Question: answer to question 9 QUESTION 9 (3 points) Which of the following statements is correct with respect to the treatment of net operating losses (NOLS)

answer to question 9

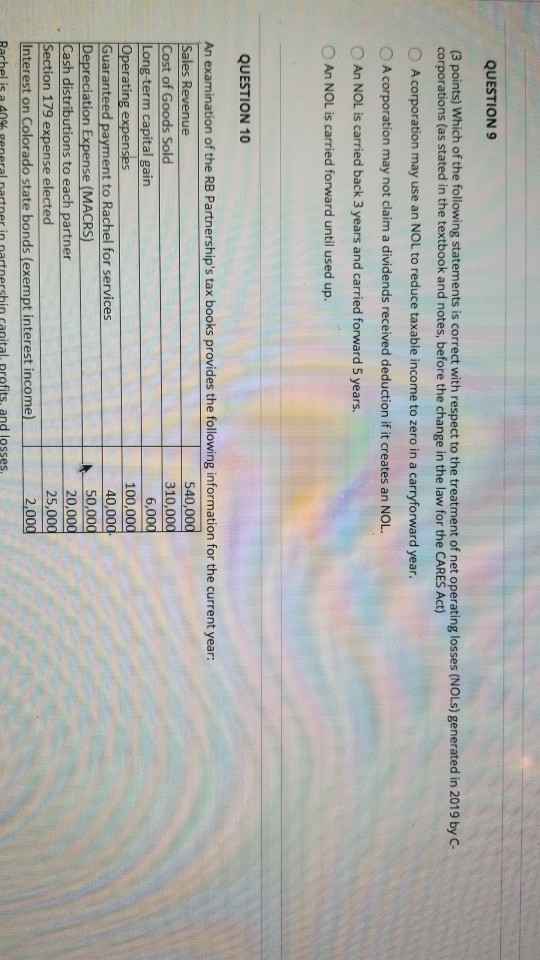

QUESTION 9 (3 points) Which of the following statements is correct with respect to the treatment of net operating losses (NOLS) generated in 2019 by C corporations (as stated in the textbook and notes, before the change in the law for the CARES Act) A corporation may use an NOL to reduce taxable income to zero in a carryforward year. A corporation may not claim a dividends received deduction if it creates an NOL. An NOL is carried back 3 years and carried forward 5 years. An NOL is carried forward until used up. QUESTION 10 An examination of the RB Partnership's tax books provides the following information for the current year: Sales Revenue 540,000 Cost of Goods Sold 310,000 Long-term capital gain 6,000 Operating expenses 100,000 Guaranteed payment to Rachel for services 40,000 Depreciation Expense (MACRS) 50,000 Cash distributions to each partner 20,000 Section 179 expense elected 25,000 Interest on Colorado state bonds (exempt interest income) 2,000 Rachel is a 40% general partner in nartnershin ranital, profits, and losses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts