Question: answer two questions 4. A stock will pay a dividend of $1 in one month and $2 in four months. The relevant risk-free rate of

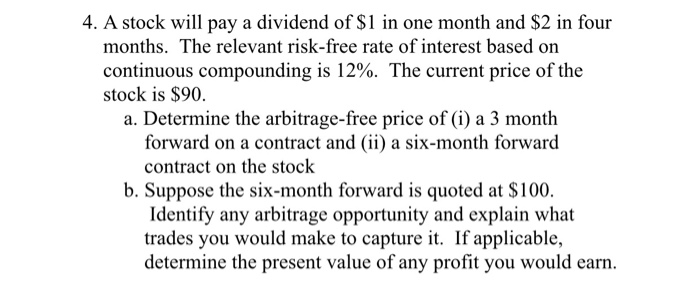

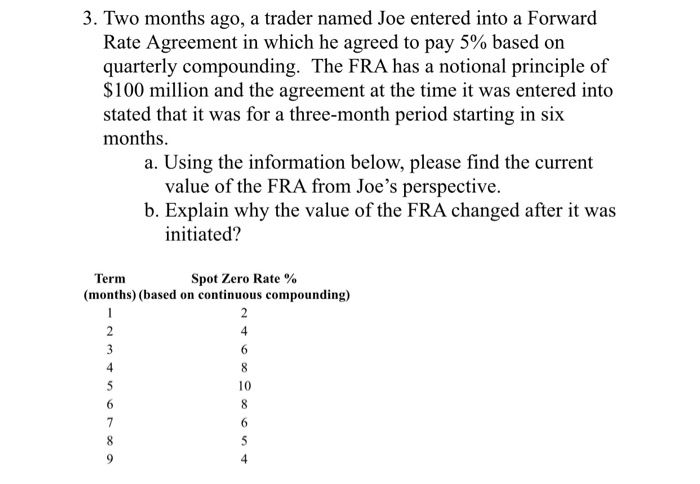

4. A stock will pay a dividend of $1 in one month and $2 in four months. The relevant risk-free rate of interest based on continuous compounding is 12%. The current price of the stock is $90. a. Determine the arbitrage-free price of (i) a 3 month forward on a contract and (ii) a six-month forward contract on the stock b. Suppose the six-month forward is quoted at $100. Identify any arbitrage opportunity and explain what trades you would make to capture it. If applicable, determine the present value of any profit you would earn. 3. Two months ago, a trader named Joe entered into a Forward Rate Agreement in which he agreed to pay 5% based on quarterly compounding. The FRA has a notional principle of $100 million and the agreement at the time it was entered into stated that it was for a three-month period starting in six months. a. Using the information below, please find the current value of the FRA from Joe's perspective. b. Explain why the value of the FRA changed after it was initiated? 6 Term Spot Zero Rate % (months) (based on continuous compounding) 1 2 2 4 3 4 8 5 10 6 8 7 6 8 5 9 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts