Question: Answer True or False. If a statement is not strictly true, then it is False, 1. An increase in the market risk premium will result

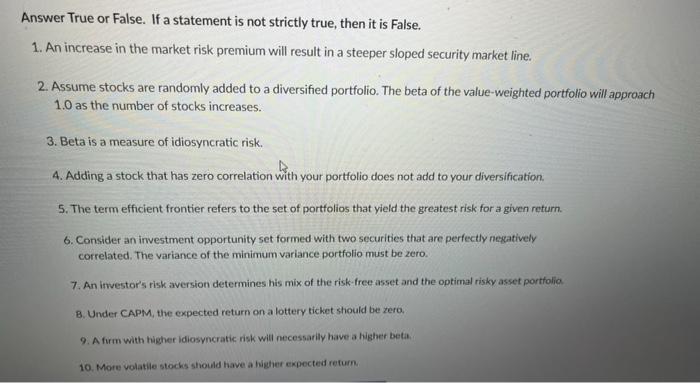

Answer True or False. If a statement is not strictly true, then it is False, 1. An increase in the market risk premium will result in a steeper sloped security market line. 2. Assume stocks are randomly added to a diversified portfolio. The beta of the value-weighted portfolio will approach 1.0 as the number of stocks increases. 3. Beta is a measure of idiosyncratic risk. 4. Adding a stock that has zero correlation with your portfolio does not add to your diversification. 5. The term efficient frontier refers to the set of portfolios that yield the greatest risk for a given return. 6. Consider an irvestment opportunity set formed with two securities that are perfectly negatively correlated. The variance of the minimum variance portfolio must be zero. 7. An irvestor's risk aversion determines his mix of the risk-free asset and the optimal risky asset portfolio B. Under CAPM, the expected return on a lottery ticket should be zero. 9. A furm with higher idiosyncratic risk will necessarily have a higher beta. 10. More volatile stocks should have a higher expected retum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts