Question: Answer True or False 1. Long-term liabilities are obligations that a company expects to pay within one year or end of cycle, whichever is longer.

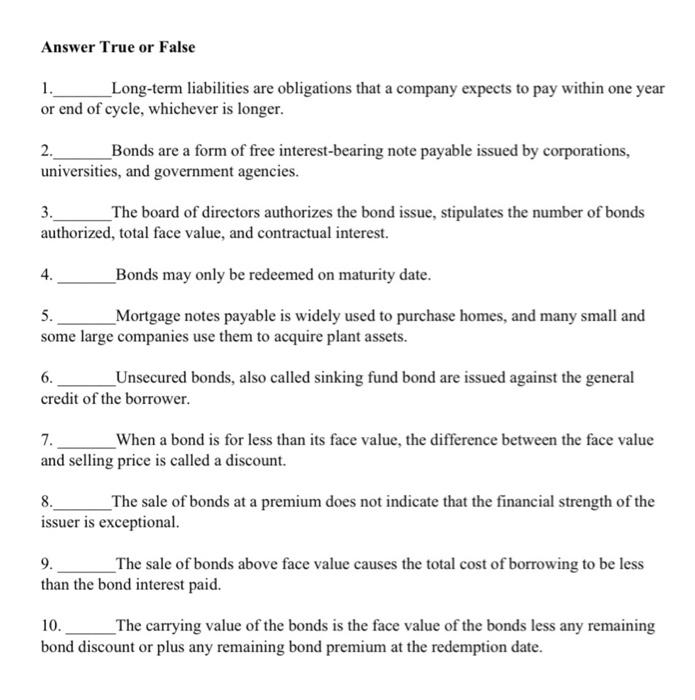

Answer True or False 1. Long-term liabilities are obligations that a company expects to pay within one year or end of cycle, whichever is longer. 2. Bonds are a form of free interest-bearing note payable issued by corporations, universities, and government agencies. 3. The board of directors authorizes the bond issue, stipulates the number of bonds authorized, total face value, and contractual interest. 4. Bonds may only be redeemed on maturity date. 5. Mortgage notes payable is widely used to purchase homes, and many small and some large companies use them to acquire plant assets. 6. Unsecured bonds, also called sinking fund bond are issued against the general credit of the borrower. 7. When a bond is for less than its face value, the difference between the face value and selling price is called a discount. 8. The sale of bonds at a premium does not indicate that the financial strength of the issuer is exceptional. 9. The sale of bonds above face value causes the total cost of borrowing to be less than the bond interest paid. 10. The carrying value of the bonds is the face value of the bonds less any remaining bond discount or plus any remaining bond premium at the redemption date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts