Question: answer two mc question. An interest rate swap is a derivative contract in which: OA the buyer has the right to purchase the underlying from

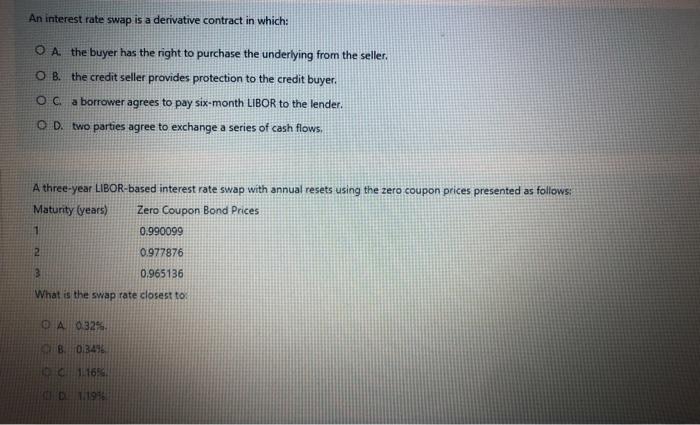

An interest rate swap is a derivative contract in which: OA the buyer has the right to purchase the underlying from the seller. O B. the credit seller provides protection to the credit buyer. Oca borrower agrees to pay six-month LIBOR to the lender. OD two parties agree to exchange a series of cash flows, A three-year LIBOR-based interest rate swap with annual resets using the zero coupon prices presented as follows: Maturity (years) Zero Coupon Bond Prices 1 0.990099 2 0.977876 0,965136 3 What is the swap rate closest to OA 0.32% GB 03492 11.16 MDL 1/1916

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts