Question: answer to 3a&b please help to answer q3c&d. Many thanks Question 3 (25 marks) Computer Pro is a distributor of Easycalculate Accounting Software'. The company

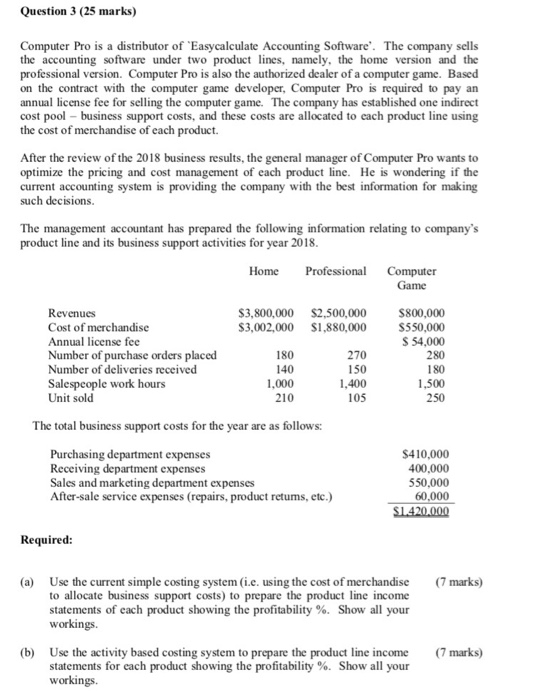

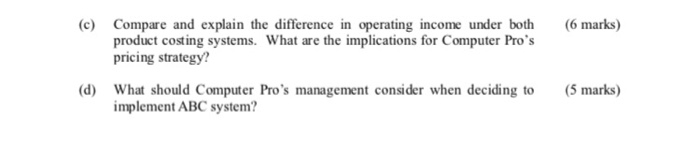

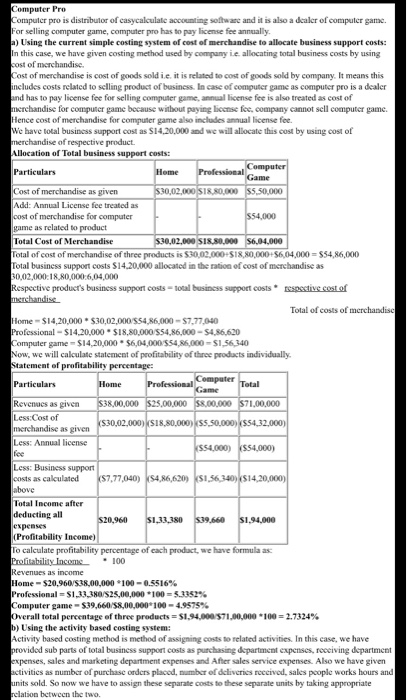

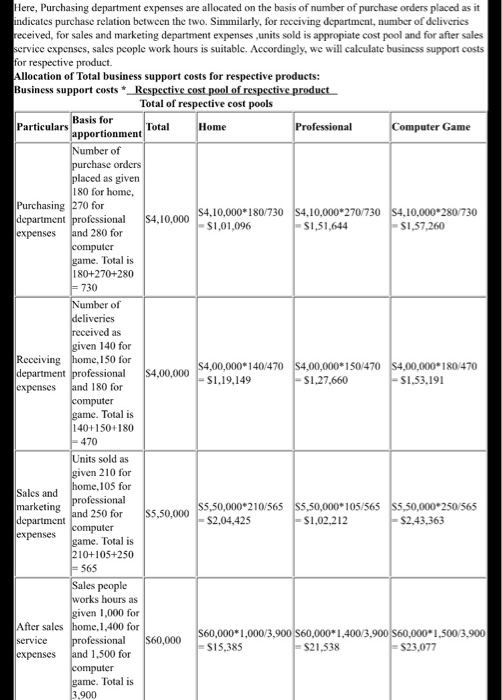

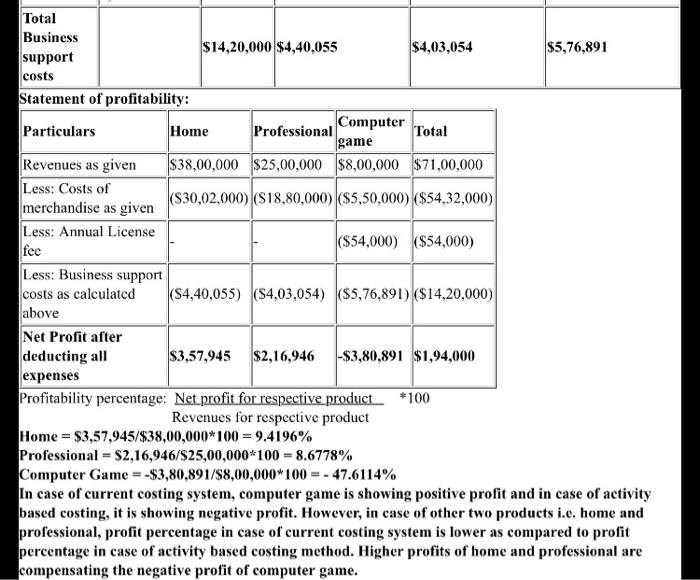

Question 3 (25 marks) Computer Pro is a distributor of Easycalculate Accounting Software'. The company sells the accounting software under two product lines, namely, the home version and the professional version. Computer Pro is also the authorized dealer of a computer game. Based on the contract with the computer game developer, Computer Pro is required to pay an annual license fee for selling the computer game. The company has established one indirect cost pool-business support costs, and these costs are allocated to cach product line using the cost of merchandise of each product. After the review of the 2018 business results, the general manager of Computer Pro wants to optimize the pricing and cost management of each product line. He is wondering if the current accounting system is providing the company with the best information for making such decisions The management accountant has prepared the following information relating to company's product line and its business support activities for year 2018. Home Professional Computer Game $3,800,000 $3,002,000 $2,500,000 $1,880,000 Revenues Cost of merchandise Annual license fee Number of purchase orders placed Number of deliveries received Salespeople work hours Unit sold 180 140 1.000 210 270 150 1,400 105 $800,000 S550,000 $ 54,000 280 180 1,500 250 The total business support costs for the year are as follows: Purchasing department expenses Receiving department expenses Sales and marketing department expenses After-sale service expenses (repairs, product retums, etc.) $410,000 400.000 550.000 60,000 S1.420.000 Required: (a) (7 marks) Use the current simple costing system (i.e. using the cost of merchandise to allocate business support costs) to prepare the product line income statements of each product showing the profitability %. Show all your workings. (b) (7 marks) Use the activity based costing system to prepare the product line income statements for each product showing the profitability %. Show all your workings. (c) (6 marks) Compare and explain the difference in operating income under both product costing systems. What are the implications for Computer Pro's pricing strategy? (d) What should Computer Pro's management consider when deciding to implement ABC system? (5 marks) Computer Pro Computer pro is distributor of easycalculate accounting software and it is also a dealer of computer game For selling computer game, computer pro has to pay license fee annually Using the current simple costing system of cost of merchandise to allocate business support costs In this case, we have given costing method used by companyie allocating total business costs by using cost of merchandise Cost of merchandise is cost of goods sold i.e. it is related to cost of goods sold by company. It means this includes costs related to selling product of business. In case of computer game as computer pro is a dealer and has to pay license fee for selling computer game, annual license fee is also treated as cost of archandise for computer game because without pavi Bicense for company cannot sell computer game Hence cost of merchandise for computer game also includes a license for We have total business support cost as $14.20,000 and we will allocate this cost by using cost of Merchandise of respective product. Allocation of Total business support costs Computer Particulars Professional Game Professional Computer Cost of merchandise as given S002 SIRRO DO 55 50.000 Add: Annual License fee treated as cost of merchandise for computer $54,000 game as related to product Total Cost of Merchandise $30,02.000 SIX 80.000 $6.04.000 Total of cost of merchandise of three products is $3002000 SIRRO 00:56 04.000 $54.86.000 Total business support costs $14.20,000 allocated in the nation of cost of merchandise as 10.02.000TR 0000604,000 Respective product's business support costs - total business support costs respective cost of merchandise Total of costs of merchandise Home - $14,20,000 $30,02,000 $54,86,000-$7,77,040 Professional - $14.20,000 $18.80,000 $54,86,000 - 54.86.620 Computer game $14,20,000 $6,04,000 $54,86,000 - $1,56,340 Now, we will calculate statement of profitability of three products individually Statement of profitability percentage: Particulars Home Professional Revenues as given $38,00,000 $25,00,000 $8,00,000 $71,00,000 Less:Cost of (530,02,000) 18,80,000) 55.50.000) 554,32,000) merchandise as given Less Annual license 554,000) 554,000) Less Business support costs as calculated 87,77,046) 54.86,620) 5156340) 514.20,000) above Total Income after deducting all 520,960 $1,33_380 539560 51,94,000 expenses (Profitability Income) To calculate profitability percentage of each product, we have formula Profitability Income 100 Revenues as income Home - 520,960 538.00.000 100 .5516% Professional SIM 2 5,00.000*100 = $3352% Computer game - 539,660 58,00.000 100-4.9575% Overall total percentage of three products = $1.94.000 571,00,000 *100 = 2.7324% b) Using the activity based costing system: Activity based costing method is method of assigning costs to related activities. In this case, we have provided sub parts of total business support costs as purchasing department expenses, receiving department expenses, sales and marketing department expenses and After sales service expenses. Also we have given activities as number of purchase orders placed, number of deliveries received, sales people works hours and units sold. So now we have to assign these separate costs to these separate units by taking appropriate relation between the two Here, Purchasing department expenses are allocated on the basis of number of purchase orders placed as it indicates purchase relation between the two. Simmilarly, for receiving department, number of deliveries received, for sales and marketing department expenses.units sold is appropiate cost pool and for after sales Service expenses, sales people work hours is suitable. Accordingly, we will calculate business support costs for respective product. Allocation of Total business support costs for respective products: Business support costs * Respective cost pool of respective product Total of respective cost pools Particulars Basis for Total Home Professional Computer Game apportionment Number of purchase orders placed as given 180 for home, Purchasing 270 for S4.10,000*180/730 S4.10.000*270/730 $4,10,000*280730 department professional S4,10,000 -$1,01,096 -S1,51,644 -$1,57,260 expenses and 280 for computer game. Total is 180+270+280 = 730 Number of deliveries received as given 140 for Receiving home, 150 for S4,00,000*140/470 $4,00,000*150/470 $4,00,000*180/470 department professional S4,00.000 - S1,19,149 $1.27,660 - S1,53.191 expenses and 180 for computer game. Total is 140+150+180 -470 Units sold as given 210 for home, 105 for Sales and professional marketing $5,50,000*210/565 $5,50,000 $5,50,000*105/565 and 250 for $5,50,000*250/565 department - $2.04,425 - $1.02.212 -$2.43.363 computer expenses game. Total is 210+105+250 = 565 Sales people works hours as given 1,000 for After sales home, 1,400 for professional service 560,000*1,000/3,900 $60,000*1,400/3,900 $60,000*1,500/3.900 $60,000 = $15,385 - $21,538 expenses $23,077 and 1,500 for computer game. Total is 3.900 Total Business $14,20,000 $4,40,055 $4,03,054 $5,76,891 support costs Statement of profitability: Computer Particulars Professional Home Total game Revenues as given $38,00,000 $25,00,000 $8,00,000 $71,00,000 Less: Costs of ($30,02,000) (518,80,000) ($5,50,000) ($54,32,000) merchandise as given Less: Annual License ($54,000) ($54,000) fee Less: Business support costs as calculated (S4,40,055) (S4,03,054) ($5,76,891) ($14,20,000) above Net Profit after deducting all $3,57,945 $2,16,946 -$3,80,891 $1,94,000 expenses Profitability percentage: Net profit for respective product. *100 Revenues for respective product Home = $3,57,945/$38,00,000*100 = 9.4196% Professional = $2,16,946/$25,00,000*100 = 8.6778% Computer Game = -$3,80,891/$8,00,000*100 = - 47.6114% In case of current costing system, computer game is showing positive profit and in case of activity based costing, it is showing negative profit. However, in case of other two products i.e. home and professional, profit percentage in case of current costing system is lower as compared to profit percentage in case of activity based costing method. Higher profits of home and professional are compensating the negative profit of computer game

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts