return, or the IRR, assuming that Rudolph Investments makes loan payments monthly. For that, you would need to follow two steps: Step 1: "financial calculator keys" CFO = C 01 = F01 = CO2 = F 02 - CO3 = FO3 = IRR CPT If any values need to be negative, don't forget the minus sign. Step 2: The answer from Step 1 is then multiplied by Put "1" if no additional math is required. The resulting annual return for the lender is percent. Put the answer in percent, not in decimals, and round to 2 decimal places. For example, if you got 12.34 percent, put just 12.34. Do NOT put the "%" sign. True or false? The higher the participation percentages applied to net operating income in excess of some agreed upon dollar amount, the higher the investor's BTIRR. Put "true" or "false". Rudolph Investments specializes in buying Christmas tree ornaments production facilities. It is planning to purchase yet another one, and to finance the purchase with a participation loan. Below is the information (all numbers in $) for Rudolph Investments' anticipated annualized before-tax cash flows (BTCF) for the 2-year holding period: Year o Year 1 Year 2 Year 2 Purchase price 1,000,000 Net Operating Income 150,000 200,000 Resale price 2,000,000 Loan amount 600,000 Loan payment 55,000 55,000 Remaining loan balance 450.000 Equity invested 400,000 Participation payment 5,000 20,000 Participation payment on sale 200,000 BTCF 90,000 125,000 BTCF from sale 1,350,000 Calculate the lender's annual rate of return, or the IRR, assuming that Rudolph Investments makes loan payments monthly. For that, you would need to follow two steps: Step 1: "financial calculator keys" CFO = C 01 = F01 = CO2 = F 02 - CO3 = FO3 = IRR CPT If any values need to be negative, don't forget the minus sign. Step 2: The answer from Step 1 is then multiplied by Put "1" if no additional math is required. The resulting annual return for the lender is percent. Put the answer in percent, not in decimals, and round to 2 decimal places. For example, if you got 12.34 percent, put just 12.34. Do NOT put the "%" sign. True or false? The higher the participation percentages applied to net operating income in excess of some agreed upon dollar amount, the higher the investor's BTIRR. Put "true" or "false

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts