Question: answer with a good explanation without using excel Q4) Suppose you bought a 7% coupon bond one year ago for $1,040. The bond sells for

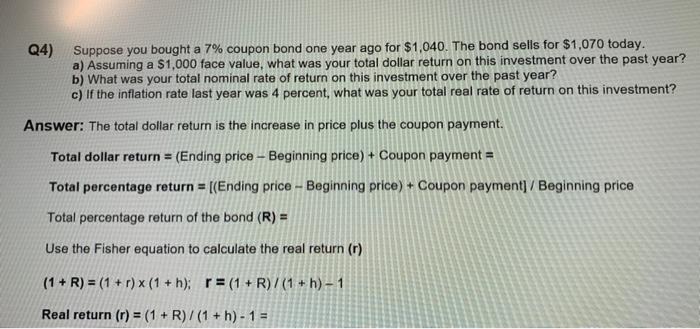

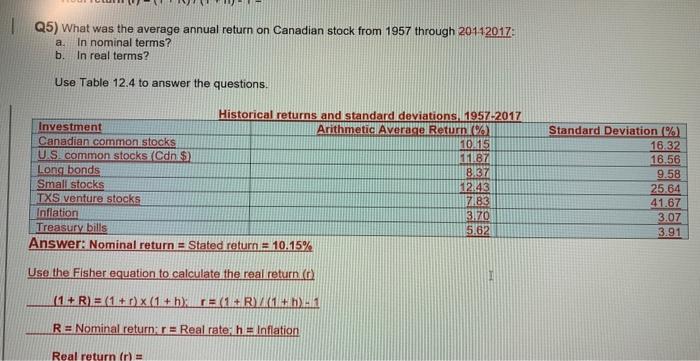

Q4) Suppose you bought a 7% coupon bond one year ago for $1,040. The bond sells for $1,070 today. a) Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b) What was your total nominal rate of return on this investment over the past year? c) If the inflation rate last year was 4 percent, what was your total real rate of return on this investment? Answer: The total dollar return is the increase in price plus the coupon payment. Total dollar return =( Ending price - Beginning price )+ Coupon payment = Total percentage return =[( Ending price - Beginning price )+ Coupon payment ] Beginning price Total percentage return of the bond (R)= Use the Fisher equation to calculate the real return (r) (1+R)=(1+r)x(1+h);r=(1+R)/(1+h)1 Real return (r)=(1+R)/(1+h)1= Q5) What was the average annual return on Canadian stock from 1957 through 20112017 : a. In nominal terms? b. In real terms? Use Table 12.4 to answer the questions. Historical returns and etandard deviatione 1957.2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts