Question: answer with a good explanation not using excel Q1) Suppose a stock had an initial price of $91 per share, paid a dividend of $2.40

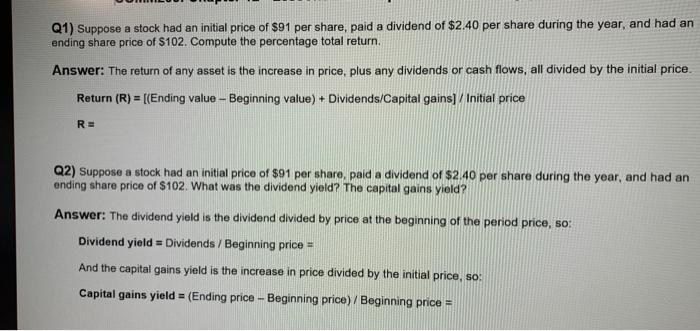

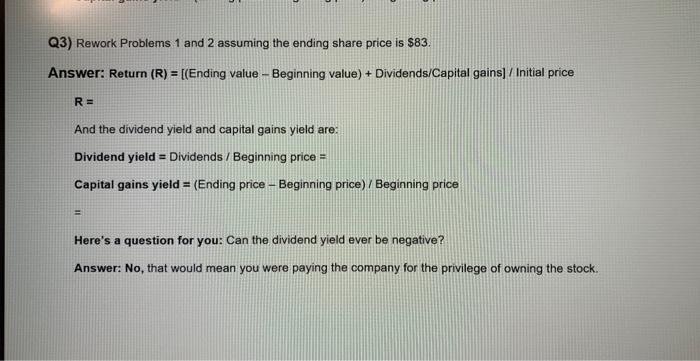

Q1) Suppose a stock had an initial price of $91 per share, paid a dividend of $2.40 per share during the year, and had an ending share price of $102. Compute the percentage total return. Answer: The return of any asset is the increase in price, plus any dividends or cash flows, all divided by the initial price. Return (R)=[( Ending value - Beginning value )+ Dividends/Capital gains ]/ Initial price R= Q2) Suppose a stock had an initial price of $91 per share, paid a dividend of $2.40 per share during the year, and had an ending share price of $102. What was the dividend yield? The capital gains yield? Answer: The dividend yield is the dividend divided by price at the beginning of the period price, so: Dividend yield = Dividends / Beginning price = And the capital gains yield is the increase in price divided by the initial price, so: Capital gains yield =( Ending price - Beginning price )/ Beginning price = Q3) Rework Problems 1 and 2 assuming the ending share price is $83. Answer: Return (R)=[( Ending value - Beginning value )+ Dividends/Capital gains ]/ Initial price R= And the dividend yield and capital gains yield are: Dividend yield = Dividends / Beginning price = Capital gains yield =( Ending price - Beginning price )/ Beginning price = Here's a question for you: Can the dividend yield ever be negative? Answer: No, that would mean you were paying the company for the privilege of owning the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts