Question: answer to first part of question is given if needed. please answer parts a & b in second image Fox Corporation purchased a machine on

answer to first part of question is given if needed. please answer parts a & b in second image

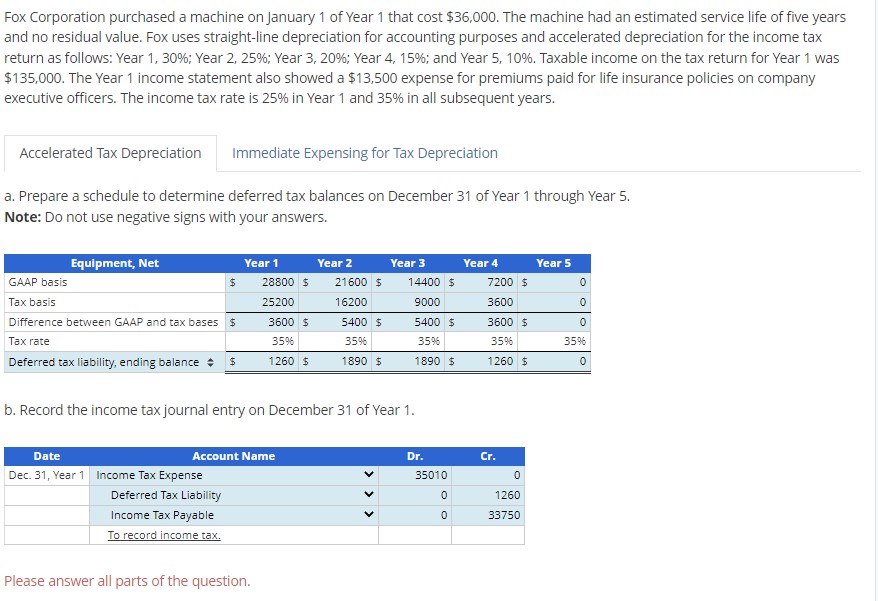

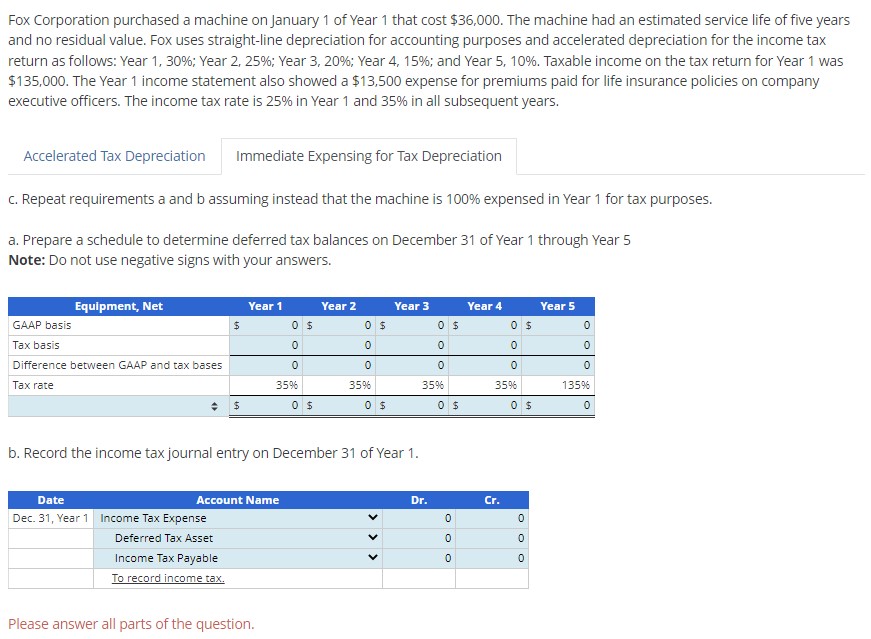

Fox Corporation purchased a machine on January 1 of Year 1 that cost $36,000. The machine had an estimated service life of five years and no residual value. Fox uses straight-line depreciation for accounting purposes and accelerated depreciation for the income tax return as follows: Year 1, 30\%; Year 2, 25\%; Year 3, 20\%; Year 4, 15\%; and Year 5, 10\%. Taxable income on the tax return for Year 1 was $135,000. The Year 1 income statement also showed a $13,500 expense for premiums paid for life insurance policies on company executive officers. The income tax rate is 25% in Year 1 and 35% in all subsequent years. Immediate Expensing for Tax Depreciation a. Prepare a schedule to determine deferred tax balances on December 31 of Year 1 through Year 5. Note: Do not use negative signs with your answers. b. Record the income tax journal entry on December 31 of Year 1. Please answer all parts of the question. Fox Corporation purchased a machine on January 1 of Year 1 that cost $36,000. The machine had an estimated service life of five years and no residual value. Fox uses straight-line depreciation for accounting purposes and accelerated depreciation for the income tax return as follows: Year 1, 30\%; Year 2, 25\%; Year 3, 20\%; Year 4, 15\%; and Year 5, 10\%. Taxable income on the tax return for Year 1 was $135,000. The Year 1 income statement also showed a $13,500 expense for premiums paid for life insurance policies on company executive officers. The income tax rate is 25% in Year 1 and 35% in all subsequent years. c. Repeat requirements a and b assuming instead that the machine is 100% expensed in Year 1 for tax purposes. a. Prepare a schedule to determine deferred tax balances on December 31 of Year 1 through Year 5 Note: Do not use negative signs with your answers. b. Record the income tax journal entry on December 31 of Year 1. Please answer all parts of the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts