Question: Answer to 7 please. Problem 6. Ross Inc. has a target capital structure that calls for 25% debt, 15% preferred stock and 60% common equity.

Answer to 7 please.

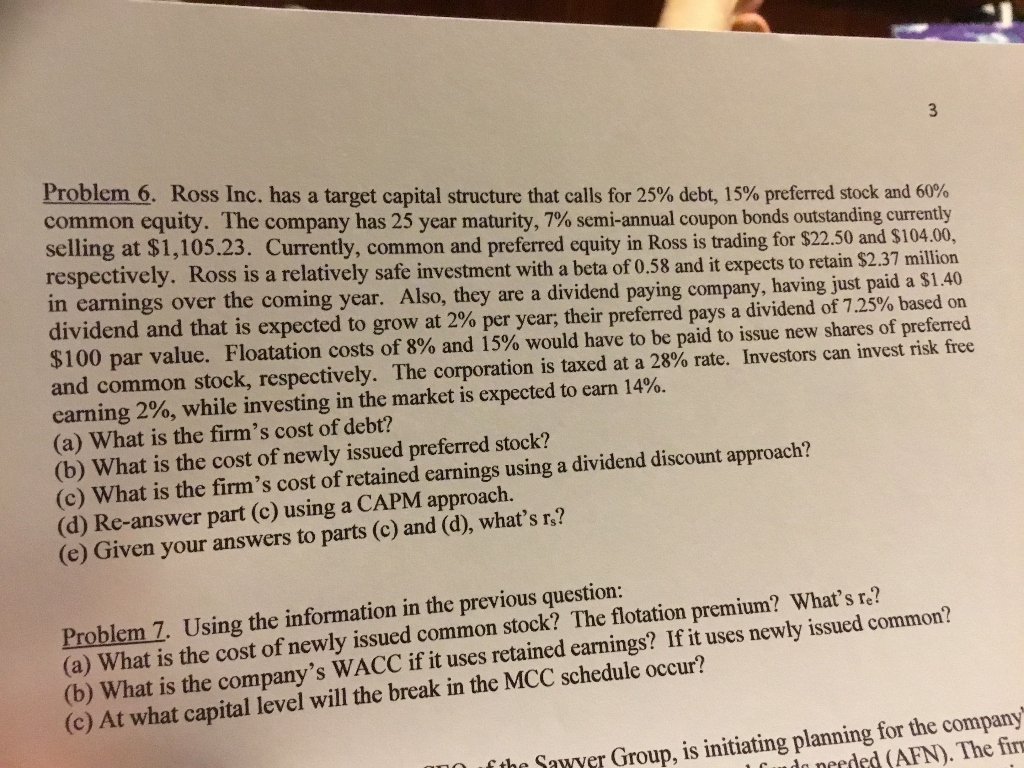

Problem 6. Ross Inc. has a target capital structure that calls for 25% debt, 15% preferred stock and 60% common equity. The company has 25 year maturity, 7% semi-annual coupon bonds outstanding currently selling at $1,105.23. Currently, common and preferred equity in Ross is trading for $22.50 and $104.00, respectively. Ross is a relatively safe investment with a beta of 0.58 and it expects to retain $2.37 million in earnings over the coming year. Also, they are a dividend paying company, having just paid a $1.40 dividend and that is expected to grow at 2% per year, their preferred pays a dividend of 7.25% based on $100 par value. Floatation costs of 8% and 15% would have to be paid to issue new shares of preferred and common stock, respectively. The corporation is taxed at a 28% rate. Investors can invest risk free earning 2%, while investing in the market is expected to earn 14%. (a) What is the firm's cost of debt? (b) What is the cost of newly issued preferred stock? (c) What is the firm's cost of retained earnings using a dividend discount approach? (d) Re-answer part (c) using a CAPM approach. (e) Given your answers to parts (c) and (d), what's rs? Problem 7. Using the information in the previous question: (a) What is the cost of newly issued common stock? The flotation premium? What's re? (b) What is the company's WACC if it uses retained earnings? If it uses newly issued common? (c) At what capital level will the break in the MCC schedule occur? If the Sawver Group, is initiating planning for the company da needed (AFN). The fire Problem 6. Ross Inc. has a target capital structure that calls for 25% debt, 15% preferred stock and 60% common equity. The company has 25 year maturity, 7% semi-annual coupon bonds outstanding currently selling at $1,105.23. Currently, common and preferred equity in Ross is trading for $22.50 and $104.00, respectively. Ross is a relatively safe investment with a beta of 0.58 and it expects to retain $2.37 million in earnings over the coming year. Also, they are a dividend paying company, having just paid a $1.40 dividend and that is expected to grow at 2% per year, their preferred pays a dividend of 7.25% based on $100 par value. Floatation costs of 8% and 15% would have to be paid to issue new shares of preferred and common stock, respectively. The corporation is taxed at a 28% rate. Investors can invest risk free earning 2%, while investing in the market is expected to earn 14%. (a) What is the firm's cost of debt? (b) What is the cost of newly issued preferred stock? (c) What is the firm's cost of retained earnings using a dividend discount approach? (d) Re-answer part (c) using a CAPM approach. (e) Given your answers to parts (c) and (d), what's rs? Problem 7. Using the information in the previous question: (a) What is the cost of newly issued common stock? The flotation premium? What's re? (b) What is the company's WACC if it uses retained earnings? If it uses newly issued common? (c) At what capital level will the break in the MCC schedule occur? If the Sawver Group, is initiating planning for the company da needed (AFN). The fire

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts