Question: ANSWER THOSE 9 QUESTIONS . ITS FOR A PRESENTATION La Croix Is Losing the Sparkling Water Wars European brands San Pellegrino and Perrier dominated the

ANSWER THOSE 9 QUESTIONS . ITS FOR A PRESENTATION

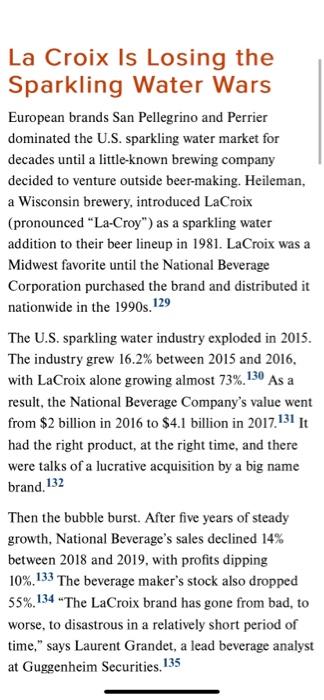

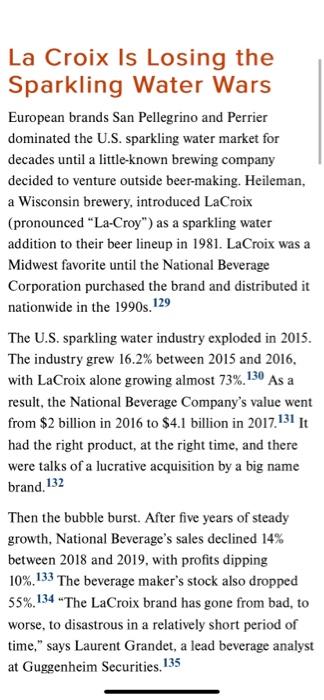

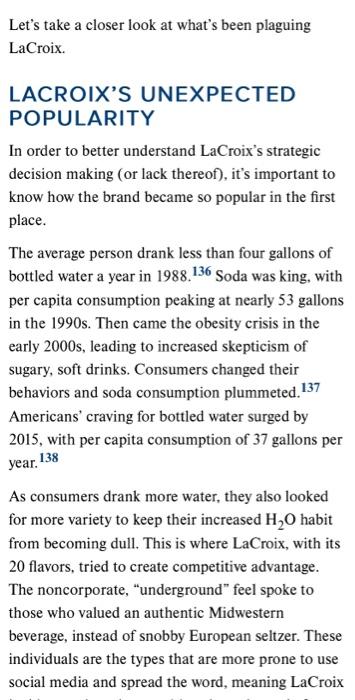

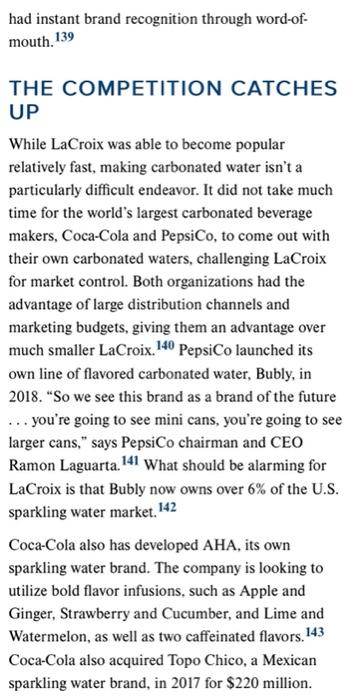

La Croix Is Losing the Sparkling Water Wars European brands San Pellegrino and Perrier dominated the U.S. sparkling water market for decades until a little-known brewing company decided to venture outside beer-making. Heileman, a Wisconsin brewery, introduced LaCroix (pronounced "La-Croy") as a sparkling water addition to their beer lineup in 1981. LaCroix was a Midwest favorite until the National Beverage Corporation purchased the brand and distributed it nationwide in the 1990s. 129 The U.S. sparkling water industry exploded in 2015. The industry grew 16.2% between 2015 and 2016, with LaCroix alone growing almost 73%.130 As a result, the National Beverage Company's value went from $2 billion in 2016 to $4.1 billion in 2017.131 It had the right product, at the right time, and there were talks of a lucrative acquisition by a big name brand, 132 Then the bubble burst. After five years of steady growth, National Beverage's sales declined 14% between 2018 and 2019, with profits dipping 10%.133 The beverage maker's stock also dropped 55%.134 "The LaCroix brand has gone from bad, to worse, to disastrous in a relatively short period of time," says Laurent Grandet, a lead beverage analyst at Guggenheim Securities.135 Let's take a closer look at what's been plaguing LaCroix. LACROIX'S UNEXPECTED POPULARITY In order to better understand LaCroix's strategic decision making (or lack thereof), it's important to know how the brand became so popular in the first place. The average person drank less than four gallons of bottled water a year in 1988.136 Soda was king, with per capita consumption peaking at nearly 53 gallons in the 1990s. Then came the obesity crisis in the early 2000s, leading to increased skepticism of sugary, soft drinks. Consumers changed their behaviors and soda consumption plummeted.137 Americans' craving for bottled water surged by 2015, with per capita consumption of 37 gallons per year, 138 As consumers drank more water, they also looked for more variety to keep their increased H,0 habit from becoming dull. This is where LaCroix, with its 20 flavors, tried to create competitive advantage. The noncorporate, "underground" feel spoke to those who valued an authentic Midwestern beverage, instead of snobby European seltzer. These individuals are the types that are more prone to use social media and spread the word, meaning LaCroix had instant brand recognition through word-of- mouth." 139 THE COMPETITION CATCHES UP While LaCroix was able to become popular relatively fast, making carbonated water isn't a particularly difficult endeavor. It did not take much time for the world's largest carbonated beverage makers, Coca-Cola and PepsiCo, to come out with their own carbonated waters, challenging LaCroix for market control. Both organizations had the advantage of large distribution channels and marketing budgets, giving them an advantage over much smaller LaCroix. 140 PepsiCo launched its own line of flavored carbonated water, Bubly, in 2018. "So we see this brand as a brand of the future ... you're going to see mini cans, you're going to see larger cans," says PepsiCo chairman and CEO Ramon Laguarta. 141 What should be alarming for LaCroix is that Bubly now owns over 6% of the U.S. sparkling water market. 142 Coca-Cola also has developed AHA, its own sparkling water brand. The company is looking to utilize bold flavor infusions, such as Apple and Ginger, Strawberry and Cucumber, and Lime and Watermelon, as well as two caffeinated flavors.143 Coca-Cola also acquired Topo Chico, a Mexican sparkling water brand, in 2017 for $220 million. Topo Chico is quite popular in the U.S. as well, specifically in Texas, where it dominates market share for imported sparkling water.144 "Unsweetened flavored sparkling water is a dynamic and exciting category as we look at our long-term growth plans," says Brad Spickert, Coca-Cola North America's SVP of hydration.145 A BRAND GONE FLAT Analysts believe PepsiCo and Coca-Cola, as well as other competitors such as Nestl and Polar, are strategically outperforming a stagnant LaCroix. The company still sells in multipacks of six or 12 instead of varying their sizes as competitors have. They also don't have single-serve cans for easy placement in convenience stores. "If you look at the range of y LaCroix four years ago, about 90% of it is exactly the same as what you can see in stores today.... They're not overly creative or aggressive in terms of trying new ways of growth in the segment," says Grandet. Customers have discovered that other brands offer acceptable substitutes."146 LaCroix's distribution network also pales in Page 241 comparison to competitors. It does not utilize a direct store delivery network for a majority of its retail channels, instead relying on warehouse distribution. PepsiCo, Nestle, and Polar all operate direct store delivery networks, which allow them to have dedicated display space in top retailers. This may PepsiCo, in particular, has used its established control over checkout line coolers to place Bubly alongside its popular core soft drinks brands. "[Pepsi has) added (Bubly) to all of those secondary locations, and they can do that because they're so powerful, according to Tom Dowdy, chief revenue officer for Hudson News Distributors, one of La Croix's distribution partners. 147 be one of the reasons analysts expect Bubly sales to surpass LaCroix by 2021.148 Industry experts don't have confidence that National Beverage CEO Nick Caporella has what it takes to bring back LaCroix's luster. Caporella does not believe LaCroix's woes are due to mismanagement. He actually blames injustice" for the company's decline in sales and profits, rather than poor strategy, Managing a brand is not so different from caring for someone who becomes handicapped," Caporella said in 2019. Analysts aren't pleased with Caporella's refusal to make strategic change. Along these lines, CNBC declared, LaCroix would be better served in the hands of an owner with strong brand-building capabilities, the financial resources to invest appropriately, and the willingness to do so.' 149 1. What is the assessment of the external environment? 2. How well do you understand the existing customers and markets? 3. What is the best way to grow the business profitably, and what are the obstacles to growth? 4. Who is the competition? 5. Can the business execute the strategy? 6. Are the short term and long term balanced? 7. What are the important milestones for executing the plan? 8. What are the critical issues facing the business? 9. How will the business make money on a sustainable basis