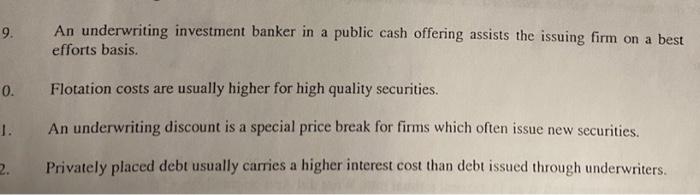

Question: answer true or false if false correct answer to be true 9. An underwriting investment banker in a public cash offering assists the issuing firm

9. An underwriting investment banker in a public cash offering assists the issuing firm on a best efforts basis. 0. Flotation costs are usually higher for high quality securities. 1. An underwriting discount is a special price break for firms which often issue new securities. Privately placed debt usually carries a higher interest cost than debt issued through underwriters. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts