Question: Answer True or False for the following: a. For MACRS depreciation, salvage value varies b. Capital expenditures are considered taxable C. For straight income line

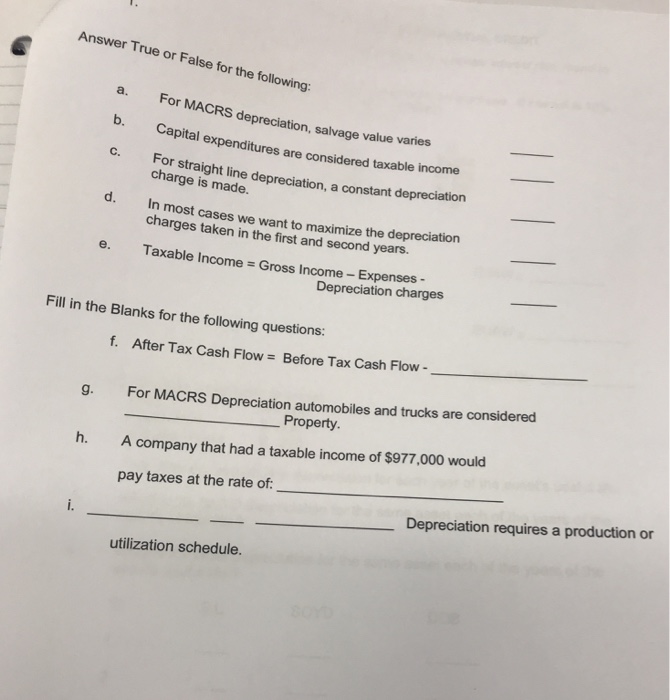

Answer True or False for the following: a. For MACRS depreciation, salvage value varies b. Capital expenditures are considered taxable C. For straight income line depreciation, a constant depreciation charge is made. d. In most cases we want to maximize the depreciation charges taken in the first and second years. e. Taxable Income = Gross Income-Expenses- Depreciation charges Fill in the Blanks for the following questions: f. After Tax Cash Flow = Before Tax Cash Flow- g. For MACRS Depreciation automobiles and trucks are consid Property h. A company that had a taxable income of $977,000 would pay taxes at the rate of: Depreciation requires a production or utilization schedule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts